During AIRINC’s 5th Global Tax Chat, we covered the latest mobility tax developments on topics AIRINC has been following recently. The information below is current as of the show’s date of March 12th.

If you didn’t get a chance to watch our show live, you can watch the recording by clicking on the link below.

We explored the following topics:

- A proposed Expatriate Employment Levy in Nigeria

- Changes in Indonesia's treatment of Benefits-In-Kind

- Alterations to Portugal's expat tax concession

- The evolving tax landscape in Argentina.

Nigeria

We started with breaking news from Nigeria – the Expatriate Employment Levy (EEL). On February 27, 2024, the Nigeria Federal Government announced the implementation of a new mandatory levy. Companies employing foreign workers in Nigeria would pay an annual levy equal to USD 15,000 for directors and USD 10,000 for other expatriate employees. The levy aimed to balance employment opportunities for Nigerians and expatriates, close wage gaps between them, and encourage companies to hire locally.

The EEL would apply to expatriate employees working at least 183 days per year in Nigeria. There would be limited exemptions for employees of diplomatic missions and certain government officials. Non-compliance by employers would be subject to penalties including fines and imprisonment. Expatriate employees would need to carry an EEL card along with their passport upon arrival and departure from Nigeria. The Nigerian Immigration Service would be responsible for the enforcement of the EEL. The government released an EEL Handbook to provide guidance on implementation of the levy. In an interesting twist, the proposed levy is stated in US dollars, rather than in Nigerian Naira, to counter the softening economy. According to BBC News, there are approximately 150,000 expatriate employees in Nigeria who would potentially be affected. The EEL is already unpopular with business groups since its announcement last month. Many thought the levy would be challenged in court since it was being implemented unilaterally by the Nigerian government without legislative approval by the National Assembly. In addition, the proposed levy was to be effective within a very short timeframe – March 15, 2024 – with deadlines for employers to comply by April 15, 2024. There already is a fee of USD 2,000 for residence permits needed for certain expatriate employees in addition to this proposed levy. The announced levy also runs counter to government efforts to promote foreign direct investment in Nigeria to boost the economy.

On Friday, March 8, 2024, Nigerian President Bola Tinubu reversed course. He announced the government’s intention to pause the implementation of the Expatriate Employment Levy (EEL). The Ministry of Interior will now begin dialogue and consultation among stakeholders to address the concerns raised. Currently, the levy will not go into effect on March 15, 2024.

The EEL would introduce a new layer of complexity for businesses that employ foreign workers in Nigeria. While the policy aimed to achieve positive socio-economic outcomes, companies were quick to challenge the levy. Affected businesses are encouraged to participate in consultations with the Nigerian government reassessing the EEL provisions. It is still possible a revised EEL scheme may be implemented, or it may be abandoned.

By staying informed and taking proactive measures, businesses can navigate this evolving landscape and maintain a competitive edge in the Nigerian market.

AIRINC will continue to monitor EEL developments as the levy consultations continue.

Indonesia

Next, we travel east to Indonesia, where Benefits in Kind (BIK) are taking center stage. The Indonesian government has issued tax regulations revising the taxable nature of BIK. The Minister of Finance issued Regulation No. 66 of 2023 (MoFR 66/2023), announcing a significant change in the taxation of most BIK benefits. The regulation is effective as of July 1, 2023, and is part of a broader effort by Indonesia called Harmonization of Tax Regulations, which began in 2021. Historically, BIK costs were not deductible by the employer and were non-taxable for employees. However, the new BIK regulations will now allow deductions for BIK costs by employers and require BIK to be taxable to the employee recipients. Further, BIK income is subject to employment payroll withholding tax and compliance and recordkeeping requirements.

There are certain BIK’s that will continue to be exempt from withholding tax (while still deductible to the employer), including:

- food and beverages made available to all employees,

- certain BIK’s provided in designated remote regions,

- BIK’s provided in connection with executing work (such as uniforms, safety equipment, provision of laptops and mobile phones used for work, etc.), and

- those BIK’s provided by qualified governmental agencies.

In the context of Global Mobility, the limited scope for exemptions means most expatriate BIK’s such as housing assistance, education assistance, moving costs, etc. will now be taxable and subject to payroll withholding tax.

In the context of overall tax collections for Indonesia, switching the point of taxation will likely result in increased tax revenues, since the corporate tax rate in Indonesia is a flat 22% while individual tax rates are progressive, with a top marginal tax rate of 35%.

If an employer agrees to cover the withholding tax on the employee’s behalf, that too is a Benefit in Kind, so any employer reimbursement of the withholding tax will also be subject to tax.

Covering the tax will require a gross-up to cover the tax reimbursement. Therefore, the cost to the employer will likely be higher than the top 35% marginal tax rate. Historically, tax reimbursements made for tax-equalized employees in Indonesia did not require a gross-up. Switching to gross-up of the tax reimbursements will increase tax costs, especially for tax-equalized expatriates.

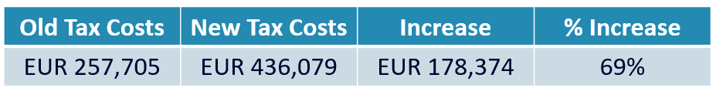

We were interested to see the impact of switching to a gross-up methodology for tax-equalized expatriate employees inbound to Indonesia. To do so, we used AIRINC’s Assignment Cost Estimator (ACE). We used a scenario for a middle manager from the Netherlands going to Indonesia for a three-year assignment and applied the old tax logic to the new tax logic. The overall increase in tax costs was 69%, reflecting not only the gross-up of the Indonesia income tax but also the knock-on effect for social security contributions due to the BIK. Most of the Indonesia social scheme contributions are uncapped, and Indonesia does not have any totalization agreements in force, so the home country’s social security contributions could also be impacted.

We recommend that Global Mobility managers ensure compliance with the new BIK rules in Indonesia and update assignment budgets for the increased tax costs. Global Mobility Managers may also want to consider revisiting compensation packages in Indonesia since there are no longer any cost savings to delivering in-kind benefits.

During our webinar we asked our audience how they stay informed about tax news:

- My Tax Provider updates me = 40%

- I track tax news from finance / accountancy firms = 31%

- I rely on general news for tax updates = 14%

- I get updates from my internal Global Mobility or Payroll teams = 15%

- I disregard tax news completely (wondering why I am here?!) = 1%

Portugal

In Portugal, a popular expatriate tax concession is changing. As of January 1, 2024, the Portuguese government announced the repeal of the Non-Habitual Resident (NHR) tax concession. The perception was that it was too generous and unfavorably impacted the local housing market. The NHR regime was introduced in 2009 during the global financial crisis as a mechanism to attract foreigners to live and work in Portugal. Under NHR, qualifying expatriate employees benefit from a flat 20% tax rate on Portuguese-source income and are exempt from Portuguese taxation on most foreign-source income, for 10 consecutive years. The scheme also taxes foreign-pension income at a flat 10% rate, and exempts taxes on gifts, inheritance, and wealth, making Portugal an attractive destination to foreign retirees. The top marginal rate for non-NHR individuals is 48%, so the NHR regime was quite generous both in tax savings and how long an individual could benefit from NHR.

The regime will continue to apply for individuals already benefiting until their 10-year period ends, or they cease to be Portugal residents. A transition period has been established for individuals who can prove a prior intention to move to Portugal during 2024, such as an employment contract (signed before December 31, 2023), a lease/real estate purchase agreement (signed before October 10, 2023), or a dependent education enrollment certificate (issued before October 10, 2023). In addition, if an individual received a residence permit prior to December 31, 2023, they may still apply for NHR status until March 31, 2024.

The NHR has been replaced with the new Incentivized Tax Scheme (ITS). The new ITS regime remains generous but fewer individuals will be eligible to claim ITS status. The new scheme will provide the same 20% tax rate on employment income for an indefinite period (as opposed to the 10-year limit under NHR). However, the scope of eligible employees has been restricted to individuals designated with specific criteria: university professors, scientific researchers, highly qualified professionals, and employees of entities classified by the government as “start-ups”.

Under the new scheme, foreign investments are only excludable if they are received from a “white list” country, and foreign pensions no longer enjoy the 10% rate, but are taxed at progressive rates.

Mobility teams will face the challenge of tracking grandfathered NHR statuses, making this a critical consideration for years to come. Global Mobility managers should be aware that the new ITS scheme is more difficult to qualify for, and there may be unintended tax consequences in connection with the individual’s non-employment income. For more details, please refer to our AIRSHARE post on Portugal linked here.

Argentina

Our final destination is Argentina, where economic challenges prompted major tax changes. Historically, Argentina would apply periodic inflation adjustments to the tax code using a value called Statutory Monthly Minimum Wage (SMVM in Spanish). The SMVM is used to set the tax brackets and the maximum contribution to social security. The SMVM would be adjusted several times per year to keep pace with inflation and prevent individuals from paying more tax simply due to bracket creep without a corresponding increase in real income. During 2023, hyperinflation in Argentina meant the SMVM factor could not keep pace with inflation.

In October 2023, the former Argentina government amended the tax law applicable to employment income. The intention was to stimulate the economy and boost net income for most employees. For 2024, no tax is due on employment incomes up to a Basic Allowance threshold, currently at about ARS 28 million. Income above the threshold would be subject to new progressive tax rates ranging from 27% up to the top marginal tax rate of 35%. All other deductions for determining taxable employment income have been abolished. We expect the new basic allowance and tax brackets will be indexed for future inflation. The net effect of these tax changes meant that lower-income and middle-income employees would not pay income tax, and only higher-income employees would be subject to tax. The net effect of the changes meant a very narrow tax base of higher-income taxpayers and only a small percentage of individuals incurring tax liability.

During this time, presidential elections were held in Argentina. A new government was elected in November 2023 with Javier Milei as President. Mr. Milei has already promised major changes to fiscal and monetary policy in response to the dual challenge of hyperinflation and a weakening Peso. He has allowed the Argentina Peso to devalue more than 50% since assuming office and suggested during the presidential campaign that he may abandon the Peso in favor of the U.S. Dollar or peg the peso to a fixed exchange rate to the dollar. Argentina has prior experience with pegging the local currency to the U.S. Dollar in the 1990s when the peso was pegged to the US dollar 1 to 1 under former President Carlos Menem. Other countries in South America either use the U.S. Dollar or pegged currencies – Bolivia, Venezuela, Ecuador, El Salvador, and Panama. Argentina’s economy would be, by far, the largest to attempt a dollarization policy. For more background on the Argentina peso, see a discussion on Argentina’s economic changes here.

Mr. Milei also submitted new income tax proposals to Parliament in early 2024 that are currently being debated by legislators. Knowing there are expected government budget shortfalls, it is likely that tax burdens will increase and the tax base will widen, so that more taxpayers will pay an income tax. Should further tax reform be implemented in Argentina, we would expect the changes to be effective from 2025.

Conclusion and Birthday Celebration

Change is inevitable in the world of global taxation. Mobility teams must stay ahead by understanding the "why" behind their program designs and how the tax implications of evolving tax rules affecting globally mobile employees inform their mobility programs. As we wrapped up, we celebrated two significant birthdays – AIRINC's 70th and Pat Jurgens' birthday on St. Patrick's Day. Unfortunately, we ran out of time for a global rendition of "Happy Birthday," but we appreciated your understanding.

Thank you to the audience for joining us. Stay tuned to the blog for more updates (why not subscribe?) and mark your calendars for next quarter's episode of Global Tax Chat. Until then, goodbye, and safe travels in the world of global mobility!

%20(77)%20(1).png)