Pat oversees AIRINC’s tax team as the Director of Global Tax.

Tell us a bit about yourself

I'm from Boulder, Colorado in the USA. I'm a grandfather to three grandchildren (I just met my third for the first time last weekend!). In my free time, I like to work on genealogy and have learned some interesting facts about my family's history: I had an ancestor on the Mayflower and another who was tried as a witch in the Salem witch trials. I'm excited to share my findings with my children and grandchildren so that they can see their family roots. I also have an extensive vinyl record collection.

I started my career in public accounting in Colorado and moved to Tokyo to work on expatriate tax compliance in 1987. I did a three-year assignment in Tokyo with PwC.

Tell us about your role at AIRINC

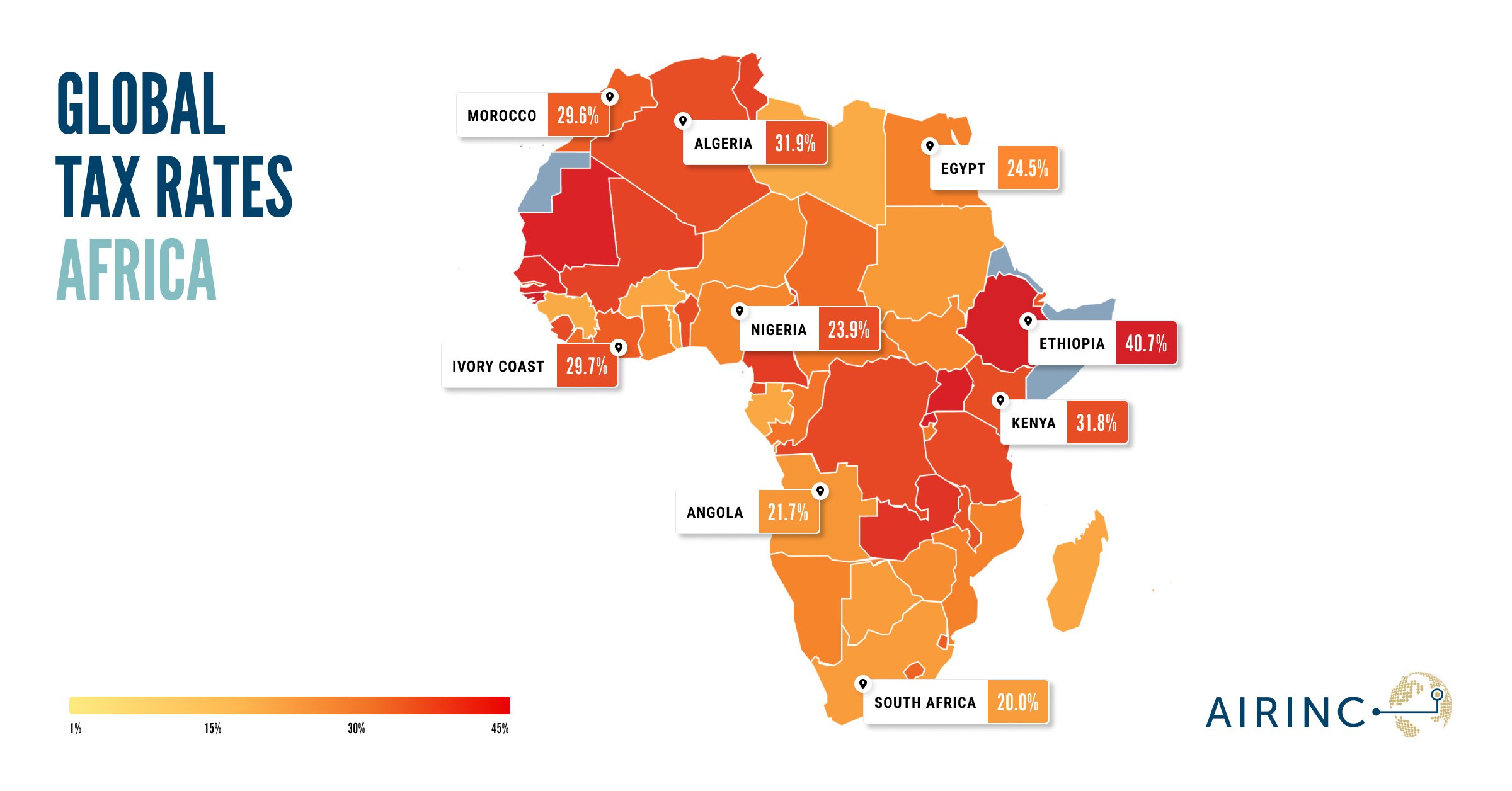

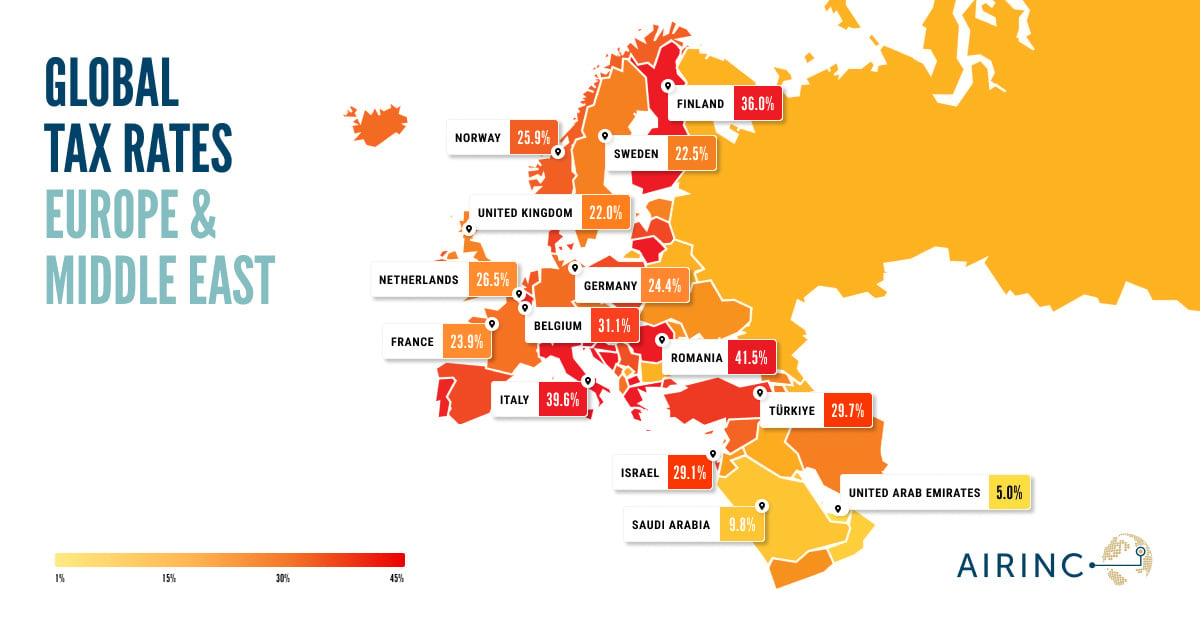

The tax team’s day-to-day work involves a lot of maintenance and updating of our International Tax Guide, which is the framework that supports all our other tools' tax calculations. Every year, we start our research in December to apply any updates to the upcoming tax year and it takes us ten months to get through the entire world. We ensure that our tools pull in current tax data and capture any new tax laws that are passed.

We also support client questions about the tax calculations in the different AIRINC tools. Clients are always asking us for details on the tax rules in different locations or scenarios. Our calculators focus on the interplay between the home country tax rules, host location tax rules and any relevant cross-border tax rules. We're constantly working with a lot of tax detail.

I particularly enjoy the consulting projects that we support. Companies can get confused about which tax approach to use with their assignees i.e., if they should tax-equalise or do something else. We always advise that the tax and compensation philosophies need be integrated, and we help the client to decide if they would benchmark their assignees against their local peers in the host location or against their peers back in the home location.

What are some of the exciting developments that you've seen in the Assignment Cost Estimator (ACE) since its inception?

I was recruited in 2006 to help AIRINC build their tax engine for a new Assignment Cost Estimator that was in development. At its initial launch in 2009, ACE supported 40 countries (which meant that the tax engine ran on a 40x40 country matrix). Now, ACE is up to a 200x200 matrix of home/host countries. The tool has gotten so sophisticated over the years -- I like to joke with my team that it's no longer a tax engine, but a tax monster as it can do all these crazy new things and do them quickly!

Since ACE's initial release, clients have been asking for the ability to save their calculations. It was a big win for us when we could finally offer Saved Scenarios in 2020.

What other projects do you have in the pipeline?

Last December, we released a more detailed report in ACE that provides extensive tax details. We're planning to further fine-tune those reports over the near future.

Our tax-related content and webinars always seem to draw a large audience, so we are planning to share more regular tax content with clients and prospects. Indeed, colleagues within AIRINC are always curious to learn more about taxes so we are running some internal trainings this autumn as well.