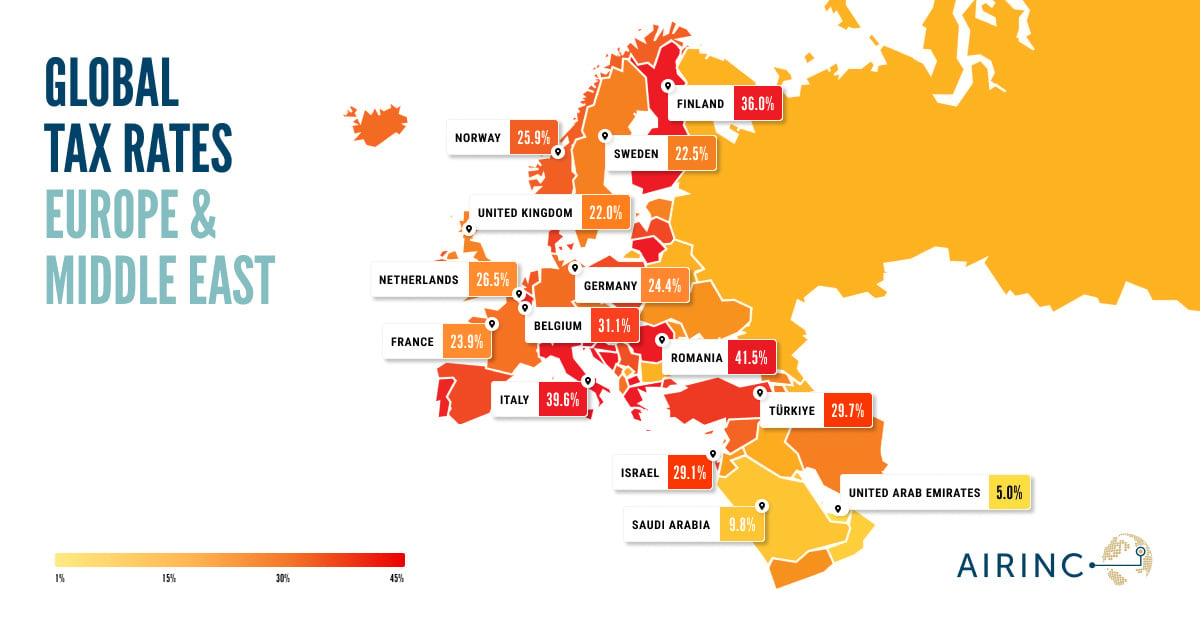

How do taxes impact take-home pay around the world? At AIRINC, we’ve already explored this question in our latest European Tax Blog, breaking down effective tax rates across the region. Now, we’re shifting our focus to the Middle East, where tax policies create a unique landscape for businesses and individuals alike.

What Is the Middle East Tax Rates Map?

The Middle East offers a unique economic landscape, with many countries boasting tax-friendly environments designed to attract businesses and expatriates. Understanding these tax structures is crucial for global mobility professionals and individuals planning to live or work in the region. Click here and zoom in for rates per country.

Analyzing Income Tax Rates Across the Middle East

The Middle East is a region that is diverse in terms of culture, economic structure, and tax systems. While some countries in the region impose individual income taxes, others do not, relying on alternative revenue sources such as oil exports, corporate taxes, or other forms of taxation. In this blog post, we will explore the varying individual income tax rates across Middle Eastern countries, highlighting how different tax policies are shaped by economic conditions, political priorities, and social frameworks.

Countries with No Individual Income Tax

In the Middle East, several countries do not impose an individual income tax, primarily due to their vast oil wealth, which provides governments with sufficient revenue to fund public services and infrastructure. These countries often attract foreign workers with their tax-free status and economic opportunities, particularly in sectors such as oil, construction, and finance.

All six of the Gulf Cooperation Council countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates) do not levy an individual income tax.

United Arab Emirates (UAE):

The UAE is one of the most well-known tax-free countries in the Middle East. It does not levy personal income taxes on individuals, making it a popular destination for expatriates and foreign workers. Instead of income tax, the UAE generates revenue through corporate taxes, especially on foreign companies, and a variety of other charges, including VAT (Value Added Tax) that was introduced in 2018 at 5%. The absence of individual income tax is part of the UAE's broader strategy to diversify its economy and attract global talent, particularly in cities like Dubai and Abu Dhabi.

Qatar:

Qatar is another country in the Middle East that does not impose a personal income tax on individuals. Like the UAE, Qatar's government relies heavily on oil and natural gas exports to generate revenue. The country has also introduced other taxes, such as corporate taxes and VAT (set at 5% in 2021), but individual income remains untaxed. This tax-free system is designed to attract skilled foreign workers to support its growing infrastructure.

Oman:

Oman, like other Gulf Cooperation Council (GCC) countries, does not levy personal income taxes on individuals. The country has historically been reliant on oil revenues, but in recent years it has made strides to diversify its economy, with efforts to develop sectors like tourism and manufacturing. Oman has, however, introduced a VAT at a rate of 5%, in line with the GCC's move to implement such a tax. In contrast to Oman’s neighboring GCC countries, an income tax on individuals has been proposed in an effort to diversify government revenue sources. This new individual income tax would primarily impact high-income earners and foreign nationals. Implementation has been delayed and is now expected to be enacted beginning in 2027.

Saudi Arabia:

Saudi Arabia, the largest economy in the region, historically has not imposed an individual income tax on its citizens. However, in recent years, the country has introduced various forms of taxation to reduce its dependence on oil revenues as part of its Vision 2030 initiative. While personal income tax is still not levied on individuals, Saudi Arabia has implemented a Zakat tax on Saudi nationals (a religious levy).

Countries with Personal Income Taxes

While many Middle Eastern countries do not tax individual income, several others have introduced personal income taxes, often in the form of progressive tax rates. These countries are often focused on diversifying their economies or have less reliance on oil revenues. Let's examine some of the countries that impose income taxes:

Jordan:

Jordan has a progressive income tax system, with rates ranging from 5% to 30%, plus a 1% national contribution tax on taxable income over JOD 200,000. The tax applies to individuals' salaries, wages, and other income, with exemptions and deductions available for certain expenses and categories of income.

Israel:

Israel imposes a progressive individual income tax system, with rates ranging from 10% to 50%. The tax is applied to all forms of income, including wages, salaries, dividends, and other earnings. While the rates are relatively high compared to many Middle Eastern countries, they are consistent with Israel’s strong social safety net, which includes healthcare, education, and unemployment benefits.

Turkey:

Turkey imposes a progressive income tax on individuals, with rates ranging from 15% to 40%. The tax system is divided into several brackets, with individuals earning over 600,000 Turkish Lira annually taxed at the highest rate of 40%. The Turkish government uses income tax to fund various services, including healthcare, education, and infrastructure. The progressive tax system is designed to address income inequality, but the overall tax burden in Turkey is moderate compared to other European or Middle Eastern countries.

Key Trends in Middle Eastern Taxation

- Oil Wealth and Taxation Policies: Many countries in the Middle East, particularly in the Gulf region, have substantial oil wealth, which allows them to forgo personal income taxes and rely on other forms of revenue such as oil revenue, corporate taxes, and VAT. This has led to a tax-free environment for individuals in countries like the UAE, Qatar, Kuwait, and Bahrain. However, there is an ongoing effort in some of these countries to diversify their economies and reduce their reliance on oil revenues, leading to the introduction of VAT and other indirect taxes.

- Rising Use of VAT: While many Middle Eastern countries do not levy personal income taxes, several have introduced or plan to introduce VAT as a form of taxation. This trend is particularly evident in the Gulf Cooperation Council (GCC) countries, which introduced a 5% VAT across the region. The VAT system provides governments with a stable source of revenue without directly taxing individuals’ income.

- Growing Focus on Economic Diversification: Countries like Saudi Arabia, Oman, and Bahrain are increasingly focusing on economic diversification, moving away from oil dependence. This shift is often accompanied by tax reforms and the introduction of new taxes, such as VAT and excise taxes. These efforts are aimed at building sustainable revenue streams that will support the economy in the long term.

- Progressive Taxation in Non-Oil Dependent Countries: In countries that are less reliant on oil revenues, such as Jordan, Turkey, and Lebanon, there is a trend toward progressive income tax systems. These countries rely more heavily on individual income tax as a source of government revenue and often use it as a tool to address income inequality and fund public services.

Middle East’s Key Takeaways

The individual income tax landscape in the Middle East is varied, with some countries embracing tax-free environments while others have adopted progressive taxation systems. Oil wealth has played a major role in shaping the tax policies of Gulf countries, allowing them to forgo personal income taxes and focus on alternative forms of revenue. However, there is a clear trend toward economic diversification and the introduction of new taxes, such as VAT, across the region. As countries like Saudi Arabia and the UAE move toward more diversified economies, it will be interesting to see how tax policies evolve to support sustainable growth while maintaining competitiveness on the global stage. For expatriates, businesses, and individuals working in the region, understanding these tax systems is crucial for effective financial planning and decision-making.

Look Out for the Next Blog!

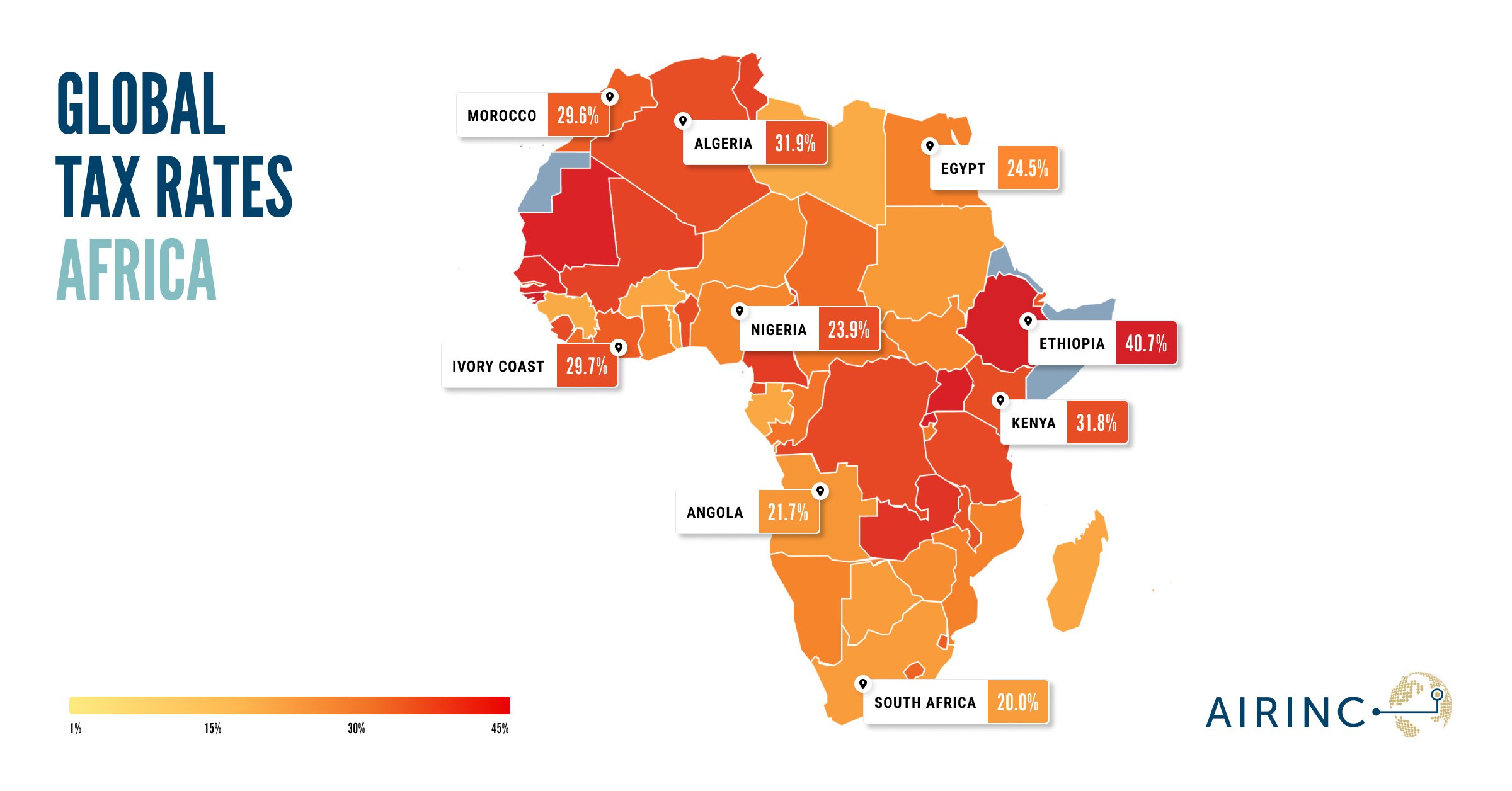

In the next blog, we’ll focus on Africa, diving into the challenges and opportunities presented by the continent’s evolving tax systems. Why not subscribe?

Are you looking for information on global tax rates around the world?AIRINC’s International Tax Guide contains all of the information you need to support your assignment tax planning — including global tax rates, deductions, and employee/employer social security contributions. |

Are you trying to move an employee from a lower- to a higher-tax rate location?Use AIRINC’s Global Salary Comparison to understand the compensation you would need to offer to cover the difference and make the appropriate offer to your employee. |

Want to hear even more on tax?!Listen again to our recent Global Tax Chat show. The session covered the latest updates in global tax compliance, including significant regulatory changes and how they impacted expatriate tax programs. |

%20(31).png)