What is included in the U.S. Inflation Reduction Act?

On Tuesday, August 16, President Joe Biden signed into law the Inflation Reduction Act (IRA), a $750 billion budget reconciliation package. The bill was passed by Congress on a strict party-vote: 220-207 in the House, and 51-50 in the Senate, with Vice President Kamala Harris casting the tiebreaking vote.

As the name of the bill indicates, the overarching goal of the legislation is to reduce inflation. The US has seen an annual inflation rate of 8.52%. Inflation has a direct impact on global mobility budgets for the cost of goods, utilities, and relocation benefits. To the extent that this bill can temper inflation, it would be a win for global mobility programs.

The bill includes very little that will directly impact global mobility programs, but there are ancillary effects to be aware of. Among the key revenue-generating provisions:

- Imposing a 15% corporate alternative minimum tax on adjusted financial statement income for corporations with profits exceeding $1 billion

Global mobility impact:- This is estimated to raise $222 billion over the next 10 years, meaning corporate spending budgets across all departments, including global mobility, may be pared down for impacted corporations.

- This is estimated to raise $222 billion over the next 10 years, meaning corporate spending budgets across all departments, including global mobility, may be pared down for impacted corporations.

- A new 1% excise tax on certain corporate stock buybacks by publicly traded companies

Global mobility impact:- No direct or indirect impact. The excise tax is assessed on the covered corporation, not the shareholders. The provision provides a disincentive to corporations to buy back their stock to make shares remaining on the market more valuable. This was inserted in the bill at the last minute as a substitute for the “carried interest” tax changes that affect certain partnership interests. The carried interest tax rules were kept intact.

- No direct or indirect impact. The excise tax is assessed on the covered corporation, not the shareholders. The provision provides a disincentive to corporations to buy back their stock to make shares remaining on the market more valuable. This was inserted in the bill at the last minute as a substitute for the “carried interest” tax changes that affect certain partnership interests. The carried interest tax rules were kept intact.

- Increasing Internal Revenue Service (IRS) funding by $80 billion. This will provide for additional personnel to be hired, upgrades to IRS technology, additional resources for taxpayer assistance and operations, and includes over $45 billion in funding for tax enforcement activities to close the “tax gap,” which is the difference in what should be collected by the IRS and what is really collected.

- The Biden administration has stated the focus of increased enforcement activity will be audits of corporations and high-wealth and high-income individual taxpayers making over $400,000 per year. Middle-income and low-income taxpayers should not expect an increase in audit rates. The increased IRS funding is expected to generate $204 billion more tax revenue over a ten-year period. The increased audit activity will happen after new employees are hired and trained, so it will likely take time to ramp up the audit activity.

- The staffing at the IRS in all functional areas will increase substantially, in part to replace existing personnel close to retirement, and to expand the workforce. The net increase in the IRS workforce is expected to be 25% to 40% over a ten-year period.

Global mobility impact:- Expect an uptick in IRS notices and audits on U.S. expatriates and inbound aliens. Tax returns with foreign compensation elements are inherently complex, and therefore more likely to include errors, misstatements, or omissions.

- Assignees tend to be more highly compensated when including taxable allowances and benefits such as housing, COLA, relocation assistance, etc., and therefore more likely to attract enforcement attention. The bill specifically mentions noncompliance enforcement on global high-net-worth taxpayers and multinational taxpayers with international tax issues.

- Along with the increased IRS funding, we can expect faster tax return processing and IRS responses to taxpayer requests for assistance.

- Global mobility managers should be prepared to increase notice and audit support fee budgets from tax providers.

- Does your mobility policy explicitly provide tax audit support? Are there employees that are specifically covered/not covered?

- The staffing at the IRS in all functional areas will increase substantially, in part to replace existing personnel close to retirement, and to expand the workforce. The net increase in the IRS workforce is expected to be 25% to 40% over a ten-year period.

- The Biden administration has stated the focus of increased enforcement activity will be audits of corporations and high-wealth and high-income individual taxpayers making over $400,000 per year. Middle-income and low-income taxpayers should not expect an increase in audit rates. The increased IRS funding is expected to generate $204 billion more tax revenue over a ten-year period. The increased audit activity will happen after new employees are hired and trained, so it will likely take time to ramp up the audit activity.

The IRA also includes certain tax incentives dedicated to green energy such as renewable electricity, clean fuels, and clean vehicles. These new and expanded tax credits are available for qualifying purchases of electric vehicles, residential energy property, and similar green programs.

- Global mobility impact: does your program encourage energy and climate change efforts? Do you include electric vehicle allowances in your policies?

There are several key individual tax provisions that did not make it into the final version of the bill, including no increases in individual and capital gains tax rates, and changes in the estate and gift tax rules. The final legislation also does not extend the COVID-19-era expansion of the child tax credit and earned income credit, which some economists pointed to as a contributing factor to inflation. Congressional Democrats are expected to make another push later this year to extend or enhance the child tax credits that expired at the end of 2021.

- Global mobility impact: Did your program make any adjustments in 2021 to hypothetical tax to recognize the increased child tax credits that may now need to be reversed?

Also omitted from the Act is any adjustment to the limited deduction for state and local taxes (SALT), which was enacted in the Tax Cuts and Jobs Act and is scheduled to expire in 2025. There were many congressional Democrats representing high income and property tax districts (the so-called “SALT caucus”) who were said to be steadfast in their opposition to any reconciliation bill that did not eliminate or relax the $10,000 cap on SALT deductions. However, the members yielded on the demand, which some argue disproportionally benefits higher income taxpayers, and voted for the package anyway. This was done because the bill was sent “closed rule” by the Senate to the House, meaning any modification would require the bill to return to the Senate for another vote, where Democrats had struggled to win support from all 50 members, and would have risked the passage of the IRA. The “SALT caucus” is expected to redouble their efforts to eliminate or amend the cap prior to the scheduled expiration in 2025 and to fight against any attempt to extend the cap beyond 2025.

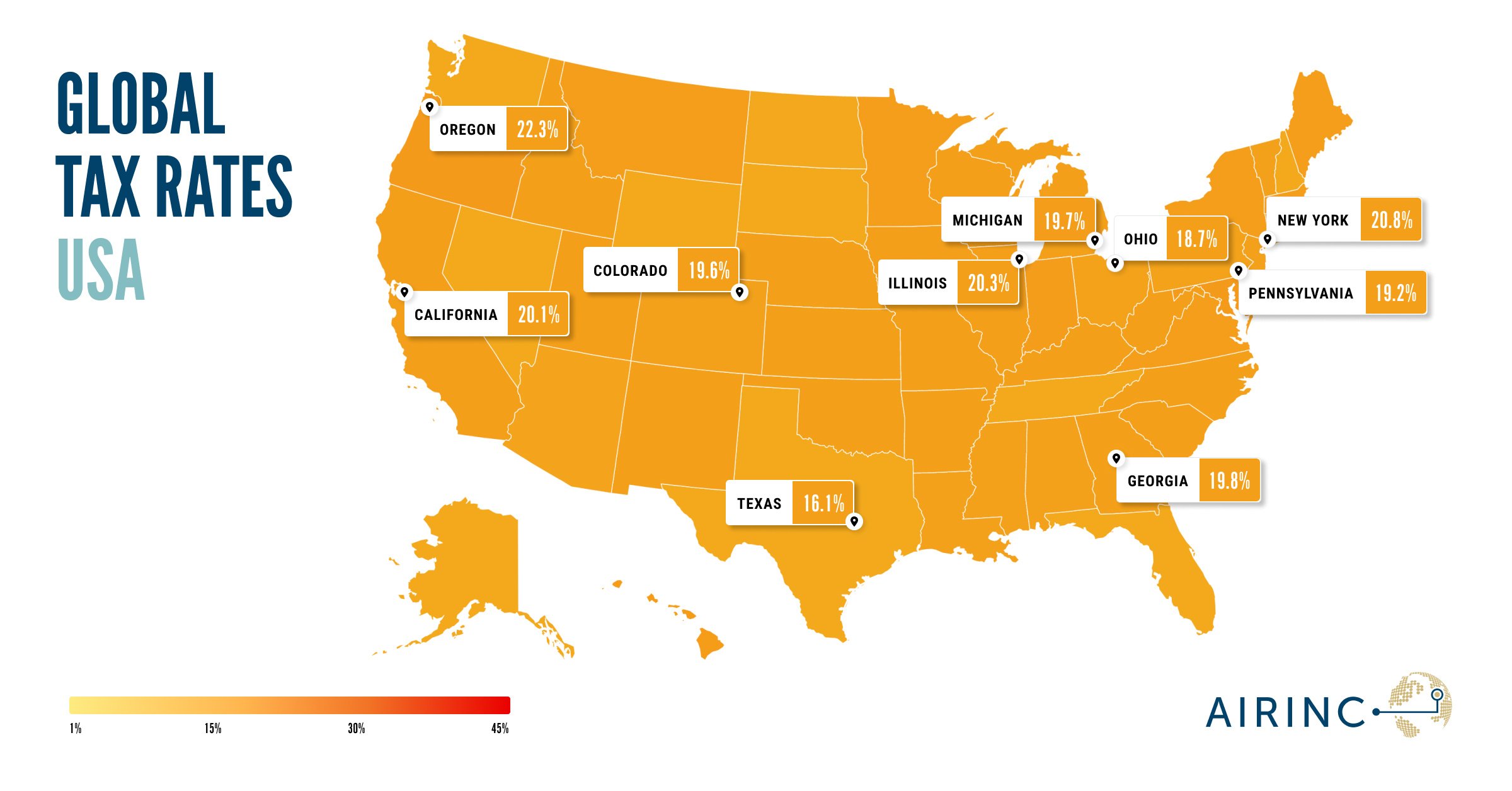

- Global mobility impact: The current SALT limitation is a detriment to global mobility programs that are paying state and local income tax on behalf of their tax-equalized employees, but cannot take a deduction exceeding $10,000, especially in high tax states like New York and California.

Time will tell if the Inflation Reduction Act achieves its intended purpose to diminish inflation. In the meantime, global mobility professionals should be prepared to understand the limited indirect impact of the legislation on talent mobility.

%20(31).png)