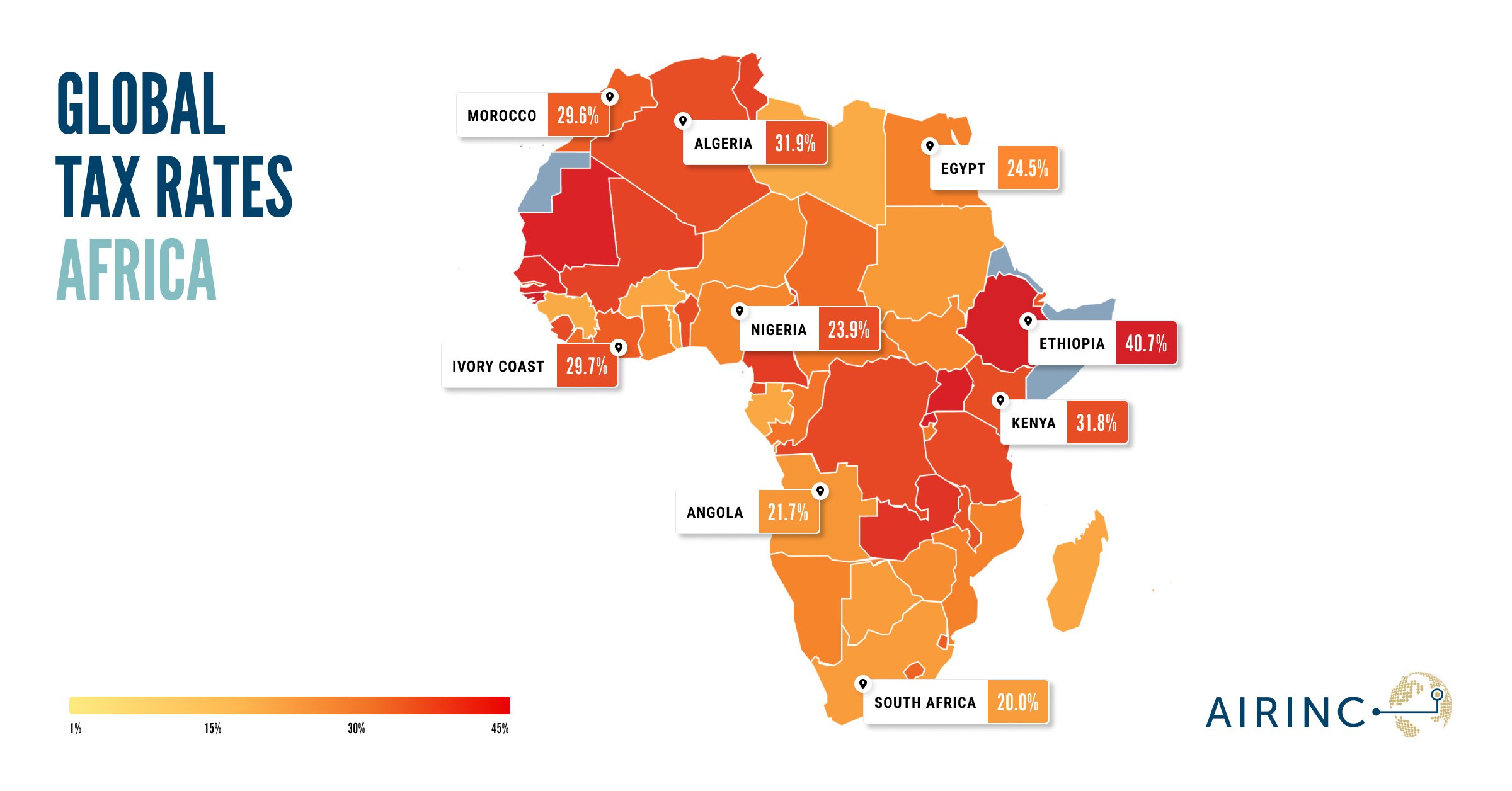

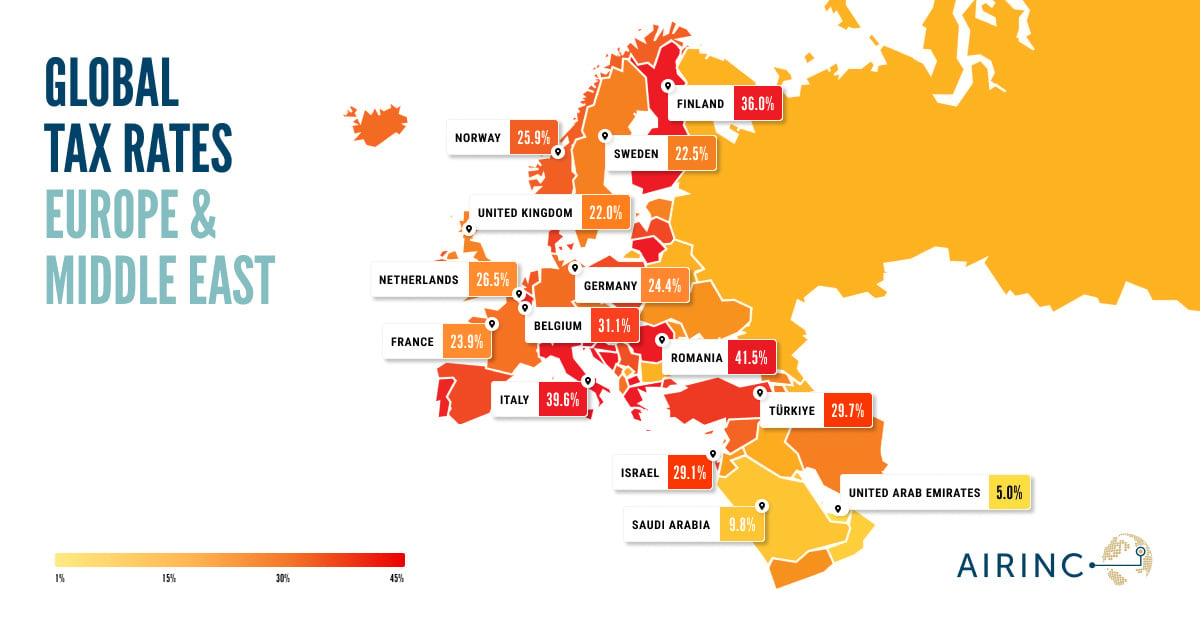

How do taxes impact take-home pay across the globe? AIRINC has published our Global Tax Rates map to illustrate effective tax rates across the globe.

In this blog series we will dive deeper into taxes across Europe, the Middle East, Africa, APAC and the United States. Stay tuned as we take you on a tax-tour across the globe—one Rates map at a time!

What Is the European Tax Rates Map?

Europe presents a fascinating contrast of economic structures, where robust social systems are funded by higher taxes. For global mobility professionals and curious readers alike, understanding these tax systems is essential for navigating the region’s financial landscape. Click here and zoom in for rates per country.

Analyzing Income Tax Rates on Employment Income Across Europe

Income tax is a critical revenue source for European governments, funding public services such as healthcare, education, and infrastructure. However, tax rates on employment income vary significantly across the continent, shaped by national policies, social benefits, and economic strategies. This post explores these variations, highlighting key trends and insights.

A Diverse Tax Landscape: Progressive, Flat, and Mixed Systems

European countries generally fall into three income tax categories:

- Progressive Tax Systems – Tax rates increase with income, often paired with social benefits and comprehensive public services.

- Flat Tax Systems – A single tax rate applies to all income levels, promoting simplicity and efficiency.

- Mixed Tax Systems – A combination of both, incorporating elements of flat and progressive taxation.

1. Progressive Tax Systems

Germany: Employment income is taxed progressively, with rates from 0% to 45%. The tax-free threshold is €10,908, while income above €277,825 is taxed at the highest rate. Additional levies include a solidarity surtax and, for some, a church tax.

France: Tax rates range from 0% to 45%, with the first €10,777 tax-free. A high-income surcharge applies to incomes exceeding €250,000 (single) and €500,000 (married). France’s ‘coefficient’ system adjusts tax liability based on family size. Notably, social security contributions often surpass income tax costs for many employees.

United Kingdom: The UK has a progressive system with three bands. The first £12,570 is tax-free, followed by 20% on income up to £50,270, 40% up to £125,140, and 45% beyond. Employees and employers also contribute to National Insurance (NIC), with employer NIC set to increase to 15% from April 6, 2025.

These progressive systems aim to reduce income inequality while funding extensive public services.

2. Flat Tax Systems

Estonia: A 20% flat tax on all employment income simplifies administration and attracts investment.

Bulgaria: Since 2008, a 10% flat tax has made Bulgaria an attractive destination for businesses and individuals seeking lower tax burdens.

Hungary: With a 15% flat tax, Hungary boasts one of Europe’s lowest personal income tax rates, promoting economic growth but raising concerns about income inequality.

3. Mixed Tax Systems

Switzerland: Switzerland’s decentralized system involves federal, cantonal, and communal taxes, leading to effective rates from 0% to 40% depending on location. Progressive tax elements remain, but cantonal competition influences overall tax burdens.

Sweden: Sweden combines a flat municipal tax (30%-35%) with a progressive national tax (0%-20%). High tax rates support extensive welfare programs and a high standard of living.

Key Trends in European Income Taxation

- Higher Taxation in Western Europe: Countries like Germany, France, and Sweden maintain high tax rates, funding strong welfare states and extensive public services.

- Attractive Tax Rates in Eastern Europe: Nations such as Bulgaria and Hungary favor flat taxes to attract investment and stimulate growth.

- European Union Regulations and Cooperation: European Union policies encourage harmonization, facilitating cross-border work and social security agreements.

Key Takeaways

The diversity of income tax rates on employment income in Europe underscores the complexity of tax systems across the continent. Whether adopting progressive tax models to fund comprehensive welfare states or utilizing flat tax systems to attract investment, European countries prioritize different approaches based on their unique economic, political, and social circumstances. As global economic trends evolve, it will be interesting to see how these tax policies continue to adapt in response to changing demographics, technological advancements, and fiscal pressures. For both individuals and businesses operating within Europe, understanding the nuances of these tax systems is crucial for effective financial planning and decision-making.

Look Out for the Next Blog!

This blog series takes us across the world delving into one region at a time. And if you love to talk tax, so do we! Why not contact us!

Are you looking for information on global tax rates around the world?AIRINC’s International Tax Guide contains all of the information you need to support your assignment tax planning — including global tax rates, deductions, and employee/employer social security contributions. |

Are you trying to move an employee from a lower- to a higher-tax rate location?Use AIRINC’s Global Salary Comparison to understand the compensation you would need to offer to cover the difference and make the appropriate offer to your employee. |

Want to hear even more on tax?!Listen again to our recent Global Tax Chat show. The session covered the latest updates in global tax compliance, including significant regulatory changes and how they impacted expatriate tax programs. |

%20(31).png)