We just had enough time to take a quick peek into the future of mobility tax during AIRINC’s fourth Global Tax Chat on December 7th AIRINC. I was joined by my colleague Jeremy Piccoli and our host Robert Zeitz. We talked about several tax developments and discussed tax implications for 2024 and beyond. We also pondered the implications of crypto and artificial intelligence.

Expatriate Tax Updates

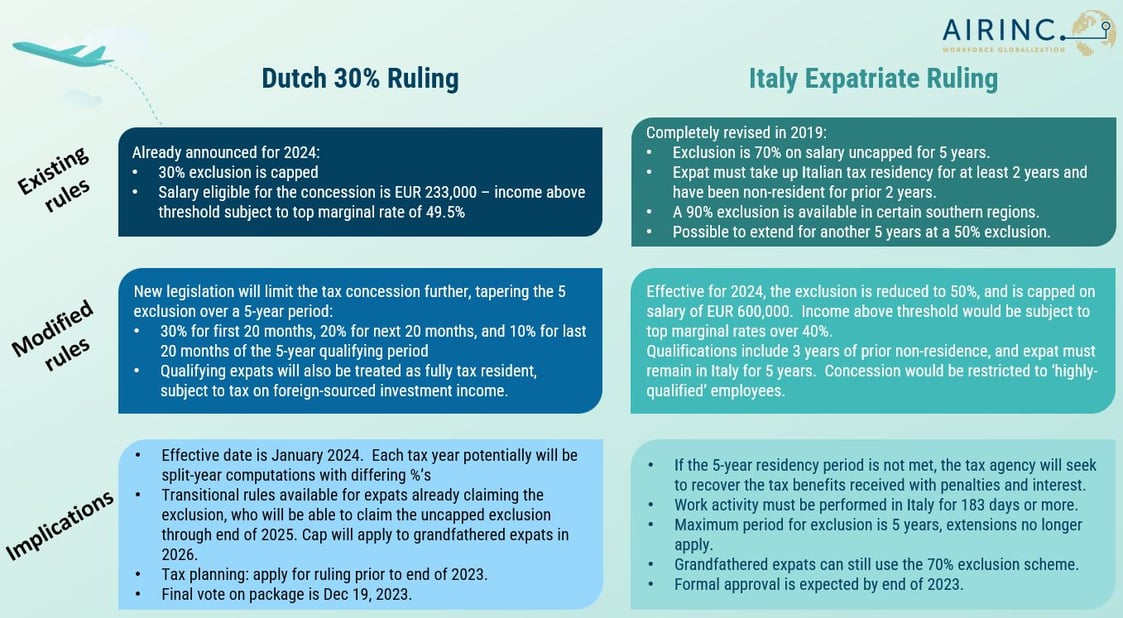

Several changes impacting globally mobile employees into the Netherlands and Italy. Both these changes are in the final process of approval and enactment effective January 2024. The key takeaway, we believe, is a need to limit the scope of the expat tax concessions by comparison to typical tax costs for locally-hired employees. Currently there are substantial tax savings when the expatriate rulings can be used. Yes, of course, the tax concessions are intended to incentivize companies to bring in qualified professionals and boost the economy, but governments will want to reduce and taper the tax breaks over time.

Both new tax proposals are expected to get final approval later this month with effective dates beginning in January 2024. If you possibly have assignees with pending assignments to Italy or Netherlands, you may consider getting them moved in during December so that the more generous grand-fathered rules can be used. I know, not realistic given the short timeframe.

Other tax developments coming in 2024 – will taxes go up or down?

Yes! Countries globally are taking different approaches to address local economic conditions.

Czechia (Czech Republic) is planning to adjust tax thresholds and reduce deductions. The effect will be an overall increase is income tax beginning for 2024.

A couple of countries have announced that there will be no changes for the upcoming year. China had previously decided to defer the elimination of certain expatriate tax concessions to 2028, responding to concerns from companies and inbound expatriate employees about the large increase in Chinese tax costs.

In the United Kingdom the government had announced last year that income tax rates, brackets, and the personal allowance would be frozen until 2028. But let’s wait until we see the UK government’s Spring Budget Statement this coming March and whether any adjustments may be made to provide tax relief.

Lastly, Argentina is cutting taxes significantly for most employees, raising the threshold for tax-exempt income and other changes. This is intended to address the hyperinflation and soft currency issues there, but a new Argentina government was recently elected, and we may see other Argentina tax proposals coming in 2024.

We even asked our audience if they felt prepared for the changes coming in 2024:

- 8% Not prepared at all!

- 54% Somewhat prepared

- 6% I’m 100% ready!

- 31% Ask me in January!

- 1% I AM already ready for 2025!

Looking at the future themes in mobility tax

There have been some broad themes we are seeing – international tax cooperation, transparency for Beneficial Ownership and Crypto, and Enforcement.

Tax Treaties

We have seen about 30 new bilateral tax treaties come into force in 2023 demonstrating countries looking to increase international cooperation. On top of that, many countries are actively implementing corporate minimum tax laws and signing multilateral instruments to enact corporate tax changes to ensure that large companies are not leveraging tax laws to avoid the global minimum tax of 15%. We have also seen numerous tax treaties with Russia and Belarus either terminated or suspended because of the Ukrainian conflict.

Crypto-currencies

Tax authorities in many countries have issued general guidance that crypto is a financial asset, and taxpayers have capital gains or losses when they are bought and sold. Given the volatility of crypto, and the possibility of using crypto to finance illicit or terrorist activities, many countries are looking to improve transparency. One major effort in understanding the cross-border crypto transactions is CARF.

CARF is the Crypto-Asset Reporting Framework and is an initiative sponsored by the OECD. As of November, 48 countries plan to implement CARF. This will provide an international standard for automatic exchange of information on crypto-assets.

Under the OECD umbrella, CARF will have a common reporting standard to exchange crypto information between tax authorities. The exchanges is planning to go live in 2027 and signals an important milestone in efforts to combat tax evasion and increase global tax transparency of crypto assets.

All entities and individuals that provide broker services that trade crypto-assets will be required to report to their local tax authorities about crypto transactions, just like existing brokerage reporting. This will include cost basis and acquisition date, sales price and sale date, and details on the reportable person – name, address, Tax ID number, birthdate, etc. All this information will be collected in a common electronic XML schema. This information will then be exchanged with other CARF member countries as appropriate.

What are the implications for Global Mobility? Increased compliance risk for mobility employees holding crypto and the prospect of increased tax compliance costs.

Transparency of Beneficial Owners

Another major effort on transparency is a new reporting requirement for US companies called Beneficial Owner Information (BOI) Reports. This is being implemented by FinCEN or the Financial Crimes Enforcement Network. Those of us in global mobility certainly will be familiar with one of FinCEN’s responsibilities as the network is responsible for FBAR’s – foreign bank accounts that many of our mobile employees need to file annually. But FinCEN also has a broader role, enforcing US sanctions, including against Russia and in coordination with other key partner countries.

What will be new beginning January 1, 2024 are Beneficial Ownership Information reporting rules. This is meant to make shell companies transparent. Enforcing transparency means knowing who on the true stakeholders in any entity doing business in the US and crack down on illicit finance and terrorist activity. There are exceptions for larger companies that already have separate but equivalent reporting requirements such as banks and other financial institutions. These rules will likely impact smaller US companies and foreign companies registered to do business in the US.

The new BOI (Beneficial Ownership Information) Report is to be filed electronically with FinCEN to disclose the ‘beneficial owners’ – the individuals who ultimately own or control a company. This information will be shared with law enforcement agencies.

Initial reports for 2024 are due January 1, 2025 for existing companies that meet reporting requirements, and then reports are due 90 days after creation for companies started in 2025, and 30 days after creation for companies started after 2025. An estimated 32 million companies initially will need to file. Some of your employees could need to file BOI depending on their business interests. Will you authorize tax assistance in meeting this filing requirement?

Enforcement

Several tax authorities are ramping up their enforcement and audit activities this past year, and we expect this to continue for 2024. The Internal Revenue Service, for example, received a substantial increase in budget funding, and a portion of those budgeted funds will be directed to reviewing and auditing companies and high-income individuals. We are also hearing about increased payroll audits looking for errors in withholding and reporting errors for remote workers and cross-border personnel.

Tax authorities are also implementing AI tools to assist in data analysis and looking for mismatches on income and deduction reporting from third parties, and flagging certain returns for review and audit if income seems underreported or deductions overstated. Over time, we are hoping AI will also help taxpayers, streamlining tax filing obligations by collecting and organizing tax items to submit to the tax office electronically and seamlessly.

If you missed our webinar, you can go Back to the Future by watching the recording of the show, click here.

Our next Global Tax Chat will be in March 2024. Look for an invitation email closer to February with registration details.

2024 Mobility Outlook Survey is open! Please participate here.

%20(77)%20(1).png)