In a recent AIRINC case study webinar, Dr. Joy E. Hill, Global Mobility Manager for Brown-Forman discussed their global mobility program with a focus on international transfers.

Brown-Forman has a very employee-centric approach, and they want to ensure that transferring employees have access to a detailed review of their current and proposed compensation structure. Brown-Forman increased the number of permanently transferred employees, and they do not want them to be surprised by tax, cost of living, or other differences to their compensation package.

To that end, they engage in a detailed compensation assessment:

- Comparison of current compensation vs. proposed

- Spending power in both locations, considering:

- Tax implications, COLA, and Housing

- Family size and host educational needs

- Benefits Assessment

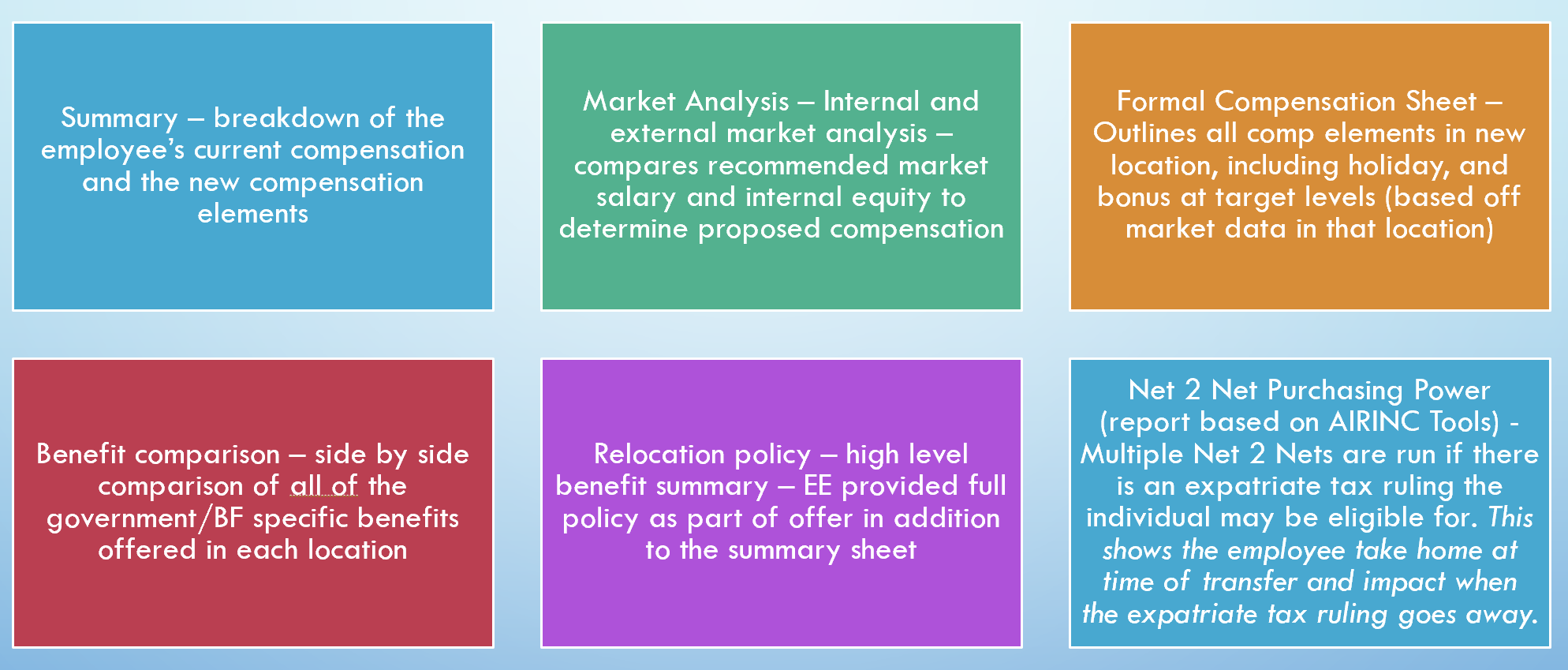

This assessment helps the business determine the likelihood of the employee accepting the transfer. The following is a breakdown of the assessment components:

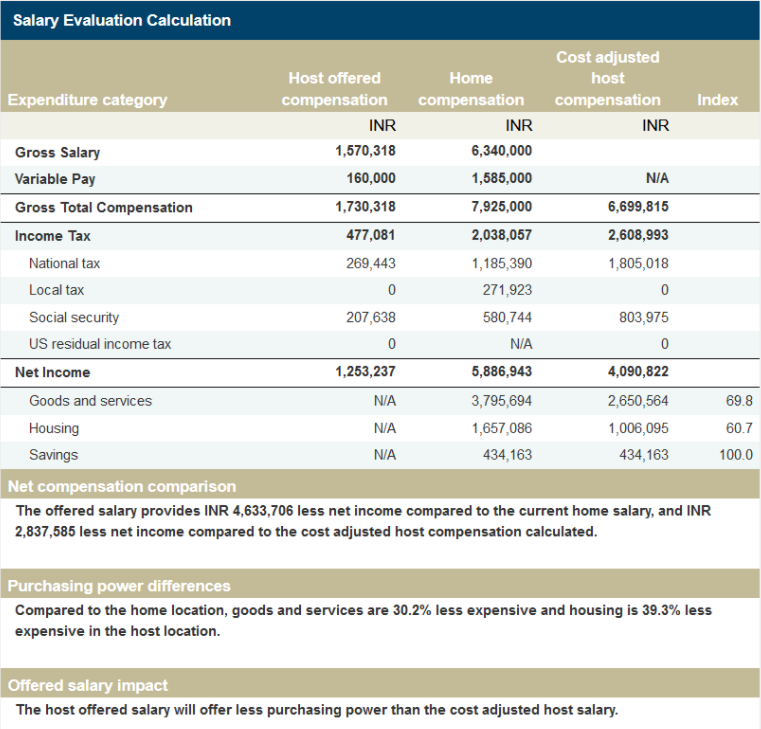

The most important part of this summary is the Net 2 Net Purchasing Power report:

- Allows you to evaluate existing and proposed compensation packages, including both salary and variable pay

- Provides flexible tax calculations for both home and host locations to define the employees’ situation

- Generates a report within minutes

Click here to learn more about AIRNC’s Salary Evaluation Tool.

At Brown-Forman, understanding the financial impact of an employee’s decision is the driving factor behind compensation assessment. Their Global Mobility team works very closely with the Total Rewards team to make sure a transfer is right for the employee and the business.

Contact us to learn more about this webinar.

.png)

%20(47).png)