AIRINC works with many companies to support local moves and permanent hires across borders. As a result, we have seen when our clients have challenges regarding moving an individual onto local terms. This blog details some of the more common compensation challenges to look out for:

This blog details some of the more common compensation challenges to look out for:

Moves from low to high tax countries

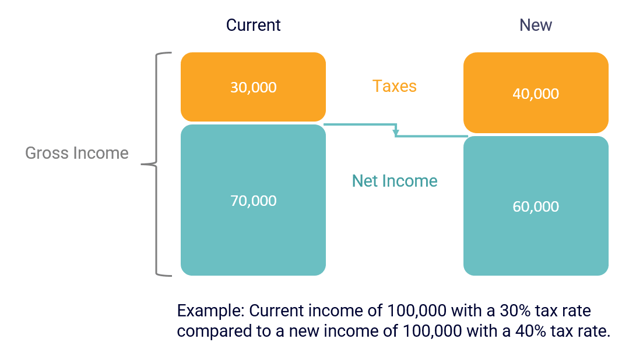

Many companies perform what is referred to as a net-to-net calculation; this is where you see what a person’s income after-tax currently is compared to what their new income after-tax would be in a new location. If the person has less money after taxes are paid then that is a potential red flag for a move.

Moves from low to high cost locations

After a company has done a net-to-net calculation, you can take that a step further and compare the cost of wages between locations by looking at the expected cost of housing and goods and services. In cases where…

- taxes are similar, but the destination is more expensive

- taxes are higher and the destination is more expensive

…a company may elect to:

- Provide a one-time transition allowance to help offset the difference

- Adjust the compensation to the higher end of the local salary band

- Pay an economically neutral salary that offsets the cost of wages and tax differences between the two locations (typically in the absence of having developed local salary structures)

- Inform the employee that the location is more expensive and should be prepared for that reality

Moves from high to low wage locations

These are some of the more difficult scenarios to navigate. When an individual is faced with a substantial lifestyle change due to lower wages than their local compensation in their current location there are a few options:

- Implement a local plus compensation package where you add-on benefits such as housing, education, etc., in addition to salary to make the move more attractive.

- Keep the individual on their current country compensation and employment terms (only makes sense when the need for their skills is temporary in the new destination).

- If the move is employee driven, educate them that the local compensation may require a lifestyle change on their behalf.

Resources available to you to support these kinds of moves

Net-to-net calculations that factor in cost of living; AIRINC’s Global Salary Comparison (GSC) tool can be used to support both individual analysis as well as holistic global salary structure analysis.

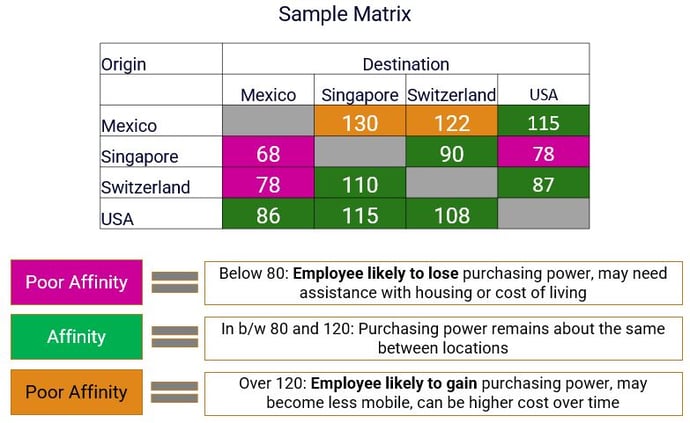

Affinity matrices can also be used to give you a representative guideline between popular sending and receiving locations (pink is bad and green means the move is a good fit).

Curious to see the GSC live in action?

If you are a potential vendor partner, or a corporate Global Mobility, Human Resources, or Compensation professional, contact us to receive a free report. One of our team members will reach out to gather the necessary information to run a sample calculation for you.

%20(22)%20(1).jpg)

%20(26)%20(1).jpg)

%20(25)%20(1).jpg)