I want to provide my views on what to expect in the tax world for 2023. I think we can draw some broad generalizations as governments and taxpayers respond to inflation and the possibility of recession. It is likely that higher income taxpayers will see tax increases and some limited tax relief to offset the costs of inflation and energy prices. Clearly a balancing act as governments consider state budgets and spending.

For example, I have already talked about the UK tax changes with a tax increase for higher income individuals and the slow-moving tax increase of Fiscal Drag by not indexing brackets and allowances until 2028. In addition, Ghana has just announced a tax increase for next year, increasing the top marginal tax rate from 30% to 35%. Sri Lanka also plans to implement tax hikes in the face of their economic problems.

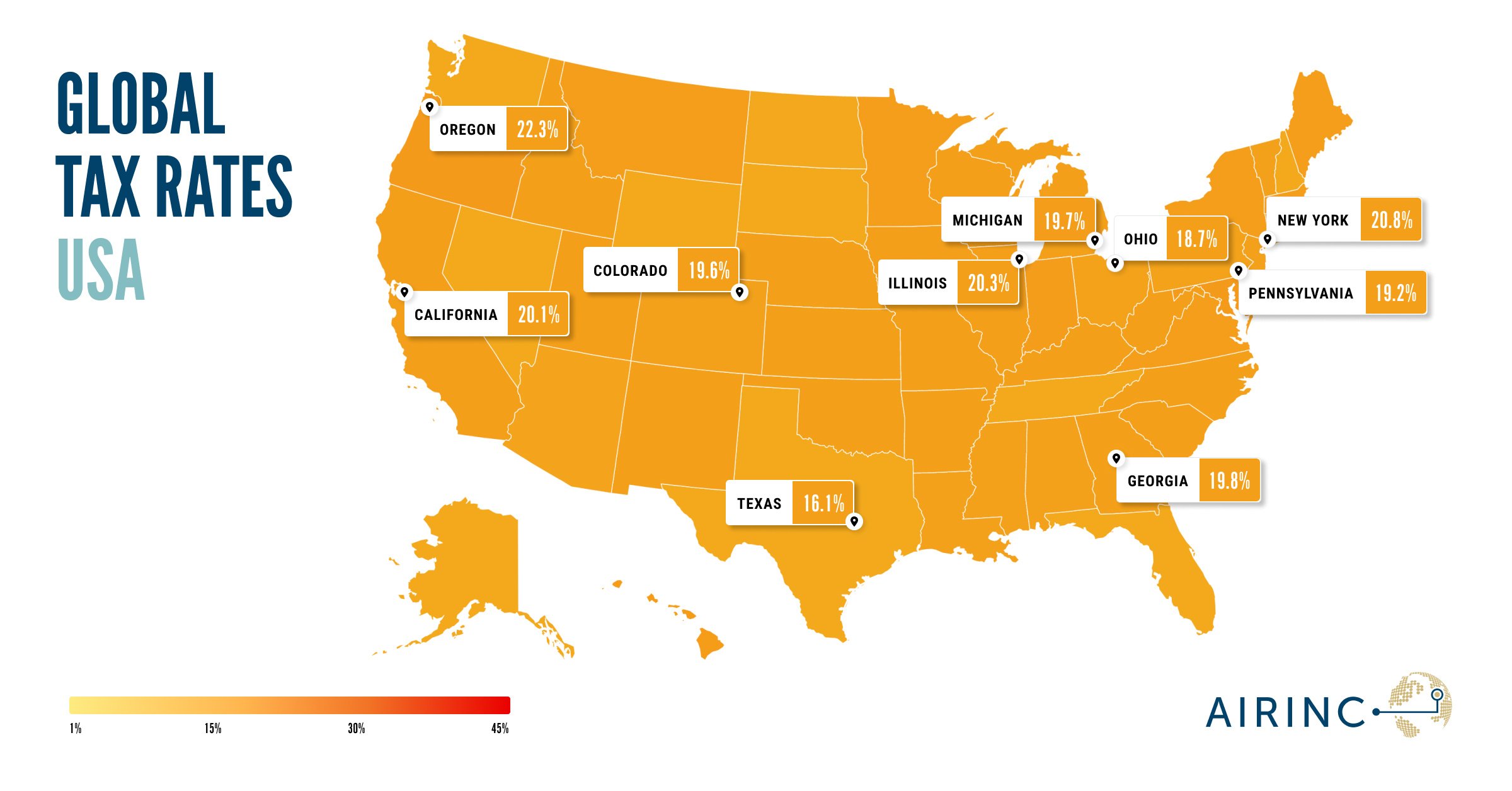

In the AIRINC tax department, we are busy updating the U.S. tax information for 2023. For federal purposes, the notable change is a large inflation-indexing adjustment for next year. The tax brackets and deductions are adjusted annually for inflation. This is required by provisions in the tax code, with the increase this year at 7%. We also are seeing some notable tax cuts at the state level, including Arizona, Arkansas, Colorado, and Iowa. Voters in Massachusetts approved a new millionaire’s tax of 4% on taxable income over 1 million.

We are not expecting any major tax legislation in the U.S. this month or next year, as Congress is still divided between Republicans and Democrats. There is a slim possibility of a tax bargain between the parties, with Republicans looking for some business-related changes around expensing of R&D costs and limitations on corporate interest deductions while Democrats looking to restore the more generous child tax credits for lower income taxpayers which includes the monthly advance cash payments that we saw in 2021.

But we can expect some major changes at the Internal Revenue Service. The IRS got a large bump in funding ($80 billion over 10 years) to address better taxpayer services, new technology, and tax collections through the enforcement and increasing tax audits. President Biden has nominated a new IRS Commissioner, Danny Werfel, who has extensive experience in the IRS and the Office of Management and Budget. He will have his hands full in 2023 to ensure that tax season is smoother than we saw over the last couple of years. We can also expect House Republicans to investigate the IRS in the 2023 Congress as they look to block that new IRS funding and tax audits.

Finally, something we will NOT be talking about in 2023. One of the most notable U.S. taxpayers is having his tax filings investigated. Six years of Donald Trump’s tax returns have now been released by the U.S. Treasury to the House Ways and Means Committee. This happened after a U.S. Supreme Court order that resolved a six-year legal fight to keep the returns confidential from Congress.

But don’t expect the public to learn too much from the committee review. There are no plans to release these returns to the public, and the House Ways and Means Committee doesn’t have long to complete its oversight work as the Republicans will take over control of the committee in the next Congress.

On December 6th, we learned that the Trump Organization was found guilty on all counts of tax fraud. The charges surrounding a tax matter that global mobility tax professionals are all too familiar with – taxable fringe benefits to employees. Yes, providing employees with free housing, cars, and covering personal expenses is considered taxable. The Trump Organization will face penalties that could be up to a maximum $1.6 million. All this about Trump’s taxes is likely to be yesterday’s news in 2023. I expect we will be focused on other tax policy developments in 2023. It will be interesting to follow.

%20(31).png)

%20(77)%20(1).png)