Ever wondered how taxes shape life across the globe? What if we told you that understanding the world’s tax systems could be as simple—and fun—as looking at a map? AIRINC’s new Global Tax Rates Maps are here to take you on a colorful, engaging, and informative journey through the intricate world of taxes. Whether you’re a global mobility professional, an expat planning your next adventure, or just curious about the numbers behind your paycheck, these Tax Rates Maps are your go-to guide.

What are AIRINC Global Tax Rates Maps?

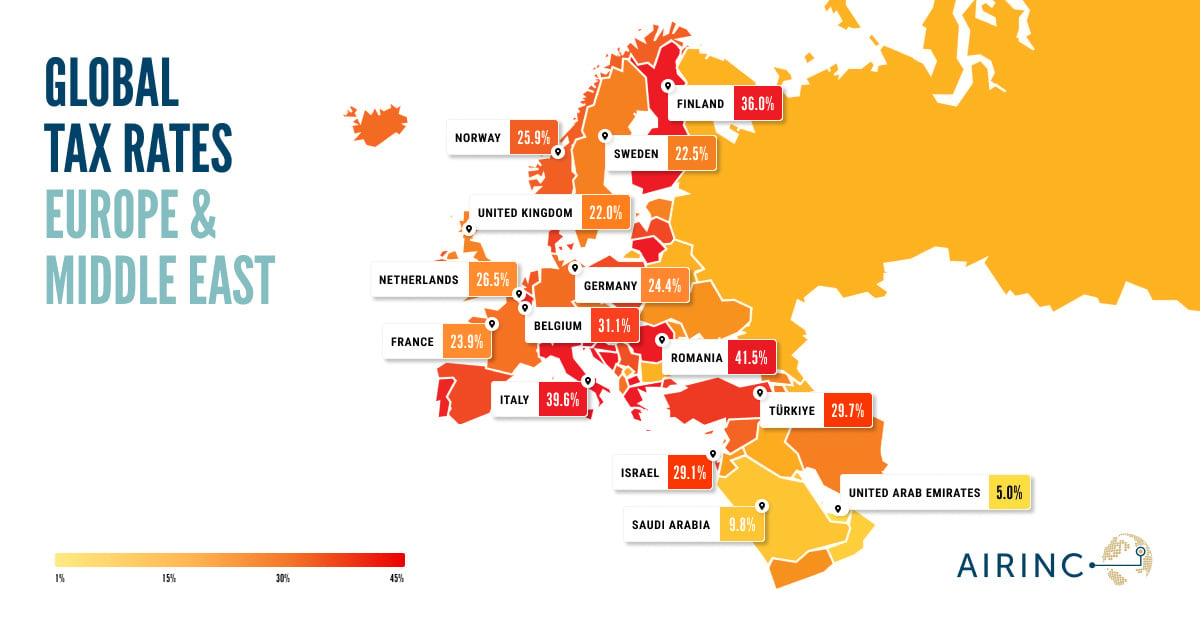

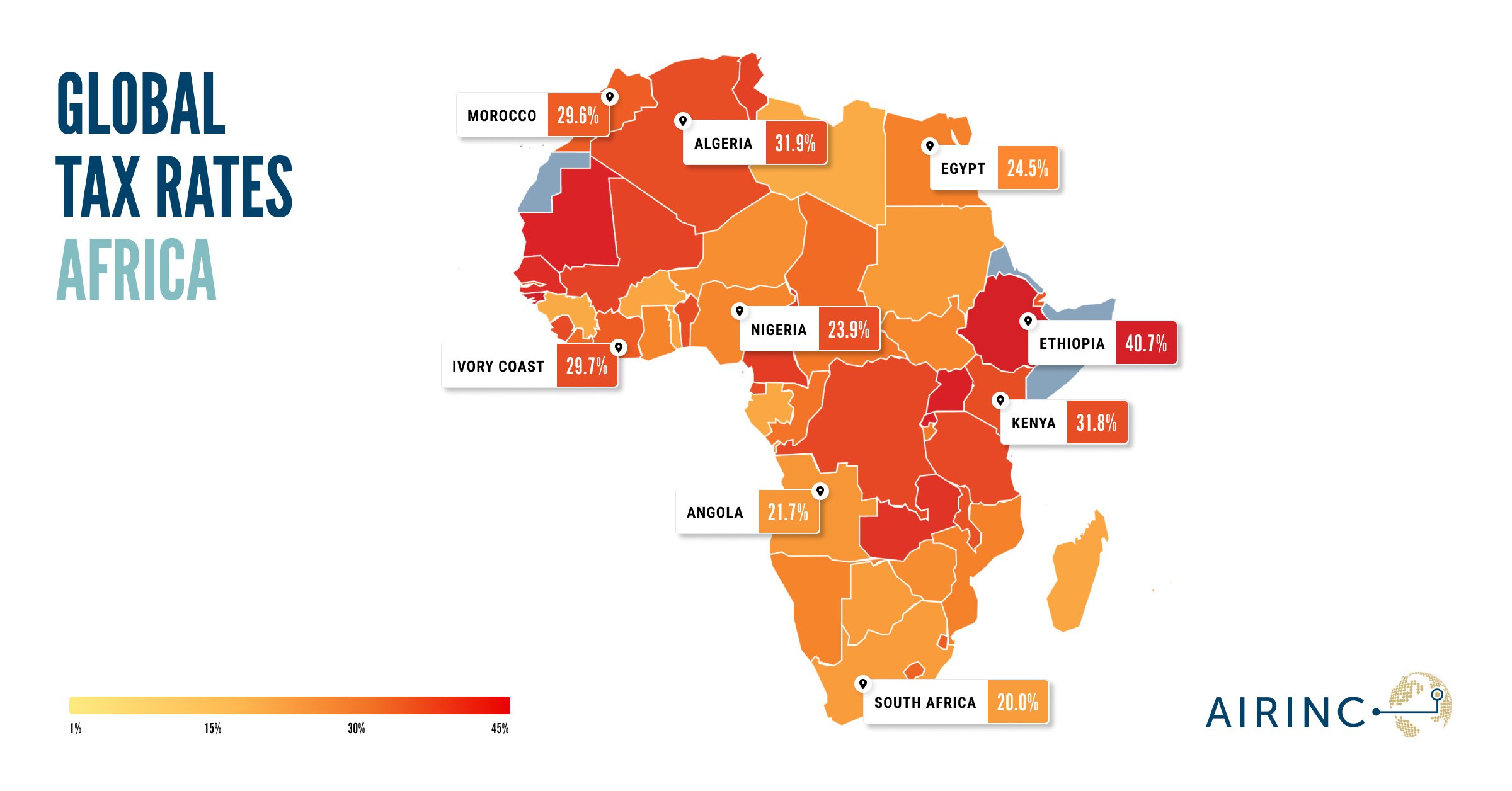

AIRINC Global Tax Rates maps are visually striking tools that showcase the effective tax rates for middle-income earners around the world. These maps cover income tax to social security contributions, giving you a snapshot of how much money individuals get to keep in their pockets after taxes.

What Makes These Maps So Cool?

- Global Perspective: See how different countries balance , tax revenue, and take-home pay.

- Comparative Insights: Spot the stark differences between high-tax Nordic nations, tax-free Gulf states, and everything in between.

- Interactive Decisions: Use the maps to consider your next career move, relocation destination, or global mobility decisions.

The tax rate you pay depends on several considerations, including:

- Location: Income tax rules vary by tax jurisdiction—not just at the country level, but also by state, city, province, or canton.

- Income Level: Many tax systems are progressive, meaning the higher your income, the higher your tax rate.

- Marital Status and Family Size: Some tax systems give preference to married taxpayers or those with dependent children. In such jurisdictions, having a larger family may result in lower taxes.

- Available Deductions and Tax Credits: Many systems offer benefits for expenses such as mortgage interest on a primary residence or charitable donations.

What is Included in the Tax Rates?

The tax rates shown on the map reflect the effective income tax rate on employment income at a representative middle-income salary assuming a family size of four. This combined rate includes income tax (national, state or province or canton, city or commune) plus mandatory social security contributions. Some social security contributions are capped based on a maximum salary subject to the contributions.

The effective tax rate may not be the highest marginal tax rate and is impacted by tax deductions and personal allowances that reduce taxable income for that tax jurisdiction.

The higher the effective tax rate, the higher the overall tax burden and the lower the net take-home pay.

Fascinating Tax Tidbits from Around the Globe

- The Big Tax Players: Scandinavian countries like Sweden and Denmark have some of the highest effective tax rates, but they also provide world-class public services like universal healthcare and education.

- Tax-Free Havens: The UAE and Qatar impose zero income taxes, though expats may need to budget for private healthcare and retirement plans

- The United States Tax Shuffle: Did you know that where you live in the U.S. could drastically change your take-home pay? States like California and New York have high state income taxes, while Texas and Florida don’t assess a personal income tax.

- Asia-Pacific talent hubs: Singapore and Hong Kong are famous for their low tax rates and business-friendly policies, making them popular hubs for global talent.

- Emerging Economies’ Trade-Offs: Countries like Vietnam and the Philippines offer low tax rates, but often provide limited public services.

Why Publish These Rates Maps?

At AIRINC, we take pride in the depth and strength of our tax database and the expertise of our in-house specialists. With decades of experience analyzing global tax systems, we’ve developed one of the most robust and comprehensive tax datasets in the industry.

What Makes Our Tax Data Unique?

- Breadth of Coverage: AIRINC tracks and analyzes tax systems in over 200 countries and 300 tax jurisdictions, offering a truly global perspective

- Granular Insights: Our data isn’t just about rates—it includes allowances, deductions, tax credits, and mandatory social security contributions, all tailored to individual scenarios such as family size and income level.

- Expert Analysis: Our in-house tax specialists keep up with legislative changes to ensure that our insights are accurate, timely, and actionable.

What’s Next? A Blog Series to Explore Tax Trends by Region!

This is just the beginning! Along with the Rates maps, we’re launching a blog series to dive deeper into the tax dynamics of different regions around the world.

Start Your Journey Through the World of Taxes Today

Whether you’re a seasoned mobility expert, a curious globetrotter, or someone with a newfound interest in global economics, AIRINC’s Global Tax Rates Maps are here to inform, entertain, and inspire. Explore the maps, join the conversation, and follow our blog series to learn how taxes shape life across the globe!

Let’s make taxes more accessible—and even a little fun. Keep an eye out for our upcoming regional blogs and get ready to dive into the colorful world of taxes with AIRINC!

Are you looking for information on global tax rates around the world?AIRINC’s International Tax Guide contains all of the information you need to support your assignment tax planning — including global tax rates, deductions, and employee/employer social security contributions. |

Are you trying to move an employee from a lower- to a higher-tax rate location?Use AIRINC’s Global Salary Comparison to understand the compensation you would need to offer to cover the difference and make the appropriate offer to your employee. |

Want to hear even more on tax?!AIRINC is kicking off its 2025 Global Tax Chat series with an exciting new session on January 30 at 9:30 AM (Boston) / 2:30 PM (London). The session will cover the latest updates in global tax compliance, including significant regulatory changes and how they impact expatriate tax programs. |

%20(31).png)