Global Mobility tax update

AIRINC Global Tax Director Pat Jurgens joined Benivo’s 'The View from the Top' hosted by Brian Friedman on June 16, providing a global mobility tax update, accompanied by immigration expert Julia Onslow-Cole, and special guest Jazmine Williams-McCoy, Director of Diversity, Equity and Inclusion at Rocket Companies.

What's the latest news in global tax?

Multi-lateral tax cooperation – Implications for Global Mobility- One tax provision announced at the recent G-7 summit is an understanding to work towards a global ‘minimum tax’ of 15% on the largest multinational companies.

- By one estimate, the minimum tax proposal would generate an additional $150 billion in tax revenues for all countries.

- Globalization and digital technologies have made it easier for companies to shift profits to minimize tax. Companies can have a digital presence in a country and pay little or no tax.

- Cooperation among tax collectors increased to combat these aggressive tax strategies known as BEPS – Base Erosion and Profit Shifting.

- Stopping BEPS is a key initiative for the OECD. OECD has been working on a collection of tax initiatives known as Pillar 1 and Pillar 2.

- Pillar 1: Where tax should be paid. What country has the right to tax income even if there is no physical headquarters there?

- Pillar 2: Amount of tax to be paid, calculating taxable income and transfer pricing rules, and looking at the wide range of tax rates applicable from country to country by establishing a minimum threshold tax rate. The new proposed global minimum tax rate of 15% is part of Pillar 2.

- Remote workers and global mobility activity could trigger Permanent Establishment and corporate taxes. A global tax agreement on BEPS will provide clarity on how taxing rights will be allocated and how much tax is due.

- This multi-lateral cooperation between tax authorities is likely to bring additional scrutiny to how Global Mobility activity and Remote Workers may trigger corporate tax risk and even make it more difficult for short-term assignments to utilize the 183 day tax treaty exemption.

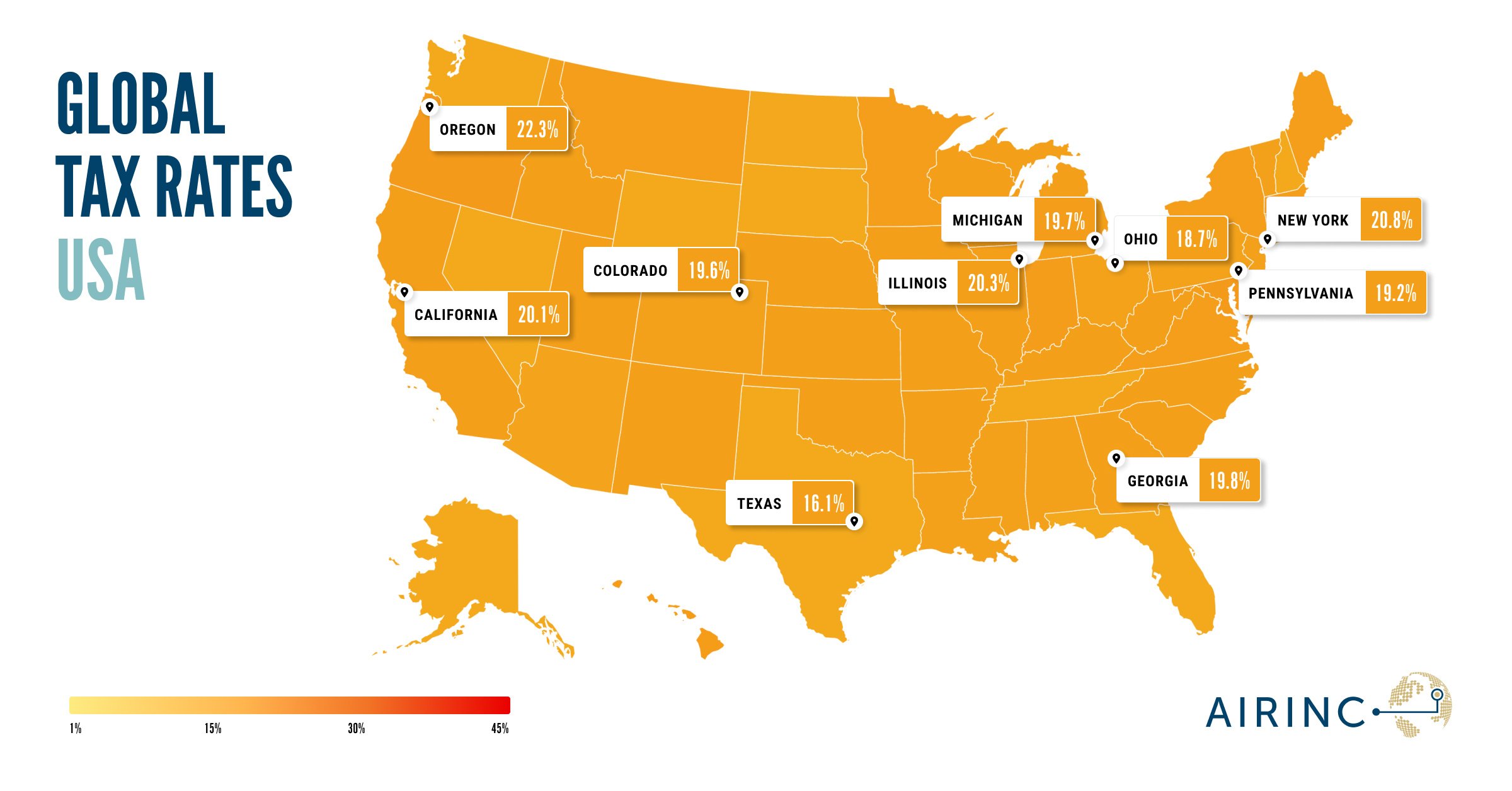

New York State begins tax audits of remote workers

- New York is living up to its reputation as an aggressive tax collector in addition to being a ‘high-tax’ state. NY enacted tax increases in May on high-income taxpayers.

- New York state expects that nonresident workers be taxed based on the employer’s normal work location and ignores time worked outside the state unless it is for the ‘Convenience of Employer’ or there is a bona fide employer office in the telecommuting location. Tax collections from workers normally commuting into New York are an important source of revenue.

- Back in October, New York’s Department of Taxation (DOT) issued guidance that no exception would be granted to the Convenience of Employer rule, even as many employees worked from home and outside of New York during the COVID-19 pandemic.

- In April, we learned that the DOT began training auditors on nonresident tax rules and how to audit 2020 individual returns from nonresidents claiming tax refunds. Remember that most New York employers continued to report nonresident NY state wages and withheld state income taxes. This left individuals attempting to claim tax refunds on their personal returns for wages earned while remote working during the pandemic.

- Hundreds of thousands of nonresidents are affected. In 2018, around 400,000 New Jersey residents paid $3.7 billion and over 90,000 Connecticut residents paid $1.3 billion in NYS nonresident taxes. These states accounted for about 10% of all individual income taxes collected by New York in 2018.

- We are expecting more state audit activity on 2020 tax returns due to so many individuals working remotely during the pandemic.

For more information on any of these tax issues contact Pat Jurgens.

Special guest Jazmine Williams-McCoy

The show welcomed Jazmine Williams-McCoy, one of the Benivo Top 100 Mobility Professionals, for a much needed conversation on Diversity, Equity and Inclusion! We enjoyed a spirited discussion about how we can confront our own biases, use DE&I for recruitment, advancement and retention in our workforce, and how everyone can promote DE&I in their own companies and policies.

Upcoming shows and how to access them

Join Benivo's LinkedIn Live Shows of 'The View From The Top' every other Wednesday at 8am PST, 11am EDT, 4pm BST, 8:30pm IST.

Pat joins again on June 30!

%20(31).png)