AIRINC Global Tax Director Pat Jurgens joined Benivo’s 'The View from the Top' hosted by Brian Friedman, providing an update on the proposed U.S. tax increases, accompanied by immigration expert Julia Onslow-Cole.

Draft U.S. Tax Proposals

- Draft tax proposals were released September 13th by the House Ways and Means committee.

- While this draft tax plan is similar to President Biden’s tax proposals, there are significant differences and is part of a complicated legislative process titled Build Back Better. The plan is really two pieces of legislation – a bipartisan “Hard Infrastructure Bill” and a larger 3.5 Trillion Democratic-only “Soft Infrastructure Plan” using a budget reconciliation rule that will certainly not gain widespread support from Republican legislators. All this now complicated by the debt ceiling stand-off.

- Since both plans need to pass in the House AND the Senate, it is likely the final versions will look different from the draft tax plan released by the House. Hearings in Congress will likely start next week as Democrats want to get these proposals to a vote in late October or November.

- There are substantial changes in– corporate tax, international tax, and reporting.

Impact on Global Mobility

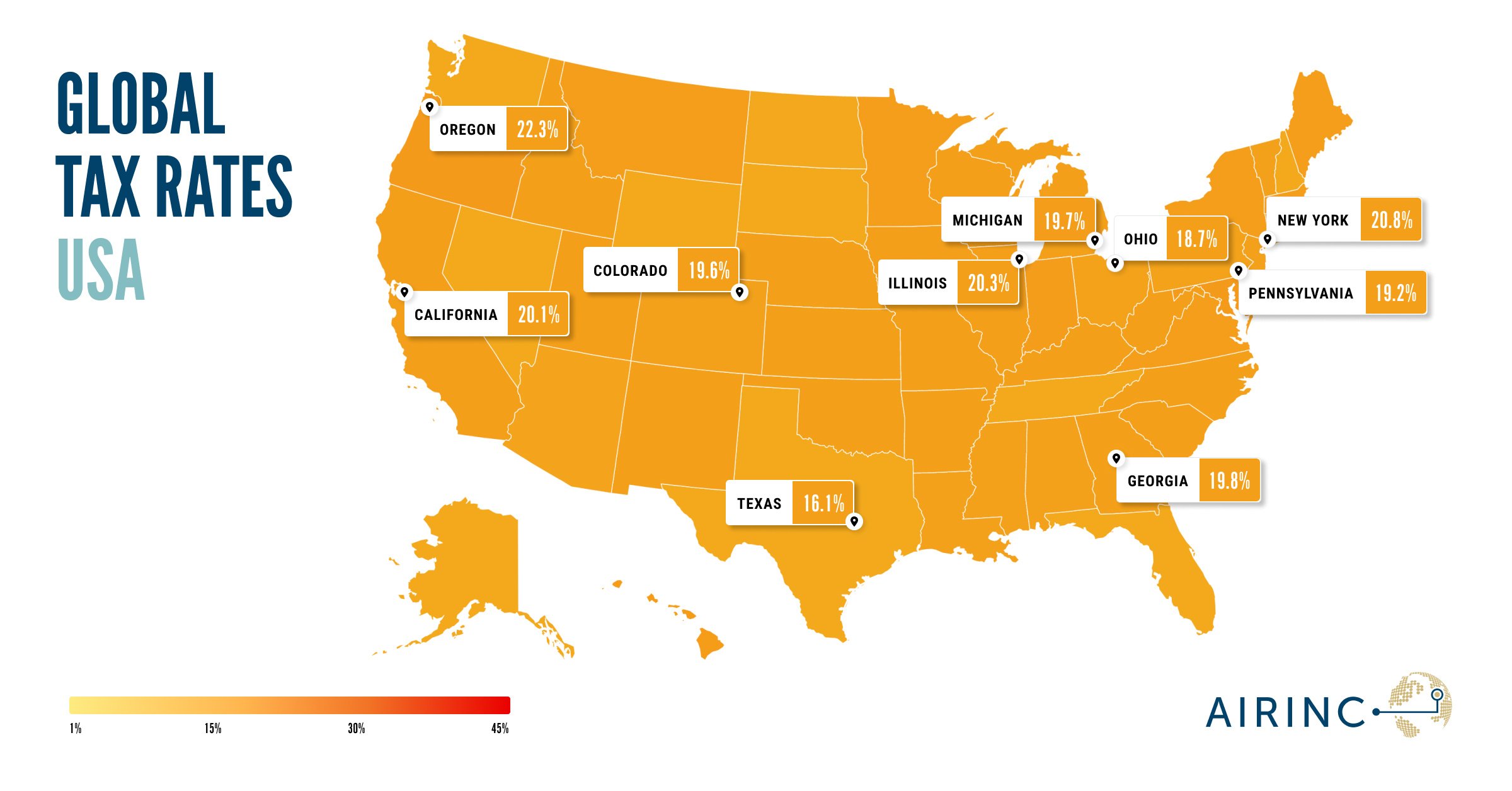

- The top marginal tax rate for individuals would increase from 37% to 39.6% which was the rate in effect prior to the Trump tax cuts. However, the tax bracket would be lowered from existing income thresholds so that more income would be subject to the higher rate: Singles - $400,000 and Married Joint - $450,000.

- The House plan also would impose a new surtax of 3% on incomes exceeding $5 million – effectively making the highest federal tax rate 42.6% on employment income compared to the existing 37% rate.

- Taxes imposed on capital gains would also increase under the plan with the top CG tax rate of 25%. But really, it’s 31.8% after considering the impact of the 3.8% Net Investment Income Tax and the new 3% surtax.

- Double tax relief from claiming Foreign Tax Credits would change under the proposal, modifying how the FTC limitation is calculated (country by country) and more importantly, repealing the carryback of FTC and shortening the carryforward period (OLD: 1 year back and 10 years forward, but NEW: No carryback and only 5 years carryforward). This could adversely impact US outbound taxpayers going to host countries with a fiscal year such as the UK.

- Not in the draft proposal:

- Any changes to itemized deductions, including the SALT limitation on state taxes but this may still be an amendment to the plan.

- Deductibility/Exclusion of moving expenses

Tax Planning, what to do now?

- Take advantage of the lower tax rates in 2021 either by accelerating income into 2021 or deferring deductions into 2022. Consider initiating assignments in 2021 so that taxable relocation costs are subject to the lower 2021 tax rates.

- Revisit your cost estimates and accruals considering the proposed changes.

More tax!

Pat joins Benivo's LinkedIn Live Shows of 'The View From The Top' with an update on tax every other Wednesday at 8am PST, 11am EDT, 4pm BST, 8:30pm IST.

If this time does not suit you, recordings of the show are available to watch again.

%20(31).png)