Do you need a global mobility tax update?

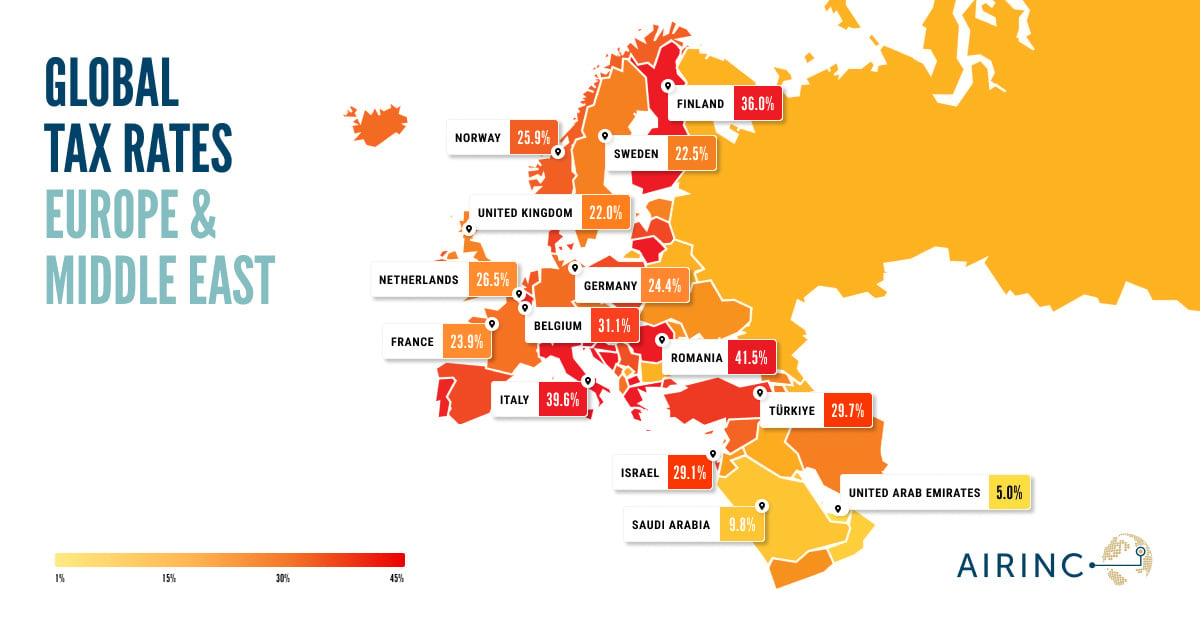

This week we look at the latest global mobility tax updates, focusing on the Netherlands and Finland.

Changes to the Netherlands 30% Ruling

This spring, Netherlands announced plans to restrict the expatriate tax concession known as the ‘30% Ruling’. This is still in the proposal stage but is expected to be effective from 2024. The 30% Ruling provides for the exclusion of 30% of wages from taxable income for qualifying inbound expatriate employees, so effectively only 70% of wages are taxed.

Beginning 2024, the proposal would cap the maximum salary that the 30% exclusion can be applied. The annual cap for 2022 is EUR 216,000 and would be indexed for inflation annually. Wage income that exceeds the cap would be taxable in full. Transitional rules for those employees currently using the traditional 30% ruling would be phased in over a 3-year period.

This change will bring the Dutch expat concession in line with recent changes in expatriate tax concessions in neighboring countries, notably Belgium and France. The change will impact higher income expatriates inbound to the Netherlands. The tax rate on income exceeding the cap would go from 34.65% to 49.5%. Mobility managers will want to consider the impact of the proposed changes to your mobility budgets.

We are expecting more details when the Dutch Budget is announced next week on September 20th.

Finland’s Proposed Exit Tax

Last month the Finnish government published a proposal to assess an “Exit Tax” for wealthy individuals. The intent is to prevent emigration-related tax evasion where individuals move to countries with low taxes or no tax on capital gains, such as Switzerland and then sell their investment assets to save tax.

The proposed rules would be effective beginning 2023. If enacted, qualifying individuals departing Finland permanently would be taxed on the appreciated value on financial assets as capital gains despite them not being sold, effectively a ‘deemed’ disposition. Assets subject to the exit tax are primarily investment property including company shares, investment funds, options, certain insurance contracts, and virtual currencies.

Individuals with investment assets valued over EUR 500,000 and with EUR 100,000 in appreciated value would be subject to the exit tax. A deemed disposition of the assets would occur the day prior to permanent departure.

Capital gains in Finland are typically subject to tax at a range of 30% to 34%. The payment of the exit tax can be postponed until the individual sells the assets. If the assets have not been sold or disposed of for 8 tax years following the year of departure, then the exit tax is no longer applicable.

Individuals that are subject to the exit tax would have a yearly tax filing obligation for as long as the assets are owned, reporting any increase or decrease in value. The filing obligation ends when all assets are disposed or when the 8-year period expires. Finnish real estate would be exempted from the exit tax since sales of Finland real estate by nonresidents are already taxable.

The public was invited to comment on the new Exit Tax, and the comment period closed on September 12, 2022. Only a few public comments were submitted, and all were against the proposed exit tax. Some commentators argued for a delay in the implementation date or limiting the scope of the exit tax.

Similar “Exit Tax” rules exist in Denmark, Norway, Canada, and the United States.

%20(31).png)

%20(10)%20(1).jpg)