In a follow-up to Jeff Hawk's "How Does Your Job Offer Stack Up?" post, Adam Silver looked at the challenges of "Attracting Talent" to a city that may be a difficult sell to employees. Then, in "Understanding the level of affinity between two locations can determine the success of a move," Michael Joyce examined the obstacles and options companies have when transferring an employee to a higher tax location. In this post I will look at the other side of the coin, attracting talent to a location with lower income tax. Wait…lower taxes…where's the challenge there? Well, as you will see, there is more to life than taxes.

International Transfers

Moving an employee to a new country is a significant investment for any company and comes with numerous risks. Will the employee adapt to the country's culture? How about the different corporate culture? Will the family be able to adjust? Many of these questions are impossible to answer ahead of time. Even though the company may have services in place to help with these challenges, there are just so many unknowns.

There are similar challenges from a compensation standpoint. Numerous factors need to be considered when determining whether the offered salary will adequately compensate the employee in the new location. Taxes are, of course, foremost in everyone's mind, but it’s crucial to understand the relative cost of after-tax expenditures like housing, utilities, goods and services, and transportation. Unlike the challenges of adapting to a new culture where there are many unknowns, using AIRINC's Salary Evaluation Tool (SET) makes it possible to answer these compensation questions when assessing a possible assignment.

Taxes and Purchasing Power

AIRINC’s SET calculator allows companies to assess how taxes and living costs will impact an employee's purchasing power in the assignment location. Income and social taxes in both home and host locations are compared using tax models designed by AIRINC's in-house tax team combined with cost-of-living comparisons conducted by our in-house pricing research team. By knowing these facts beforehand, both the company and the employee can have more confidence that the assignment will start off on the right foot.

Case Study: Australia to Singapore

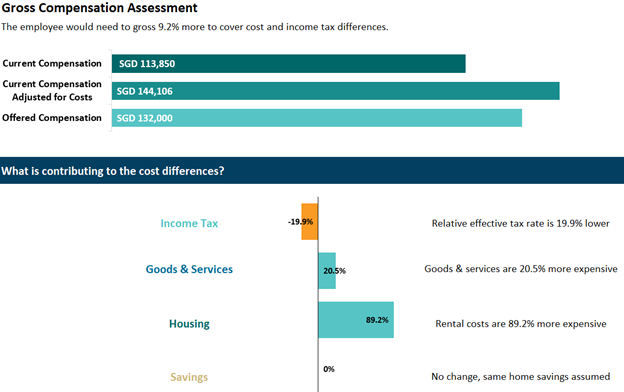

To see how SET can help determine a fair salary, let's look at a permanent transfer of an Australian national to a position in Singapore. At home, the employee was paid a total of AUD110,000, which includes both salary and bonus. The company is considering offering a salary of SGD132,000, which is approximately 16% higher than the home salary (above exchange rate adjustment). This seems like a reasonable offer, and it fits within the range of their Singapore salary range, but how do we know if it's fair?

The first step is assessing the impact of income taxes. In the report below, we see income taxes in Singapore are 19.9% less than back home in Darwin, Australia. With taxes almost 20% lower, and the offer salary 16% higher, it would appear the employee will be considerably better off in Singapore. While some companies may not go beyond this comparison, SET goes a step further by considering what the higher net income will afford the employee.

According to our research, Goods & Services are 20.5% higher in Singapore and Housing & Utilities are a whopping 89.2% higher! Using this additional information, we can now calculate that, despite lower taxes in Singapore, the gross compensation necessary to give this employee the same standard of living and savings rate as they had at home is 9.2% higher than the original proposed offer salary of SGD132,000. The company now has all the information they need to consider whether the offer salary should be adjusted. Providing this analysis will help reassure the employee by showing them there will not be a negative financial impact from the move.

Data to Help with Cross-Border Compensation

In this example, an accurate assessment of the real costs in Singapore helped determine an appropriate compensation package. There are challenges with any cross-border move. Having the data you need to make those complex compensation decisions can be the difference between a failed assignment or positioning the ideal candidate for success. AIRINC SET calculator puts that data at your fingertips.

Please contact us if you would like to learn more.

%20(22)%20(1).jpg)