In our recent post on "How Does Your Job Offer Stack Up?" Jeff Hawk discussed the compensation challenges of sourcing talent, along with affinity, and purchasing power. This is the next post in the series that provides a real life case study example.

One of the challenges that companies face within the U.S. has been attracting talent to what are often perceived as “dying” cities, especially in the Rust Belt. Many people have a perception of these cities that may no longer match the reality on the ground and this can present a challenge for recruiting.

Financial Impact of a Move

One way that companies and local chambers of commerce have tried to change perceptions is through education. Many clients have leveraged AIRINC’s data to help give recruits and transfers a better picture into how a move will affect them financially. While money isn’t everything, giving potential recruits a window into how far their salary can go is a great way to help get them interested in taking a job in a location that they may perceive as less desirable.

Boston to Detroit

Detroit is a great example of a city where popular perceptions of the area and reality differ. Since the 2008-2009 recession, Detroit has seen a resurgence which has not fully permeated popular conceptions of the city. Looking at the financial advantages of relocating there can be an effective way to get recruits to revisit their perceptions of the metro area. While it isn’t quite as inexpensive as it was a decade ago, Detroit is still a significantly less expensive location than cities like San Francisco, New York, Boston, and Chicago, and that can be a strong door-opener for companies looking to recruit there.

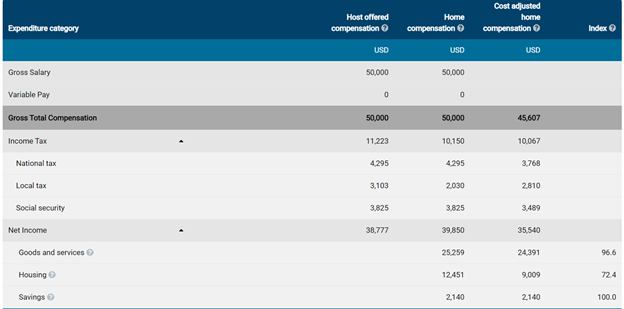

You can see an illustration of this in the Salary Evaluation Report for Boston to Detroit detail below. This report compares costs in the two cities at an income of USD 50,000 and a family size of 1. We have assumed that this employee is renting since they are an early-career employee.

Tax Implications

In the report, comparing the first two columns shows the difference in tax costs alone. Comparing the first and third columns shows the difference in costs from a tax AND a cost of living perspective.

As you can see, looking at the tax cost comparison in the first two columns, the employee would actually be worse off in Detroit versus Boston – their net income would actually decrease by about USD 1,000 from USD 39,850 to USD 38,777!

Cost of Living Implications

However, once you take into account the differences in the cost of housing (almost 30% cheaper in Detroit) and goods and services (almost 5% cheaper in Detroit), the assignee’s purchasing power increases by about USD 3,200 – almost 10% of their Boston net income, so a significant bump – in Detroit compared to Boston.

Providing a concrete example of the area’s financial advantages like the above is an excellent way to open a recruit’s mind. However, money isn’t everything: pairing that financial information with educational materials about the area and even connecting them with locals is necessary, too. In Detroit’s case, the Detroit Regional Chamber launched the Let's Detroit program as a way to help attract and retain talent in the metro area by educating people about Detroit and creating connections to allow people to understand what it’s really like to live there through innovative approaches like “Text a Detroiter” which allows people from anywhere in the world to text message to a Detroit local their questions about the area and get answers.

Stay tuned for more case studies in the coming weeks to illustrate some real-life examples of affinity and purchasing power. In the meantime, please contact us if you would like to learn more.

%20(54)%20(1).png)

%20(53)%20(1).png)

%20(25)%20(1).jpg)