In the world of long-term temporary assignments, two popular approaches are often used: the Home-Based Tax Equalized (also known as the "Balance Sheet") and the Host Plus (also known as "Local Plus"). After exploring the basics of each approach in our previous blog post, it's time to delve into the process of selecting the right assignment approach.

It’s important to know that expatriate assignments are not one-size-fits-all. The budget of the employer, priorities of both the employer and the employee, and the salary affinity between the home and host countries must all be considered when deciding which approach the employer will use. This decision should be based on a variety of factors: assignment length, level of employee, assignment purpose, intended assignment conclusion, and home and host location.

CHOOSING AN ASSIGNMENT APPROACH

Some of the more important factors in selecting one of these assignment approaches is understanding the cost difference and intricacies between them.

There are three main areas where the Balance Sheet and Host Plus differ:

- Compensation and Benefits

- Assignment Package Configuration

- Tax Treatment

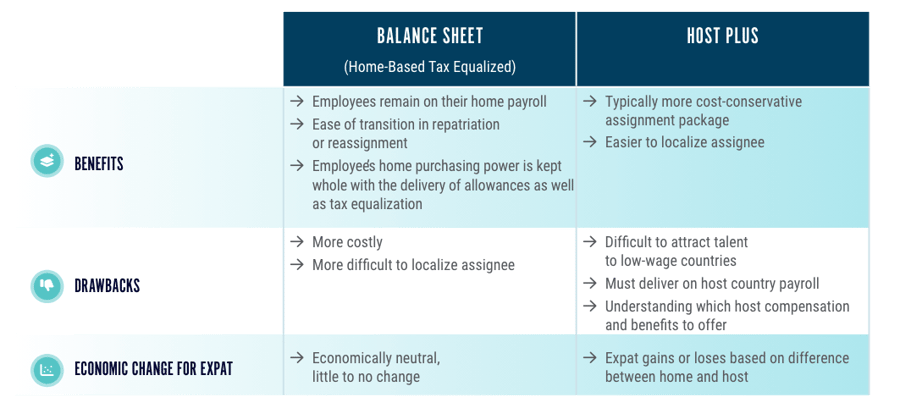

Compensation and Benefits

With the Balance Sheet, an employee will remain on their home country salary and benefits. This is done to expedite repatriation or reassignment at the conclusion of the existing assignment.

With Host Plus, employees are placed on host country peer salary, as well as host country benefits. This approach treats the employee more as a local in their assignment country, but with some allowance benefits.

Package Configuration

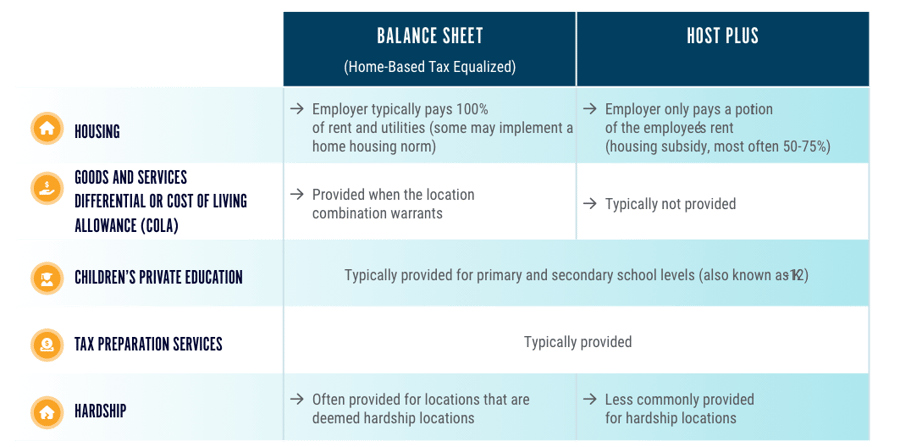

The largest difference between the package configuration of the Balance Sheet and a Host Plus assignment is that the former is typically the more costly approach. That is because more allowances are typically provided, and the allowances themselves tend to be more generous. With Host Plus, fewer allowances are provided, and the allowance amounts tend to be more conservative.

Here is an outline of some of the differences between the two approaches:

Each approach has its own benefits and challenges, and it is often important to understand which is best for each of your unique scenarios.

Don't miss out on the exciting conclusion of our blog series, where we dive into the tax treatment for the balance sheet and host plus approaches.

%20(24).png)

%20(28).png)

%20(2)%20(1).jpg)