The America Rescue Plan Act

On March 11th, President Biden signed the American Rescue Plan Act (ARPA) of 2021, representing a $1.9 trillion tax and spending package targeted towards economic recovery and health impacts of the coronavirus pandemic. The new law, supported and fast-tracked by Congressional Democrats and the White House, contains a wide array of provisions. Among those relevant to individuals, ARPA provides another round of direct stimulus payments to eligible taxpayers, temporarily increases several low and middle income tax credits, includes significant state and local assistance, funds vaccine production and distribution, and extends the federal supplement to state unemployment benefits through September 6, 2021.

What's included in the package

The third round of stimulus (‘economic impact’) payments provides up to $1,400 for adults and any dependents. The payments begin to phase out at $75,000 for single filers and $150,000 for joint filers and are completely phased-out at $80,000 (single) and $160,000 (joint). Approximately 89% of filers will receive some payment, according to analysis from Tax Foundation. These phase-out thresholds are lower than the stimulus payments sent out in 2020, meaning there is a subset of individuals that received previous payments, but will no longer be eligible. Conversely, the 2020 payments were only provided to children under the age of 17, but the ARPA payments are eligible for all dependent children (e.g. older high school and college age students), and dependent relatives (e.g. elderly parents).

How to qualify

Qualifying individuals must have a Social Security Number to receive the stimulus payment. The IRS will use the most recent tax return submitted to determine how much the stimulus check will be: tax year 2019 or 2020 depending on how quickly the taxpayer has filed returns.

Stimulus payments are already being distributed, with the IRS estimating about 90 million payments were sent as of Wednesday, March 17th, representing an estimated half of eligible households. Stimulus payments are not taxable income but will need to be reported on the 2021 tax return. If an individual was eligible for a payment but did not receive it or the payment was too small, the difference can be claimed as a credit on the 2021 tax return.

| Global Mobility Perspective: |

| Some tax-equalized U.S. inbound assignees will qualify and receive the stimulus payments. Global mobility programs will need to consult and interpret their policies to determine whether those individuals are allowed to keep the payments, or should remit them to the company, under the Tax Equalization policy. Does your policy make a clear distinction on these type of ostensibly ‘tax’ payments, or does the extraordinary pandemic circumstances dictate a more lenient interpretation? Either way, the company should be drafting and remitting communication to impacted individuals in order to clearly state the company position. |

Child Tax Credits

Parents and children are a clear focus of ARPA, with targeted relief aiming to lift an estimated 45% of children out of poverty, an atypical and disconcerting statistic for a global world power.

Under the new law, Child Tax Credits (CTC) have been expanded only for 2021, but Democrats are endeavoring to make them permanent. For 2021, the credit is increased from $2,000 to $3,000 per child, or $3,600 for children under the age of 6. The age limit for qualifying children also increased from 16 to 17. The credit base is also widened by extending eligibility to children without Social Security Numbers (but with Individual Taxpayer Identification Numbers) and to residents of Puerto Rico and U.S. territories.

Finally, the CTC for 2021 is now a refundable credit and eligible for ‘advance’ payments. Taxpayers will receive the benefit even if they owe no income tax and they can get 50% of the benefit ‘advanced’ over a six-month period beginning in July, with the remaining half claimed on the 2021 tax return. The IRS will be responsible for implementing a CTC advance payment system by July (which may be an aggressive timeline).

Under the American Rescue Plan, the 2021 increase (i.e., the extra $1,000 or $1,600) is gradually phased-out for individuals with an AGI of $75,000 (single) / $150,000 (joint). However, the increase can't be reduced below zero (other limitations to this reduction will apply as well). After any reduction of the increased credit amount is calculated, the pre-existing phase-out is then applied to the remaining credit amount. So, for individuals with an AGI of $200,000 (single) / $400,000 (joint), the credit is subject to an additional reduction – possibly to $0.

Effectively, the CTC is now very similar to many European family allowances/child benefits systems: a direct government cash payment based on family size.

Child and Dependent Care Tax Credit

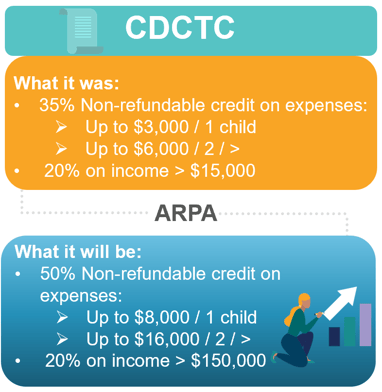

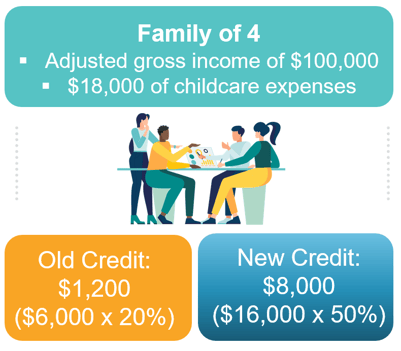

CTC is not to be confused with the Child and Dependent Care Tax Credit (CDCTC) for qualifying childcare expenses. This CDCTC has also been expanded substantially for 2021.

Previously, the CDCTC was a non-refundable credit of 35% of certain qualifying childcare expenses up to $3,000 for households with one child, and $6,000 for households with two or more children. The credit phased out for incomes above $15,000 to a maximum percentage of 20%.

ARPA makes the CDCTC credit fully refundable, and the credit is increased to 50% of expenses. The plan also substantially increases the eligible expenses to $8,000 for households with one child and $16,000 for households with two or more children, while the income phaseout would be increased to $150,000. The act also increases the pretax contribution limit for dependent care flexible spending accounts from $5,000 to $10,500 for 2021.

Comparison:

| Global Mobility Perspective: |

| The ARPA will reduce U.S. tax costs for taxpayers (and, in effect, companies that are paying U.S. taxes on behalf of equalized inbound assignees). U.S. Hypothetical tax calculations may need to be revised to incorporate the new higher credit amounts, new phaseouts, and newly eligible dependents (less hypothetical tax to be collected). Absent a round of revisions, expect larger Tax Equalization Settlements to be payable to employees in 2022. |

Federal filing deadline [update]

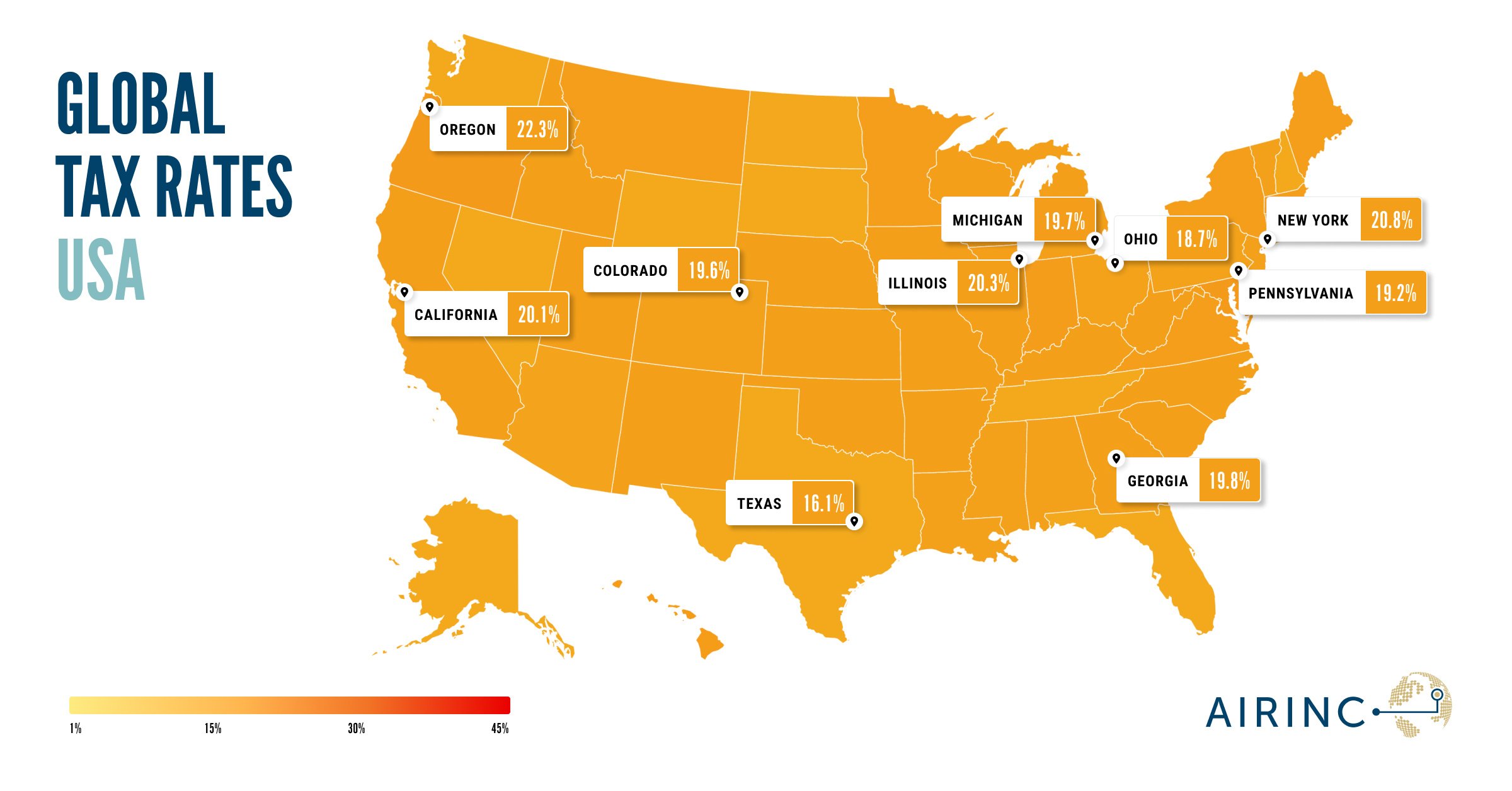

Finally, the IRS has announced that the Federal filing deadline for tax year 2020 has been extended from April 15, 2021 to May 17, 2021, providing taxpayers additional time to file and pay taxes. The extension is automatic, meaning no action is required by taxpayers. The extended deadline, however, does not apply to 1st quarter 2021 estimated tax payments, and importantly, it does not apply to state tax returns, where deadlines are set and managed by each individual jurisdiction. Individuals should confirm their state filing deadline obligations to avoid potential interest and late payment/filing penalties.

Update as of March 23, 2021:

Many states are also extending their deadlines to at least May 17th. The states to push the deadline, as of March 23rd are:

What's next?

What’s Next? In order to fund the American Rescue Plan Act, President Biden is reportedly planning the first major tax hike since 1993. The plan is reported to include the following:

-

Will not raise taxes on households earning less than $400,000.

-

Raise the top marginal rate from 37% to 39.6% for income above $400,000. Remember that marginal rate means the next dollar above $400,000 is taxed at 39.6%, not that the entire $400,000 is taxed at 39.6%.

-

Cap itemized deductions at 28% for households earning above $400,000.

-

Create a social security ‘donut hole.’ Currently social security is payable on wages up to $142,800 for 2021. The plan would create a hole where wages would continue to not be subject to social security from $142,800 to $400,000, but begin again above that threshold.

-

Tax capital gains as ordinary income for those earning more than $1,000,000 per year.

-

Increase the corporate tax rate from 21% to 28%.

A tax legislation this comprehensive would likely not come into effect until tax year 2022 at the earliest, but negotiations are expected to be arduous as the nascent administration navigates and assuages a 50-50 Senate that is unlikely to conjure much bipartisan support.

For more information please reach out to our tax team.

%20(77)%20(1).png)