Australia is a popular destination for expatriates, students, tourists, investors, and businesses due to its high quality of life, security, education, healthcare, economic stability, political stability and welcoming multicultural society.

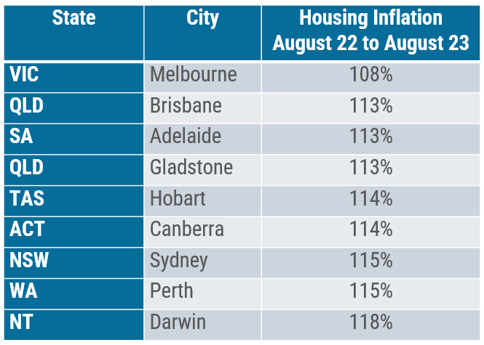

The AIRINC housing team sets and updates rents for more than 40 Australian host locations each year, including all 8 capital cities. Clients in mining, energy, finance, consulting, healthcare, agriculture, and information technology use these housing budgets to manage assignments into Australia. Rents in Australia are rising due to a combination of factors related to supply and demand. From July 2022 to 2023, expatriate rents rose by an average of 11%. Bigger increases were seen in many capital cities and resource hot spots, such as Gladstone.

In advance of results from Quarter 1, 2024 surveys we wanted to share some of the drivers of these rental price increases.

- Population Growth: Australia has experienced significant population growth in recent years, driven primarily by immigration. This influx of people increases the demand for housing, putting upward pressure on rents.

- Urbanization: There's a trend of increasing urbanization as more Australians move from rural areas to major cities. This migration amplifies the demand for rental properties in urban areas.

- Changing Living Patterns: Post-pandemic living patterns have shifted to the creation of more individual households (no roommates) and a decrease in number of occupants per household. Many renters also want an additional bedroom for use as a home office. This means more and larger units are required to accommodate the same number of people.

- Limited Housing Supply: There is an overall housing shortage in Australia. New construction is limited or slow to roll out because of high interest rates, stringent zoning regulations, labor shortages, and high material costs. Rental stock is also being lost to the profitable short-term furnished rental market which has strong demand from global nomads, tourists, foreign students, and business travelers.

- High Property Purchase Prices: The soaring prices of properties make homeownership less attainable for many Australians, forcing them to remain in the rental market. This sustained demand further drives up rental prices. Landlords are also affected by high purchase prices, interest rates, and inflation which causes them to raise rents in response.

- Natural Disasters: Recent bushfires, flooding, and storms have led to temporary or permanent loss of housing stock. In areas affected by such disasters, the reduced supply can contribute to rent increases.

Reach out to your AIRINC contact for the latest recommendations for Australia rent budgets. New data will be available in early April.

AIRINC provides ‘at-the-ready’ housing budgets by job level and family size. We do the research for you saving time and giving you the confidence that your support is up to date and competitive. Budgets are based on our continuous surveys and benchmarks of typical allowances across the income and family size spectrum. Our dedicated experts support your budgets, providing you advice and information for your locations. Contact us!

%20(27).png)

%20(28).png)