Determining an equitable cost-adjusted salary

With respect to U.S. domestic transfers, state and local income tax differences are of particular relevance for determining an equitable cost adjusted salary. Two individuals within the United States can have the same salary and family size and earn vastly different spendable incomes because of the different tax rates throughout the states and cities. Forty-one states levy individual income taxes on wage and salary income. Nine do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Of the forty-one states that tax wages, 33 (including District of Columbia) impose a progressive income tax; meaning the more income earned, the higher the effective tax rate. Compared to a flat state tax rate, the progressive nature of most state tax systems makes it difficult to accurately shorthand calculations. While a flat 5% income tax in Massachusetts is easy to adjust for, the progressive system of California has ten brackets ranging from 1% to 13.30%. Layered on top of this is each state allowing different deductions, allowances, and credits for determining a final tax due.

An imbalanced tax system and the complexity for HR

Among the forty-one states, there are 4,964 county and city local income taxing jurisdictions across 17 states. This dichotomy creates an imbalanced tax system across the country that most other nations do not oblige. For example, in 2020, every resident in the 6.6 million square miles of Russia paid the same 13% income tax rate, compared to the nearly 5,000 different taxing jurisdictions across the 3.8 million square miles of the United States.

The U.S. state and local tax idiosyncrasy adds a level of complexity for U.S. domestic transfers that HR and mobility professionals may need to consider in order to equitably move employees across the United States.

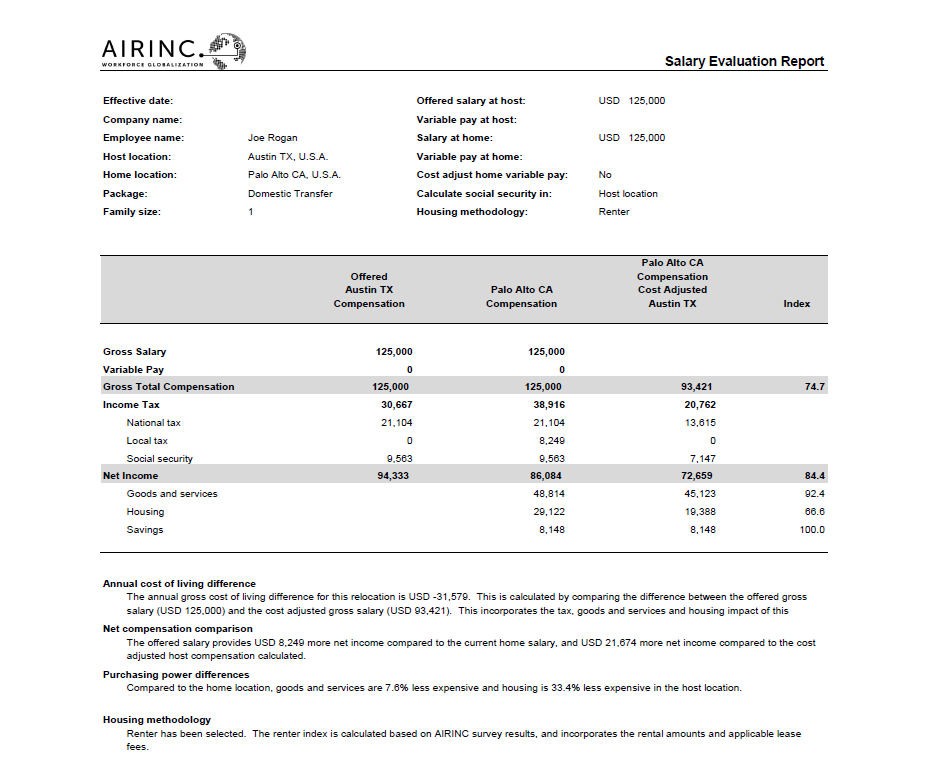

Let’s look at an example of a move of individual earning $125,000 from Palo Alto, CA to Austin, TX. Using AIRINC’s Salary Evaluation Tool, it can be estimated that the employee in Texas earning $125,000 would net $94,333, and the same salary in California would net $86,084, with the difference driven entirely by the high state income tax in California. If we layer in the goods & services and housing spending differences between the locations, the tool calculates an appropriate cost-adjusted Austin, TX salary of $93,421. This figure, backed by AIRINC’s comprehensive, researched-backed indices and models, accurately reflects the location differences by the three pillars of spending categories: goods & services, housing, and income tax, while keeping savings neutral.

Above is a sample report from AIRINC's Salary Evaluation Tool.

An independent, data-driven gross salary

The report arms the company with an independent, data-driven gross salary to offer to their employee, which retains the employee’s original spending power. This can act as a starting point for negotiations, whereby meeting somewhere in the middle of the original $125,000 and the calculated equivalent of $93,421 allows each party to enjoy a portion of the windfall.

If taxes were uniform across the country, it would be a simpler analysis of cost-adjusted location differences. However, the federalism tax system of the United States adds an unwieldy layer of complexity and requires a holistic scrutiny that AIRINC supports with the Salary Evaluation Tool.

How does COVID-19 and remote work factor in here?

Stop me if you’ve heard this before, but COVID-19 has had a vast impact on all aspects of life. In particular, employers that may or may not have been dipping their toes in the remote working pool prior to March 2020 have been (un)wittingly pushed into the deep end. Employers are seeing increased productivity, lower overhead and turnover, and wider talent pools. Employees are enjoying the benefit of more flexible work schedules, reduced commuting time and cost, and location independence.

As jurisdictions slowly begin to lift COVID-19 restrictions, resilient employers are proactively enacting remote working policies envisaged to establish the "new normal" post-pandemic. Companies are working to establish guidelines, eligibility, restrictions, and approval processes for permanent remote working arrangements. Where an employee lives, and now works, has a corresponding impact on spendable income, and employers are facing the difficult process of determining when or if salaries should be adjusted to recognize the change.

What is the best way to manage U.S. domestic moves for your employees and business goals?

Having the right policies in place can go a long way with streamlining Mobility decisions, and having the right tools on top of those policies can lead to greater success in 2021 and beyond.

If you would like to discuss the best way to manage your U.S. domestic moves, please reach out today. AIRINC is here to listen to your concerns, partner with you on finding best-case solutions, and deliver a collaboration-driven plan that will meet your criteria for success.

%20(31).png)

%20(26)%20(1).jpg)