Belgium has had an expatriate tax concession since 1983 – almost 40 years. But starting in 2022, the rules are changing. The old rules allowed several tax advantages to qualifying inbound employees, including:

- “Deemed Nonresident” status – Not taxed on non-Belgian sourced income, particularly for compensation attributable to days worked outside Belgium

- General exclusion of EUR 11,250 (or a higher amount of EUR 29,750 if working for a “coordination or research center”)

- The old concession was not limited to a certain number of years

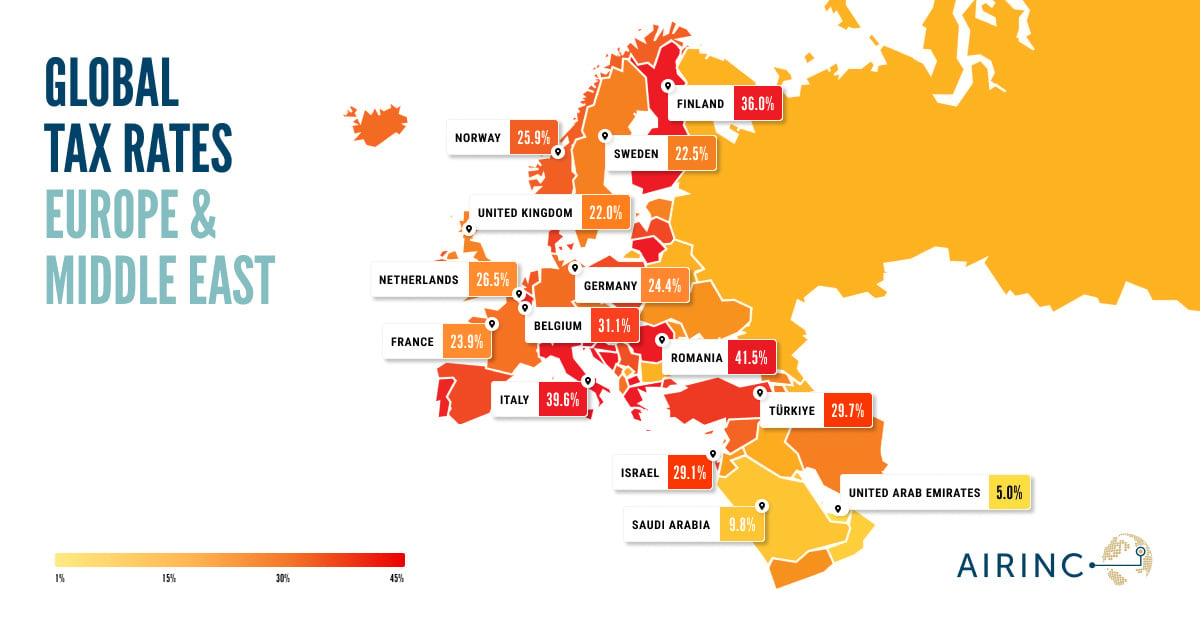

The new expatriate concession will begin January 1, 2022, and will be codified in the tax law, giving more certainty of the rules. The concession will be consistent with similar expat rulings in other European countries. The new expat regime will have several key differences. The general exclusion is now 30% of gross compensation, capped at EUR 90,000. The concession is limited to 5 years, with a possible extension of 3 years or 8 years in total.

The “deemed nonresident” provision will no longer apply. This means that the normal residence rules apply, and most expats moving to Belgium will probably be treated as Belgian tax residents. Thus, compensation attributable to days worked outside Belgium will be taxable.

Qualifying expats will need a minimum annual income of EUR 75,000, although certain researchers will not need to meet any income threshold. Instead, researchers will need to hold a master’s degree or equivalent experience in their field for 10 years. The expat must not have been a Belgium tax resident for 60 months prior to the Belgium employment or incurred a Belgium nonresident tax liability on professional income. Also, the expat cannot have lived within 150 kilometers of the Belgian border.

The expat regime must be applied for with the tax authorities within 3 months of the start of Belgium employment. It will be possible for the expat regime to transfer to a new Belgium employer, but this cannot lead to the regime status beyond 8 years. It is expected the exclusion will also apply to social security contributions, but tax authorities still need to confirm this.

There will be transitional rules for those taking advantage of the old expat regime as the legacy regime is phased out:

- They can continue to use the old regime for 2 more years, or

- They can apply for the new regime, assuming they meet all the new requirements for the remainder of the 5-year plus 3-year period. Careful tax planning will be needed. Deciding whether to opt in or opt out of the new concession must be made by 6/30/2022.

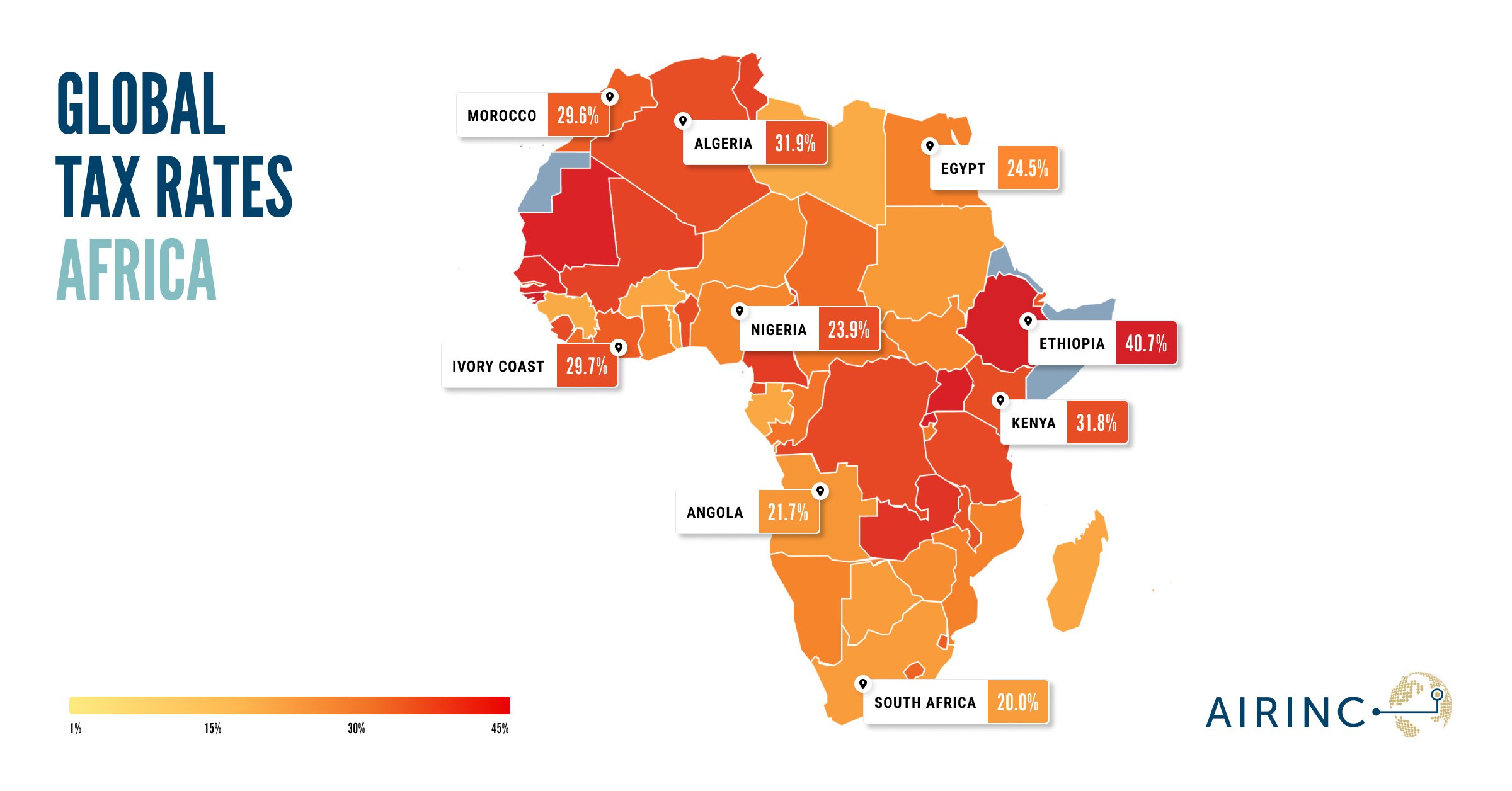

Summary: This new expat regime is very similar to the Dutch and French 30% rulings, but with a cap of EUR 90,000 on the excluded amount. This is being implemented to simplify the concession, making the rules more transparent, and to make the concession competitive with other schemes in Europe. The Belgium government hopes the changes will incentivize companies to attract talent to Belgium.

Want to hear more?

Pat joins Benivo's LinkedIn Live Shows of 'The View From The Top' with an update on tax every other Wednesday at 8am US Pacific, 11am US Eastern, 4pm UK, 8:30pm India.

If this time does not suit you, recordings of the show are available to watch again.

Photos kindly supplied by our Brussels colleagues

%20(31).png)