It’s no secret that many locations around the world are facing ever increasing housing costs, and our home city of Boston is no different. Boston’s housing market is grappling with soaring prices and limited inventory, creating a steep challenge for both residents and companies trying to attract talent to the city.

Why Boston Rents Are Boiling Over

Known for being an innovation hub and a major center for biotech and healthcare, its proximity to some of the most prestigious universities in the world, the rich culture, and — let’s not forget — the best clam chowder around, has made Boston a desirable place to call home for several decades. However, high demand for housing, coupled with slow or stalled new construction projects, has driven up rental costs considerably in just the past five years.

The recent rise in global inflation has made things worse by significantly increasing construction costs, making it even harder to finance and build new housing units to meet the growing demand. Although Mayor Wu has announced plans to remove many of the restrictions on new unit construction, the impact of these proposed changes has yet to be reflected in rental prices.

Another key contributor to rising rental costs is the sharp drop in vacancy rates over the past year. Most Boston renters are well aware of the competitive rental market and often choose to extend their leases rather than move. As a result, the vacancy rate has fallen below 1 percent.

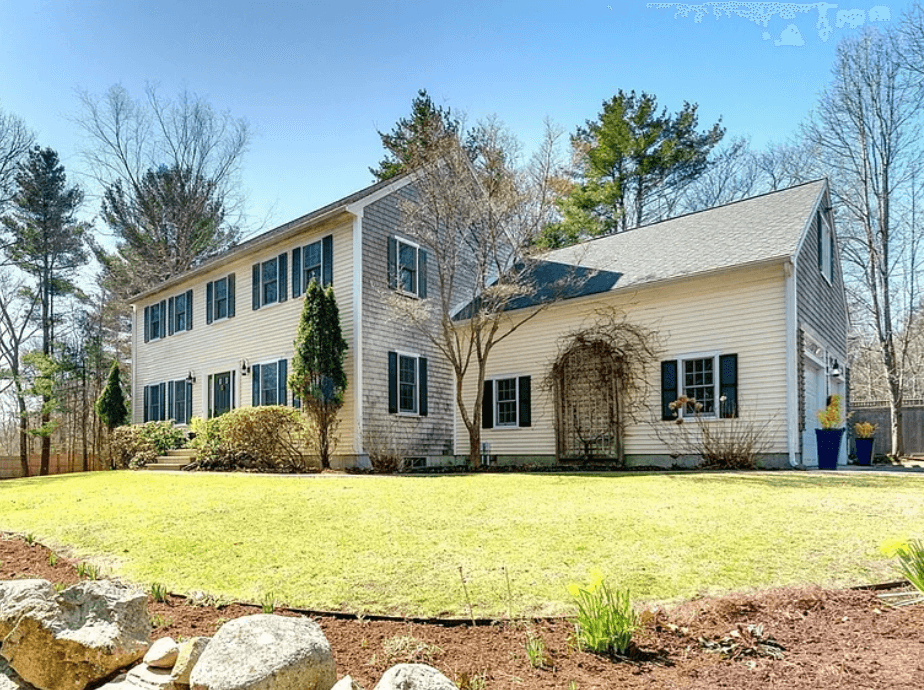

Many would-be home buyers have been priced out of Boston and its surrounding suburbs due to skyrocketing real estate prices. These individuals — along with college students, recent graduates, expatriates, and families — are all competing for limited rental accommodations, putting even more pressure on the market.

Mobility Solutions for a Costly Market

Boston is just one of many cities around the world where housing costs have surged. Mobility professionals across industries are developing creative and tailored solutions to continue supporting employee relocation in the face of rising expenses.

- For renters, a common strategy is to provide a lump sum equivalent to several months of rent. This can be critical in markets like Boston, where signing a lease often requires upfront costs totaling at least four months of rent — first, last, security deposit, and broker fees. Some companies choose to cover broker fees or offer repayable loans for security deposits to help ease the immediate financial burden.

- For relocating homeowners, support may include covering closing costs or providing a home purchase differential — an additional financial contribution to help offset the price gap when the destination market is more expensive than the origin. This differential is often calculated using average home prices and can be used to supplement the down payment. Read more from our U.S. Domestic Survey below.

While these tailored solutions can make transitions smoother and more financially feasible, the top priority is setting expectations before relocation. Some companies offer educational resources ahead of the move to help manage expectations, improve employee satisfaction, and support a successful transition.

By proactively addressing housing challenges with thoughtful and customized support, companies can ease the financial pressure of relocation while also strengthening employee engagement and long-term retention.

%20(51)%20(1).png)