Özel Tüketim Vergisi (ÖTV), special consumption tax, increased

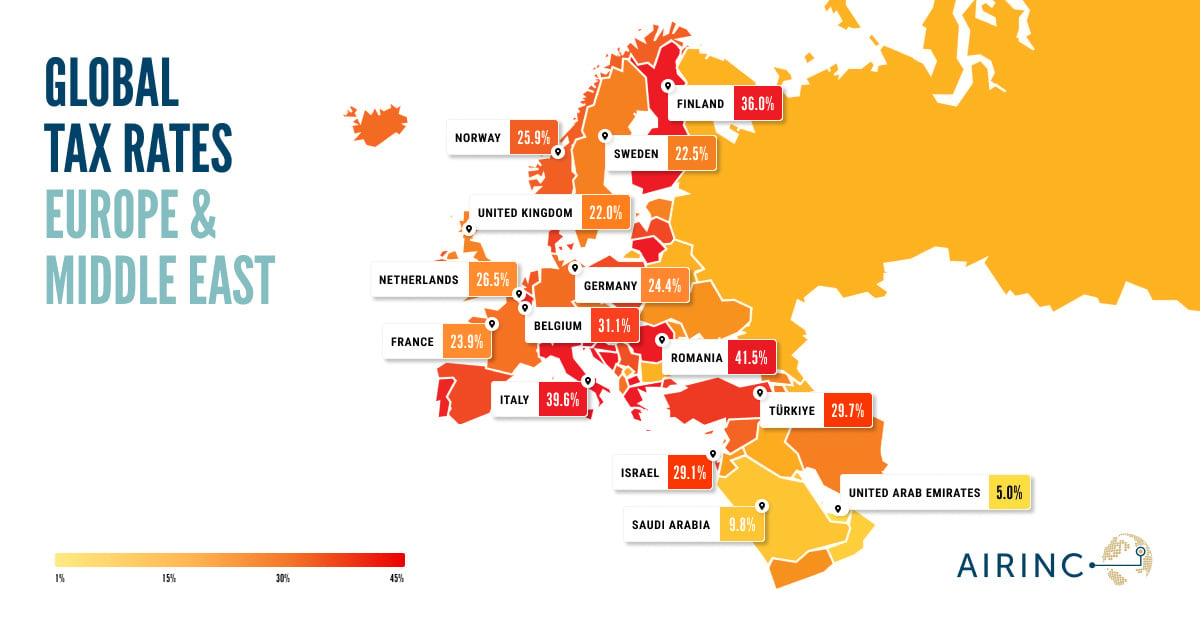

In late August, Turkey increased a special consumption tax known as Özel Tüketim Vergisi (ÖTV). The tax primarily relates to imported luxury goods, which includes imported cars. The tax was first introduced in 2002. However, it increased in recent years due in part to Turkey’s economic downturn. Value Added Tax (VAT) is also levied on vehicle sales in Turkey, which, combined with the new ÖTV rates, can make the tax burden among the highest in the world for the purchase of certain new vehicles. AIRINC’s November 2020 research showed a large increase in automobile prices due to these taxes.

The updated ÖTV rates depend on multiple factors such as engine displacement, engine type, and the price of the vehicle. At the low end of the spectrum, the rates remained unchanged for cars with an engine size less than 1.6 liters and a price less than 130,000 TRY. The taxes start to change for cars with a purchase price greater than 130,000 TRY and an engine size less than 1.6 liters, increasing from 60% to 80%. At the high end of the spectrum, the rates went up 60% for cars with an engine size greater than 2.0 liters and a price greater than 170,000 TRY, increasing from 160% to 220%.

Data Points Q4 2020: Expatriate Trends & Survey Data Highlights

The above excerpt is taken from AIRINC's quarterly newsletter, Data Points, bringing you the latest updates from our Housing, Goods & Services, and Tax departments. January 2021's edition also featured:

- 24 Currencies showing 3-month exchange rate fluctuations of more than 5%

- Goods & Services inflation higher than 5% for 6 months in Argentina, Turkey, and India

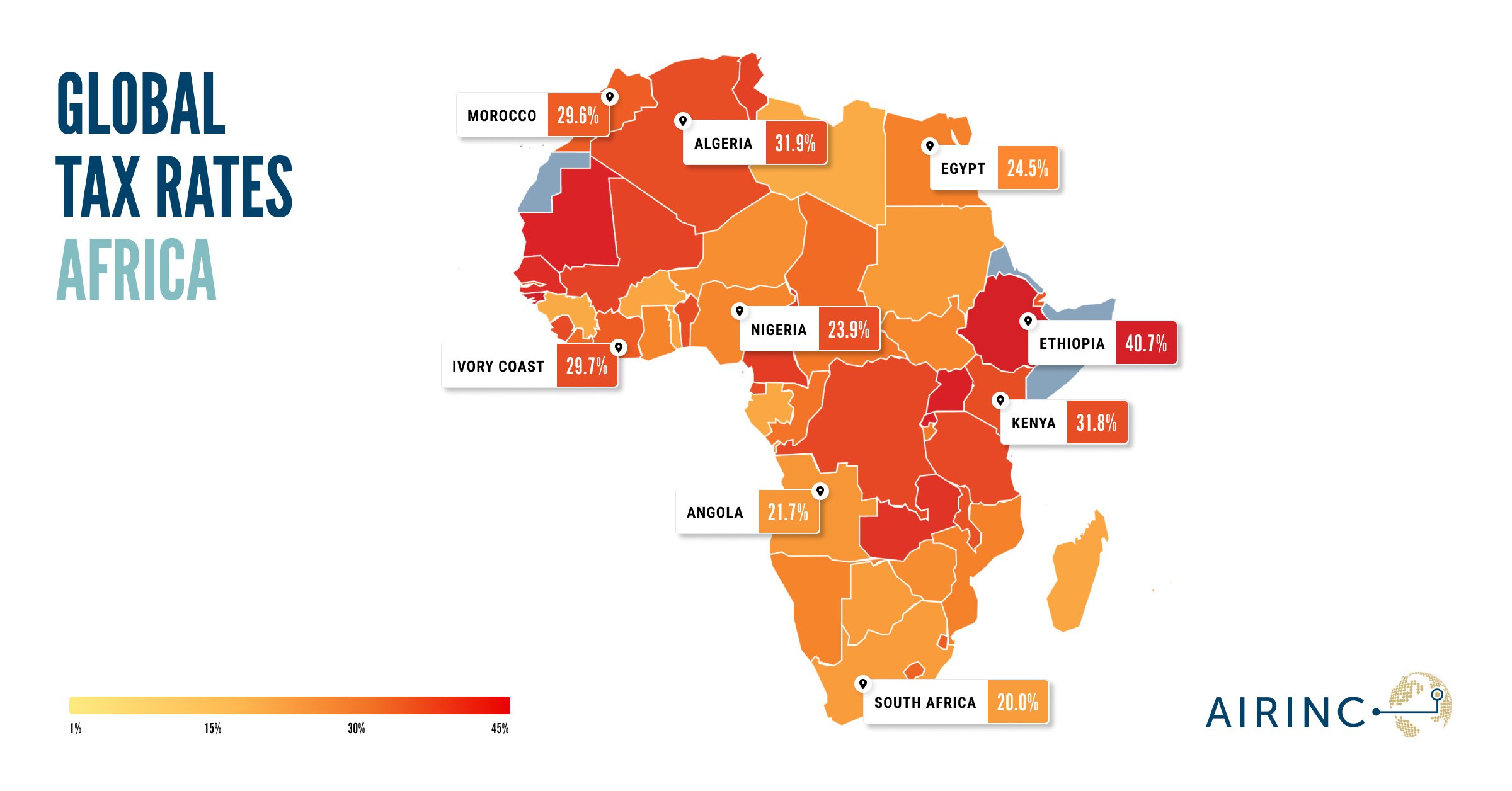

- Tax updates along with global COVID-19 individual income tax responses

- Rents dropping in London, Kiev, and Chengdu

- ...and more

%20(31).png)