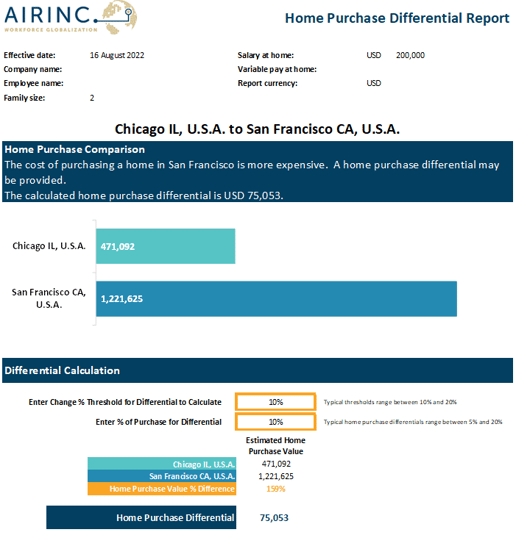

Relocating talent in the U.S. can create affordability challenges for your employees, especially when deploying talent to high-cost locations. AIRINC has developed an innovative new solution that helps your employees when they need it most -- up-front when they are looking to purchase a home.

AIRINC’s Home Purchase Differential was designed based on actual client needs and calculates a lump sum payment to cover the additional cost of buying in higher-cost markets. The differential provides an up-front payment that the employee can use to secure a larger down payment, allowing access to more affordable monthly mortgage payments. You have the option to tailor the payment to your policies - tapering or setting a threshold for the payment.

Home Purchase Differential reports can help by:

- Providing a “know before you go” comparison between housing markets to help educate employees before they accept their relocation

- Estimating home sale/purchase costs, which can be used in cost estimates or for creating lump sums

- Determining if assistance is necessary and, if so, at what level

- Calculating the required down payment assistance to help employees secure affordable long-term housing

By comparing home purchase costs between the origin and the destination, mobility professionals can help to facilitate a successful relocation. Contact us or reach out to your AIRINC representative to learn more.

%20(87)%20(1).png)

%20-%202026-02-11T123751.310%20(1).png)

%20(22)%20(1).jpg)