As companies expand across borders, international assignments have become a strategic tool for developing talent and supporting global operations. But with cross‑border work comes a complex challenge: taxation. Employees may face unfamiliar tax systems, higher tax burdens, or unexpected liabilities simply because they accepted an assignment abroad.

To create fairness and predictability, many organizations use a mechanism known as hypothetical tax. Although the term sounds abstract, it plays a central role in global mobility programs and helps ensure that employees are neither advantaged nor disadvantaged by working internationally.

What Is Hypothetical Tax?

Hypothetical tax (often called “hypo tax”) is a notional amount of tax that an employee would have paid had they remained in their home country. Instead of paying actual home country taxes, the employee pays this hypothetical amount to their employer while on assignment.

The employer then takes responsibility for the employee’s actual tax obligations in the host country, and any potential home country residual liability.

In short:

-

The employee pays the home country equivalent (hypo tax).

-

The employer pays the real tax due in the host country.

-

The goal is to keep the employee’s net pay similar to what it would have been at home.

This system is a cornerstone of tax equalization policies.

Why Companies Use Hypothetical Tax

-

Fairness Across Employees - Without hypo tax, employees in high tax home countries might avoid assignments, while those from low tax countries might benefit disproportionately. Hypo tax levels the playing field.

-

Predictable Compensation - Employees know they will take home roughly the same net pay as if they had stayed home, reducing anxiety about tax surprises.

-

Simplified Mobility Planning - Employers can budget more accurately for assignment costs because they control the actual tax payments. Because the employee is responsible for a hypo tax, any on assignment tax planning benefits the company.

-

Talent Attraction and Retention - A well designed hypo tax policy signals that the company supports employees who take on global roles.

How Hypothetical Tax Works in Practice

Step 1: Determine the Home Country Tax Baseline

The employer calculates what the employee would have paid in taxes if they had stayed home. This includes:

Income tax

-

Social security contributions

-

Local or regional taxes

-

Standard deductions and allowances

The calculation is based on home country rules, not the host country.

Step 2: Deduct Hypo Tax From the Employee’s Pay

The employee’s pay is reduced by the hypothetical tax amount. This ensures their net pay resembles their home country net pay.

Step 3: Employer Pays Actual Host Country Taxes

The employer handles:

-

Host country income tax

-

Home-country income tax, if any

-

Social security obligations

-

Tax filings and compliance

-

Any tax equalization settlements at year end

Step 4: Year End Reconciliation

Tax situations often change (bonuses, salary increases, marital status, dependent children), a reconciliation ensures the employee paid the correct hypothetical amount — no more, no less. Companies can elect to always do reconciliations, do them upon request from the employee, or selectively authorize them depending on the employee’s situation.

Example Hypo Tax Scenario

Imagine an employee from the United States is assigned to Germany.

-

At home, they would have paid $30,000 in taxes.

-

In Germany, their actual tax liability is $45,000.

Under a hypothetical tax system:

-

The employee pays $30,000 (hypo tax).

-

The employer pays the additional $15,000 to cover the higher host country tax.

The employee’s net income stays consistent with their U.S. baseline.

Challenges and Considerations

1. Complexity of Tax Systems

Calculating hypothetical tax requires expertise in home country tax rules and frequent updates as laws change.

2. Employee Communication

Hypo tax can feel confusing or unfair if not explained clearly. Transparency is essential. Employees assigned to low or no-tax countries may feel disadvantaged compared to their local peers.

3. Equity Across Different Home Countries

Global mobility teams must ensure the policy applies consistently across diverse tax regimes.

4. Special Situations

Certain factors complicate calculations, such as:

-

Equity compensation

-

Split year residency

-

Spousal income

-

Short term vs. long term assignments

-

How personal taxable income is tax equalized, if at all

Why Hypothetical Tax Matters for Global Mobility

Hypothetical tax is more than a payroll mechanism — it’s a strategic tool that:

-

Encourages global mobility and typically is used for home-based assignment programs

-

Protects employees from tax volatility

-

Helps companies deploy talent where it’s needed

-

Makes repatriation to home country easier financially for the employee

-

Ensures fairness across the workforce

In a world where international assignments are essential for business growth, hypo tax keeps the focus on the work, not the tax bill

Conclusion

Hypothetical tax is a foundational element of modern global mobility programs. By stabilizing net pay and removing tax related barriers, it allows employees to embrace international opportunities with confidence. For employers, it creates predictability, fairness, and a smoother path to global talent deployment.

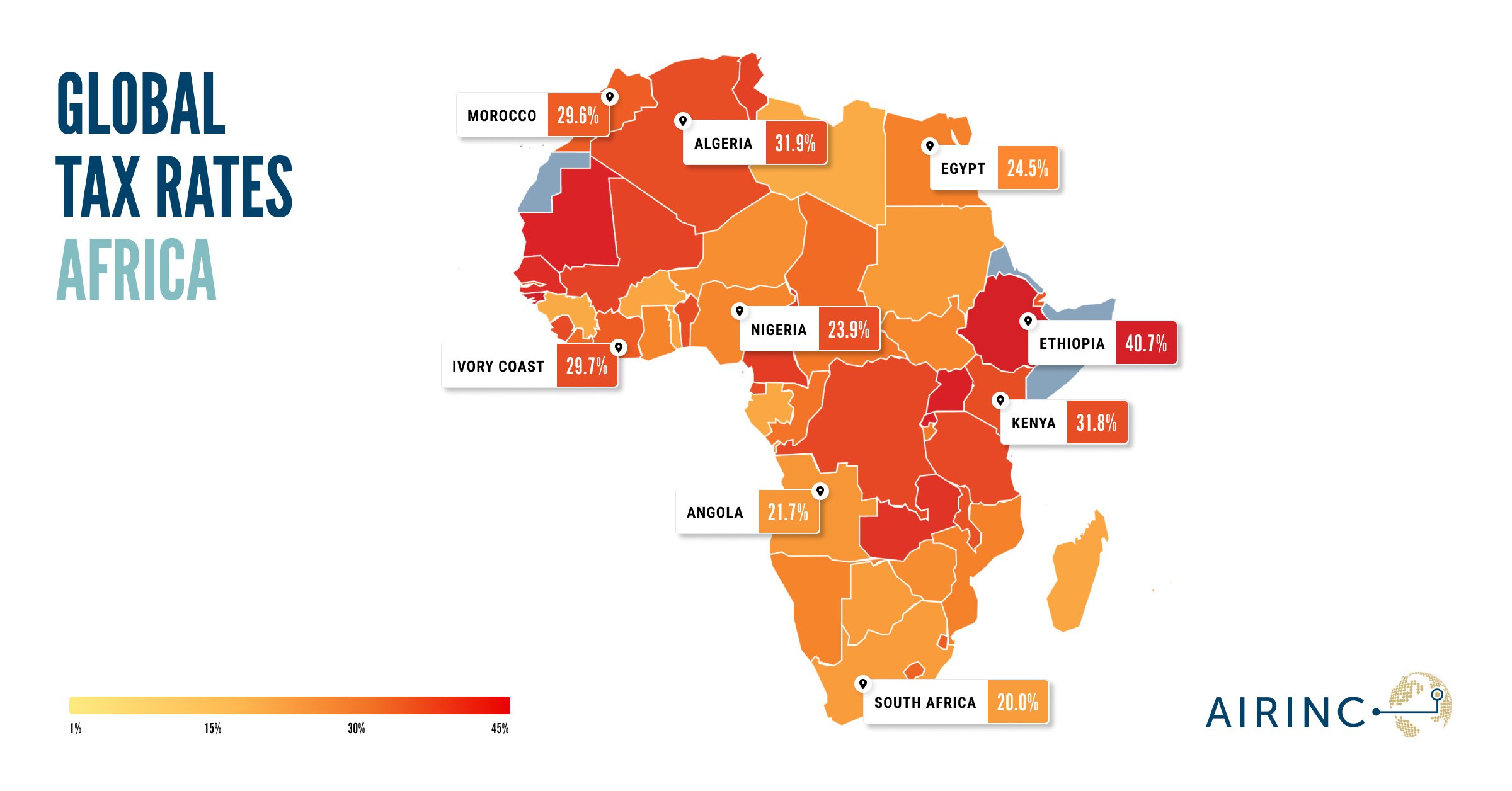

Are you looking for information on global tax rates around the world?AIRINC’s International Tax Guide contains all of the information you need to support your assignment tax planning — including global tax rates, deductions, and employee/employer social security contributions. |

Want to watch again?Rewatch the AIRINC and GTN Summer Mobility Tax School sessions here: Mobility Tax 101 - Foundations of Global Mobility Taxation |

What’s Driving the Cost of Mobility?Global mobility isn’t just about moving people—it’s about making smart talent investments. Every assignment or transfer carries a price tag, and those costs can look very different depending on the route, policy, and structure. Leveraging AIRINC data and our tax engine, we used the Assignment Cost Estimator (ACE) to create a new infographic to encourage you to advise and influence with data. |

%20-%202026-02-04T222549.716%20(1).png)

%20(18).jpg)

%20(77)%20(1).png)