In the next in our "Have you met?" series, we meet Jeremy Piccoli. Jeremy joined AIRINC in 2012, after spending 6 years in PwC’s International Assignment Services group. It was during Jeremy's time there he met Patrick Jurgens, who recruited him to join AIRINC.

Tell us about your role at AIRINC?

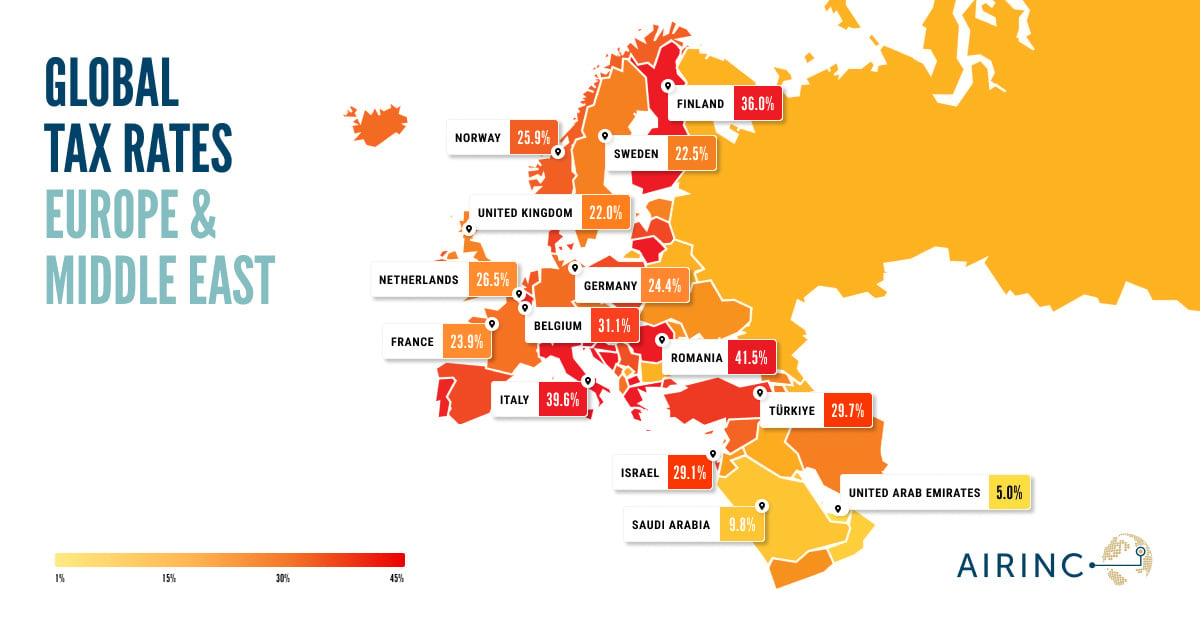

I am the Director of Global Tax Solutions, responsible for maintaining and updating the international tax data and logic that lives within AIRINC’s tools and offerings.

What do you like about working at AIRINC?

After numerous ‘busy seasons’ in public accounting, with rigid compliance deadlines, it has been rewarding and refreshing to focus on the collaborative and consultative aspect of global mobility taxation at AIRINC. I also enjoy the diverse and multifaceted backgrounds that AIRINC employees bring to the company. It fosters a creative work environment that is inspiring and innovative.

What are your favorite AIRINC tools?

My favorite tool is our Assignment Cost Estimate tool. I’ve talked to numerous clients and partners that lamented the manual, time-consuming process cost estimation can have on a Global Mobility team. ACE offers a unique, quick, accurate, and data-driven solution to provide our clients with trustworthy estimates.

What is your role / involvement with ACE AIRINC tool?

Tax is typically the most expensive single cost in an estimate, and as such, our tax logic needs to be reliable and continuously updated. ACE not only utilizes our International Tax Guide (ITG) tax models, but also layers in additional tax logic needed for cost estimation, such as: totalization agreements, income tax treaties, expatriate rulings, taxability of line items, etc. Depending on the estimate, ACE may be running over 75 different tax calculations for a single estimate.

What do you like about working on ACE AIRINC tool?

I enjoy working with the product and technology teams to create configured client accounts within ACE, which are specifically tailored to client policies and preferences. Configurations are a collaborative process between AIRINC teams and the client users which helps us understand needs, and work to development new capabilities.

What are some of the exciting enhancements / developments that you've seen in ACE AIRINC tool since its inception?

When I started at AIRINC, ACE only had 2 packages (HBE and Host Plus), and location coverage was about 40 countries. Since then, we’ve added Short-Term, Commuter, and One-Way Transfer packages, as well as many client custom packages, and now support over 110 countries. We’ve also enhanced our report to include an optional ‘Tax Details Report’ which provide users with additional information regarding tax methodology and logic within a specific cost estimate.

Tell us something about yourself?

I’m an early remote worker adopter, thanks to the flexibility that AIRINC afforded. I was a remote worker as a ‘trailing spouse’ when my wife accepted a 2-year assignment in Basel, Switzerland from 2014-2016. During the assignment, we travelled to over 20 countries (Slovenia being my personal favorite), and the experience also allowed me to better engage my European clients and colleagues. I greatly appreciate the experience of living and working internationally, especially now that our travel capabilities have diminished with our 3 young children, ages 5, 3, and 1.

.png)

%20(18).jpg)