In our second Global Tax Chat we focused on social security and were joined by our host Robert Zeitz and special guest Gary Chandler from Vialto. Here is a summary of what we discussed.

EU/EFTA Framework Agreement for Telework

The European Union/European Free Trade Association has a new approach for teleworkers called the Framework Agreement for Telework. The framework will be effective as of July 1, 2023. Under the framework, more flexibility is allowed for employees that have a hybrid work arrangement, spending some workdays in their home country, and primarily working at the employer’s location based in a different country. The basic rule is that social security contributions are due where the work is performed, generally where the employer is located.

For remote workers, time worked in the employee’s home country would not trigger social security contributions due in the employee’s home country only if time worked in the employee’s home country does not exceed a specified threshold. Historically, up to 25% of time worked in the home country could be ignored. Under the new Framework, the threshold is increased to up to 49.9%. Qualifying telework employees would only pay social security contributions in the employer’s country and no contributions would be due in the employee’s home country. An A1 certificate should be requested from the country where the employer is located.

The framework defines qualifying telework as work performed using a computer and other information technology for their employer located in another member country. It does not cover an employee doing other work activities, such as engaging with clients in the home country, or working on behalf of an entity located in the employee’s home country. It only applies to employees, so contractors are excluded from the framework.

The intent of the framework is to streamline compliance administration and avoid requirements to withhold and remit home country social security contributions. Employers will need to obtain A1 certificates for qualifying teleworkers which can be obtained for periods up to 3 years, and there is a possibility to request A1 certificate extensions of coverage. Should the employee exceed the threshold of time worked in the home country, then the home country becomes the primary work location and social security contributions would shift to the home country.

Still to be determined is how many of the EU/EFTA countries will opt into the Framework. We expect some clarity about which countries will opt in by the end of May. Switzerland, Belgium, Austria, and Germany have already announced plans to opt in. It is not clear if any EU/EFTA countries will intentionally opt out of the Framework. Both the employer’s country and the employee’s home country will need to be members of the Framework to obtain the A1 certificate. It also is unclear how this framework will impact United Kingdom employees as the U.K. is no longer an EU member since Brexit was implemented. Global mobility managers should consider whether any employees might benefit from the telework arrangement and if A1 certificate should be obtained ahead of the July 2024 effective date.

Retirement Age in France

On May 1st, demonstrators in France protested the increase in the retirement age from 62 to 64. However, the increase in the retirement age is not unique to France. Under many old age pension schemes globally, retirement benefits for older persons are funded by current contributions by younger workers. Coupled with longer life expectancies and fewer young workers, the pension schemes run the risk of running out of money. Pension schemes have only a few options to maintain funding – increase contributions, cut back on benefits, and/or increase the retirement age. Many countries are gradually raising retirement ages in response to these financial pressures.

France has a relatively young retirement age (the youngest is Sri Lanka at 59 years) while many countries have retirement ages of 65 years or more. As for life expectancy, France has a life expectancy of 82.4 years as of 2015. Within EU countries the range of life expectancy is highest in Spain at 83 years and lowest in Lithuania at 74.6 years. This means that France, with one of the highest life expectancies and one of the lowest retirement ages, will have financial difficulties for the pension fund with a relatively long period for pension benefits and fewer current employees contributing into the system.

We can expect the retirement ages will continue to increase in many countries in the decades ahead as life expectancies continue to lengthen.

Planning for Old Age Pensions under Social Security

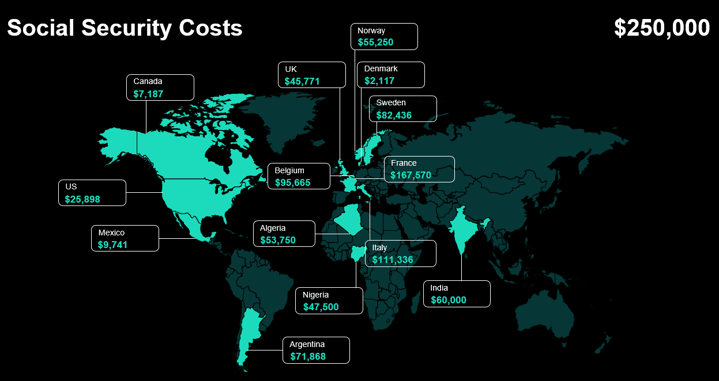

Social security is often considered another tax. But it is a tax unlike any other as those contributions are directly linked to future benefits. The main benefit that employees are concerned about is their retirement pension. Most global mobility managers are familiar with policies that encourage employees to remain in their home country social security scheme. That may not be the most effective approach for your cross-border employees. One thing to understand is that social security costs can vary substantially between countries. Based on representative samples of countries globally, the combined employee and employer social security costs can range from a low of USD 2,000 to a high of USD 167,000 on a representative salary of USD 250,000.

Likewise, the retirement pension benefits under social security also vary widely from country to country, as shown in this chart: (source – Vialto Partners) .

| Country |

Annual maximum contributions in USD |

Retirement age |

Work years needed for maximum pension |

Annual pension benefit in USD |

| United States |

25,898 |

67 years |

35 years |

43,524 |

| United Kingdom |

45,771 |

67 – 68 years |

35 years |

11,869 |

| Belgium |

95,665 |

65 – 67 years |

45 years |

46,526 |

This chart illustrates that there isn’t a direct correlation between costs and benefits. The U.K. retiree doesn’t receive as much pension as other countries despite the higher level of contributions made over a 35-year career.

Summary

For employers of globally mobile employees, cost savings are available. This can be done either by intentionally choosing a host country with a lower contribution rate, by looking for refund opportunities or portability of retirement benefits when the employee repatriates, or even choosing to pay in the home country social security scheme by using a Totalization Agreements. Totalization Agreements, for example, not only help coordinate contributions between two countries but also coordinate retirement benefits for employees who split their career between the two countries where a totalization agreement is in force. By analyzing the home and host countries for both relative costs and potential benefits to the employee, it is possible to find flexibility within your mobility program. Finally, it is very important to communicate and educate employees on social security so they understand how they will be impacted in a cross-border arrangement.

We hope you found our summary of the second Global Tax Chat helpful. Our next Global Tax Chat (#3) will be in September 2023. Subscribe to our blog for the details.

Blog authored by:

- Pat Jurgens - Director, Global Tax Research & Consulting

Pat is beginning his 40th tax season in expatriate tax compliance. Learn more about Pat through our blog! - Jeremy Piccoli - Director, Global Tax Solutions

Jeremy knows about taxes in over 280 countries & tax jurisdictions through his work with AIRINC's International Tax Guide

%20(77)%20(1).png)

%20(19).png)