On July 25th, AIRINC and Global Tax Network co-hosted our first session in our 2024 summer school webinar series on Mobility Taxation. The session covered essential tax support for inbound employees to the U.S.A. Below is a summary of the topics covered, as well as the live polling results.

International Transferee Taxation

The type of transferee scenario impacts the tax support that is needed. This can be different than other mobility services (such as immigration or household goods). At a high level, most Mobility fact patterns fall under three main categories of assignments, transfers and other (including virtual assignments).

Typical tax services needed by mobility types include understanding the requirements for breaking residency in the home country, and the timing of establishing tax residency in the new country. Additionally, individuals must learn a new tax system, including tax rates and the filing process, and be aware of potential trailing obligations in the home country, such as bonuses and equity. Furthermore, they must address challenges of double taxation, especially in the year of the move and if the employee retains assets in the home country.

Poll Results: What tax services do you provide for international transferees to the U.S.?

- 12% - None, or cash stipend

- 62% - Tax Counseling Session

- 55% - Tax Preparation for year of transfer

- 46% - Tax Preparation for year of transfer and the year after transfer

- 12% - Net Pay calculation

What Makes U.S. Taxes So Complex?

What makes U.S. taxes so complex includes understanding U.S. federal tax residency rules and the differences between federal and state taxation. Additionally, there is the U.S. taxation of personal income and non-U.S. source income, as well as the distinctions between tax withholding and tax liability on salary, among many other factors. Brett, from GTN, shared this epic flowchart to help illustrate the issue!

Arrival Year Flowchart

Once an individual becomes a tax resident of the U.S., they are taxed on their worldwide income. The U.S. has a unique approach to taxation on various items, such as foreign currency exchange gains, Passive Foreign Investment Companies (PFICs), and the responsibilities of officers, directors, or shareholders of foreign corporations, which requires the filing of Form 5471. Additionally, U.S. tax residents must comply with Report of Foreign Bank and Financial Accounts (FBAR) reporting requirements.

Click here for the GTN Blog Post on reporting obligations of U.S. taxpayers with foreign financial investments and here for the GTN Guide.

Poll Results: How do you handle out-of-scope fee request for additional U.S. tax preparation service fees for complex items -- such as PFIC’s, multiple rental properties, cryptocurrency transactions, first-year residency analysis, etc.?

- 18% - Included in bundle with tax provider, for all transferees

- 72% - We pay for it a-la-carte, as needed (or as approved)

- 3% - Not paid for (even if authorized for U.S. tax return prep)

- 8% - N/A – we do not pay for tax return preparation

Extra Tax Support for U.S. Moves

Companies may want to consider increasing level of support for transferees to the U.S.A. -- perhaps even beyond what is offered in a “global” international transferee policy.

Tax Withholding in the U.S.

Poll Results: Based on what you have learned today, what will be your approach for tax services for transferees to the U.S.?

- 19% - I’d like to increase support, but cannot due to budget limitations

- 28% - I will explore ways to increase support

- 48% - I am happy with our current level of support

- 5% - We pay too much for support! We’re looking for ways to reduce costs

U.S. Tax Gross-Up Methodology

Employer reimbursement of an assignee’s tax liability is generally considered taxable compensation, triggering additional taxes, a situation known as "Tax-on-Tax." When the taxable reimbursement is factored in, the calculated reimbursement often falls short of providing the assignee with the correct "net" after-tax income. To address this issue, two common approaches are used: a simple mathematical formula employing a flat tax rate (typically the "supplemental" rate), or a sequence of calculations that account for progressive rates, deduction phaseouts, and maximums.

Need a refresher on Tax Gross-Ups? Click here to watch the joint AIRINC / GTN Mobility 101 webinar recording.

Supplemental Rate Approach

Marginal Rate Approach

This approach uses an estimate of the employee’s total income and filing status to determine the appropriate marginal rate to gross-up allowances:

- Federal brackets: 10%, 12%, 22%, 24%, 32%, 35%, 37%

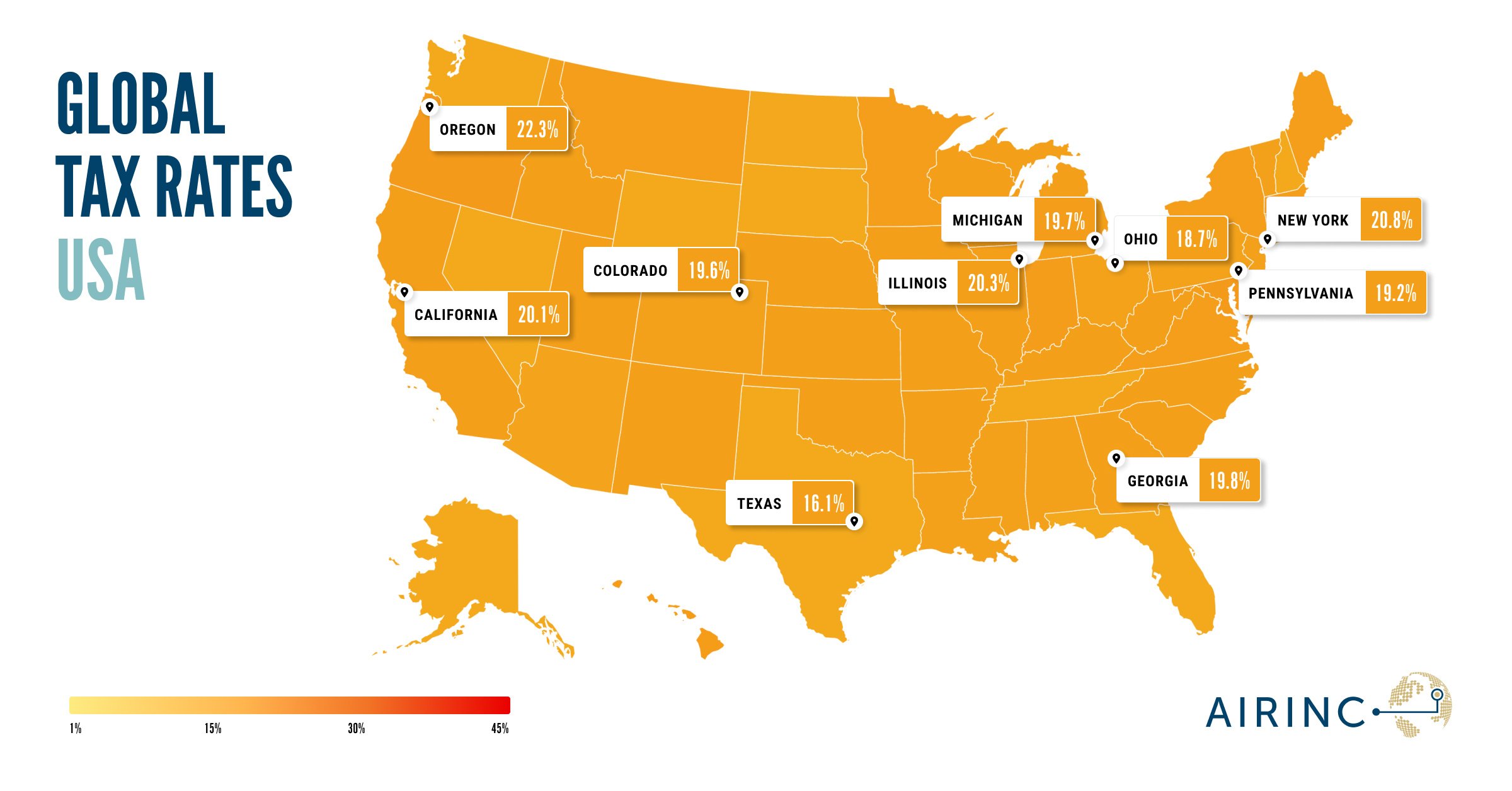

- State rates: vary by state!

Technically, U.S. federal gross-ups cannot be withheld at higher than 22% unless:

- Year-to-date supplemental wages exceed $1,000,000, OR

- The company uses the “aggregate” method of withholding

In practice, we have never seen the Internal Revenue Service (IRS) challenge this position – and it is also unclear what penalties the IRS would assess for overpaying withholding tax.

With / Without Approach

A with / without approach is a more precise calculation of the appropriate gross-up for a taxable allowance given the income-level, family size, and other factors

Example: Gross Salary of $150,000 with a net amount to be grossed-up (moving expense) of $25,000:

- Run a gross-to-net calculation (internal tool, or AIRINC’s International Tax Guide) on salary only

- Take the net income ($115,591) and add the net amount to be grossed-up ($25,000) = $140,591

- Run a Gross-Up on that total $140,591

- The Total Gross Income ($185,996) from Step 3 less the Gross Salary ($150,000) is the gross bonus/allowance amount ($35,996) in order to get to the net ($25,000)

- The difference ($10,996) is the tax, and can be apportioned to the different tax buckets (Federal, State, City, Social Security)

With / Without Reconciliation

If using the Supplement Rate or Marginal Rate approach: Run a With/Without calculation to ensure that a transferee is not personally responsible for any of the tax on any taxable relocation benefits. This may be company policy or by employee request.

Poll Results: What tax gross-up rate do you use for taxable relocation items for transferees to the U.S.?

- 38% - Supplemental rate

- 12% - Estimated marginal rate of employee

- 7% - Top marginal rate

- 9% - Detailed calculation based on employee circumstance

- 34% - I don’t know

Benchmark Data

Recently we have surveyed companies on International One-Way Transfers. Some highlights were included in the presentation. Subscribe to the blog to see when the full highlights from this survey will be published.

Lump Sums

If companies pay a lump sum to cover some or all relocation benefits, what is the income tax treatment on the lump sum?

28% of respondents indicated that they do not pay a lump sum;

27% reported that there is no company assistance, and the employee pays all income taxes on the lump sum;

and 45% stated that the company assists with the income tax costs, for example, via gross-up.

Tax Briefings

The survey also reported tax briefings for international one-way transfers were commonly provided (78% of companies provided briefings).

Tax Preparation Support

Do you provide tax preparation support for international one-way transfers?

- Yes, in the year of transfer 49%

- Yes, in the year of transfer and following year 19%

- Yes, for more than 2 years 1%

- Yes, indefinitely 2%

- For as long as transition / phase-out assistance is provided 2%

- Until trailing tax liabilities end 2%

- Sometimes, depending on destination and/or employee circumstances 10%

- Handled on a case-by-case basis 4%

- No, we don’t provide tax return support 6%

- Other 7%

Watch Now

If you missed attending this session of our summer school series on mobility taxation live, you can view the recording on-demand here. Each session is eligible for 1 CRP/GMS credit. Details provided on the recording.

Please consider joining our next session, covering global mobility tax developments in the U.K, scheduled for August 8, 2024, at 10am EDT. Subscribe to the blog to stay informed about upcoming webinars, events, product updates, and more.

%20(24).png)

%20(33).png)

%20(77)%20(1).png)