The U.S. housing markets continue to surge!

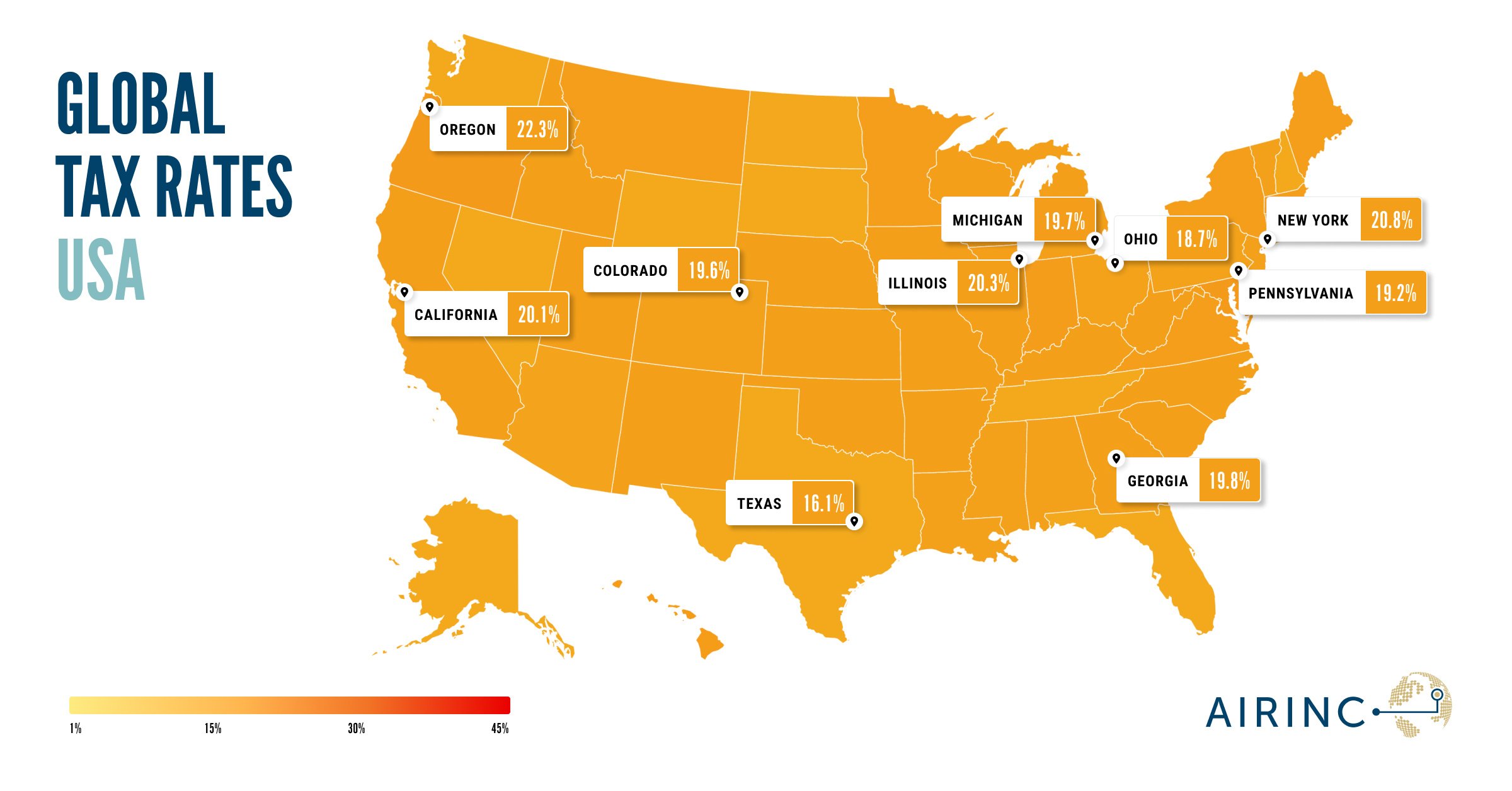

Even with mortgage rate hikes, the U.S. housing market surge continues. AIRINC published updated rental and home purchase data August 1st and found over the past 6 months, a vast majority of the U.S. experienced double-digit growth in home prices. The work to live concept continues, with largest growth in locales like Florida, Texas, North Carolina, and Montana.

What does this mean for domestic relocation?

The good news is, if you are relocating talent and they are selling a home, they are reaping the benefit of this growth on the home sale side. However, there are some notable downsides. Not all markets are moving at the same rate, so buying into the market is still a challenge for many. Rising interest rates compound the already challenging task of relocating to tight markets.

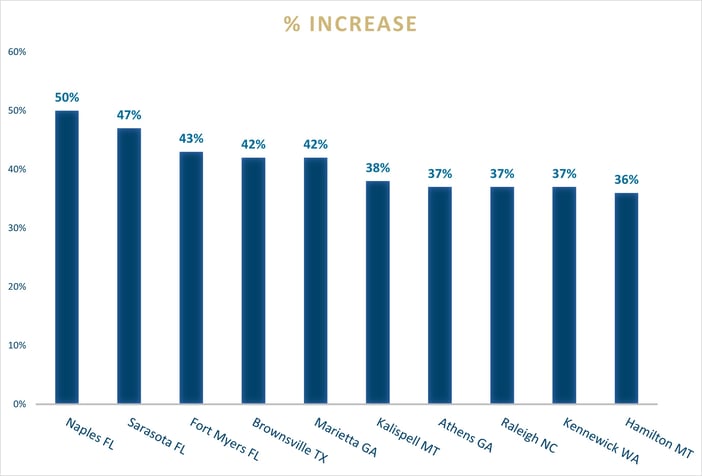

What markets are showing the most growth?

Here is the top 10 list of United States real estate markets on the rise for home purchase over the past 6 months:

What steps are industry leaders taking to address these challenges?

AIRINC recently facilitated a domestic relocation roundtable for industry leaders. Support for relocating talent to challenging markets was at the top of their list. Here is what they shared:

- Introduce a Mortgage Subsidy: While some companies have a domestic COLA or housing subsidy in their relocation policy, it is not the norm. With return-to-work mandates and a tight labor market, the group discussed how targeted housing support can be leveraged as an incentive that helps talent relocate and buy into high-cost markets. Domestic COLA payments tend to be an all-in calculation that includes tax and cost of living measurements, whereas carving out a benefit that specifically focuses on housing addresses the largest barrier of the move and can be more cost effective. Mortgage subsidies can vary in generosity, but typical support is around 10% of home value and calculated as a differential between the origin and destination locations.

- Dust off that MIDA: MIDAs or Mortgage Interest Deferral Assistance was common in relocation policies back in the 1990s when double digit mortgage rates were the norm. The group discussed, while this protection has not been used in quite some time, it is still in many relocation policies and may be a lever to provide some relief. A few organizations said they were considering adjusting the threshold needed to benefit from MIDA support.

- Incent to Rent: Rental markets have also been affected by the market surge, but the cost to rent is much lower than purchasing a home. Companies continue to offer “incent to rent” programs to make renting more attractive than purchasing a home. This is particularly useful if you know the individual is likely to move again in 2-3 years. This practice also introduces further equity to your program, where traditionally homeowners would receive a richer package than non-homeowners.

Contact us if you would like to join our domestic relocation round table or learn more about how AIRINC can support your domestic relocation program.

%20(51)%20(1).png)