Housing affordability and increased costs have long presented challenges for domestic relocation. Mortgage rates in the U.S. were at historic lows in the 2010s. Since then, the average 30-year fixed mortgage rate has nearly tripled. While it’s true that mortgage rates are still lower than they were in the 70s, 80s and 90s, the current rates coupled with increased housing prices have put a massive strain on a new generation of homebuyers. Employees may have to choose between renting in the new location or turning down a relocation altogether. Companies continue to look at adaptive ways to support homeownership during a relocation.

Mortgage support

Relocation professionals have commented that a main concern to relocation potential in 2023 is a downturn in housing activity because of high mortgage rates and decreased affordability. Some corporate relocation programs offer unique mortgage support models. Our friends at Rocket Mortgage have been kind enough to share details and an example about one such model.

- Mortgage Interest Differential Assistance (MIDA) Program is designed to offset the impact of higher mortgage interest rate environments by easing the gap between current market rates and a lower rate that transferees have on their current mortgage

- Benefits are applied regardless of interest rate environment

- The MIDA payment is determined by taking the difference between their current interest rate and the new (higher) mortgage interest rate, for like products (i.e. 30 year fixed rate) and multiplying the difference by the Current Loan Balance (Old Mortgage).

- For example:

3.00% Old Interest Rate (Conforming 30 Year Fixed)

7.00% New Interest Rate (Conforming 30 Year Fixed

4.00% Interest Rate Differential X $300,000 Current Loan Balance (Old Mortgage)

$12,000 is the yearly mortgage interest differential (.04 x $300,000 = $12,000)

Payout Example:

You can weight the impact of the MIDA to help ease a transferee into their new destination

Year 1: $12,000 x 100% = $12,000 Total or $1,000/month

Year 2: $12,000 x 50% = $6,000 total or $500/month

Year 3: $12,000 x 25% = $3,000 total or $250/month

Total Amount Provided to Transferee in the 3-year period = $21,000

Cost-of-living support

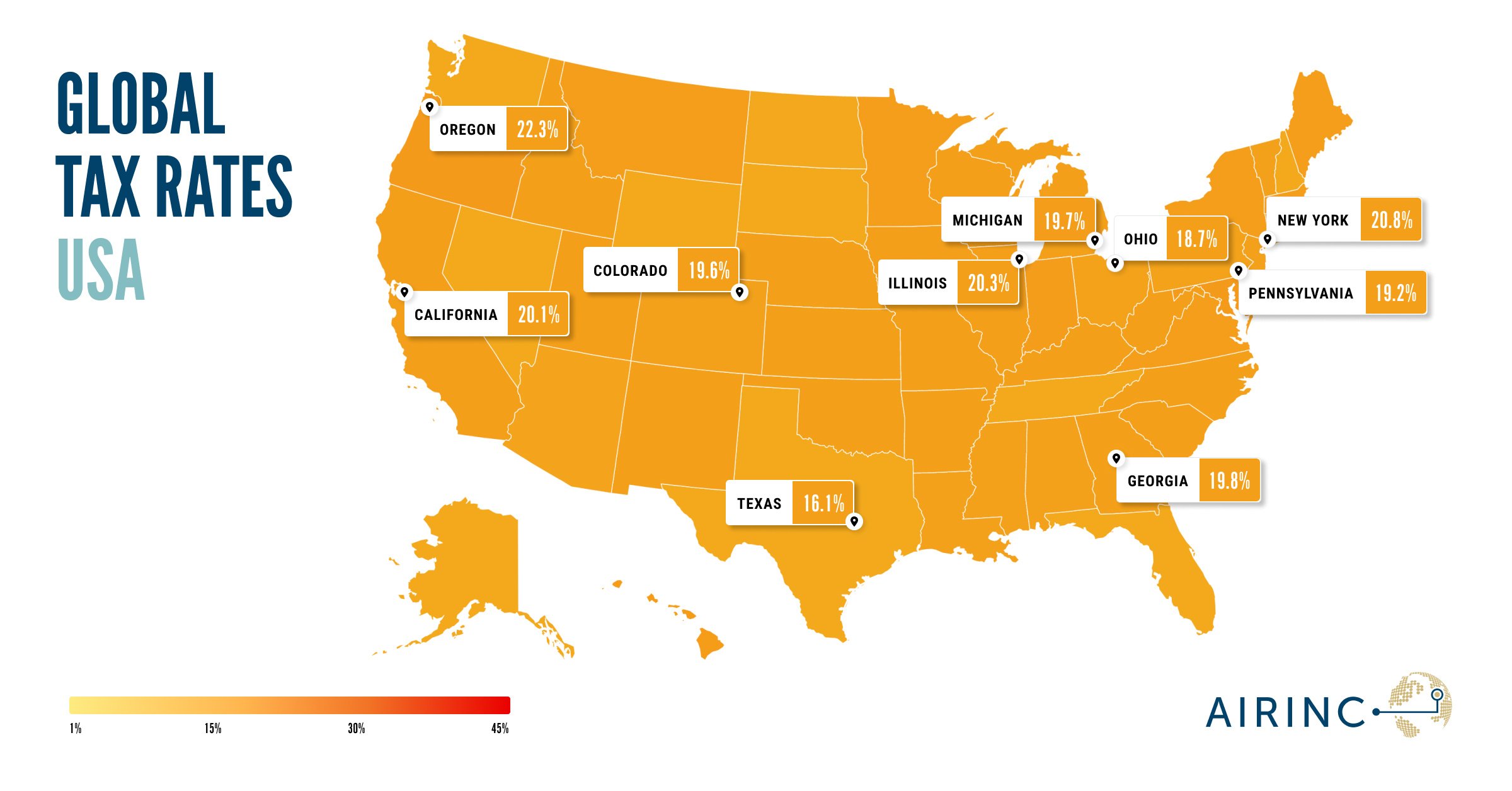

Some companies have chosen to address the changing housing and mortgage rate costs within their existing cost-of-living programs. Housing, Goods & Services, Transportation and Taxes are all taken into account when determining how much, if any at all, cost-of-living assistance is provided. These programs are typically paid out in a similar 3-year, declining balance as mentioned above.

The right approach is the one that supports the program’s philosophy, policy and budget. Contact us for more information on how to structure mortgage assistance or total cost-of-living assistance programs.

%20(51)%20(1).png)