Sydney Opera House. Photo taken by AIRINC Surveyor Zenab Tavakoli.

Low and middle income tax offset retained

The Australia budget was postponed to October due to the COVID-19 pandemic. Retroactive to July 1, 2020, the income tax schedule was favorably adjusted, the low income tax offset increased, and the low and middle income tax offset (set to expire) was retained. The net effect is a decrease in income tax for all taxpayers.

Australia took multiple measures in response to COVID-19, including:

• Temporarily reduced minimum drawdown rates for superannuation.

• Temporary early release of superannuation, up to $10,000 of 2019-2020 superannuation, and $10,000 in 2020-2021.

• $750 tax-exempt payments to social security, veteran, and other income support recipients and concession card holders. The first round was sent in March and the second round was sent in July.

• A simplified method for claiming deductions for working from home, effective March 1 – December 31, 2020.

• The JobKeeper scheme was extended through March 28, 2021.

Data Points Q4 2020: Expatriate Trends & Survey Data Highlights

The above excerpt is taken from AIRINC's quarterly newsletter, Data Points, bringing you the latest updates from our Housing, Goods & Services, and Tax departments. January 2021's edition also featured:

- 24 Currencies showing 3-month exchange rate fluctuations of more than 5%

- Goods & Services inflation higher than 5% for 6 months in Argentina, Turkey, and India

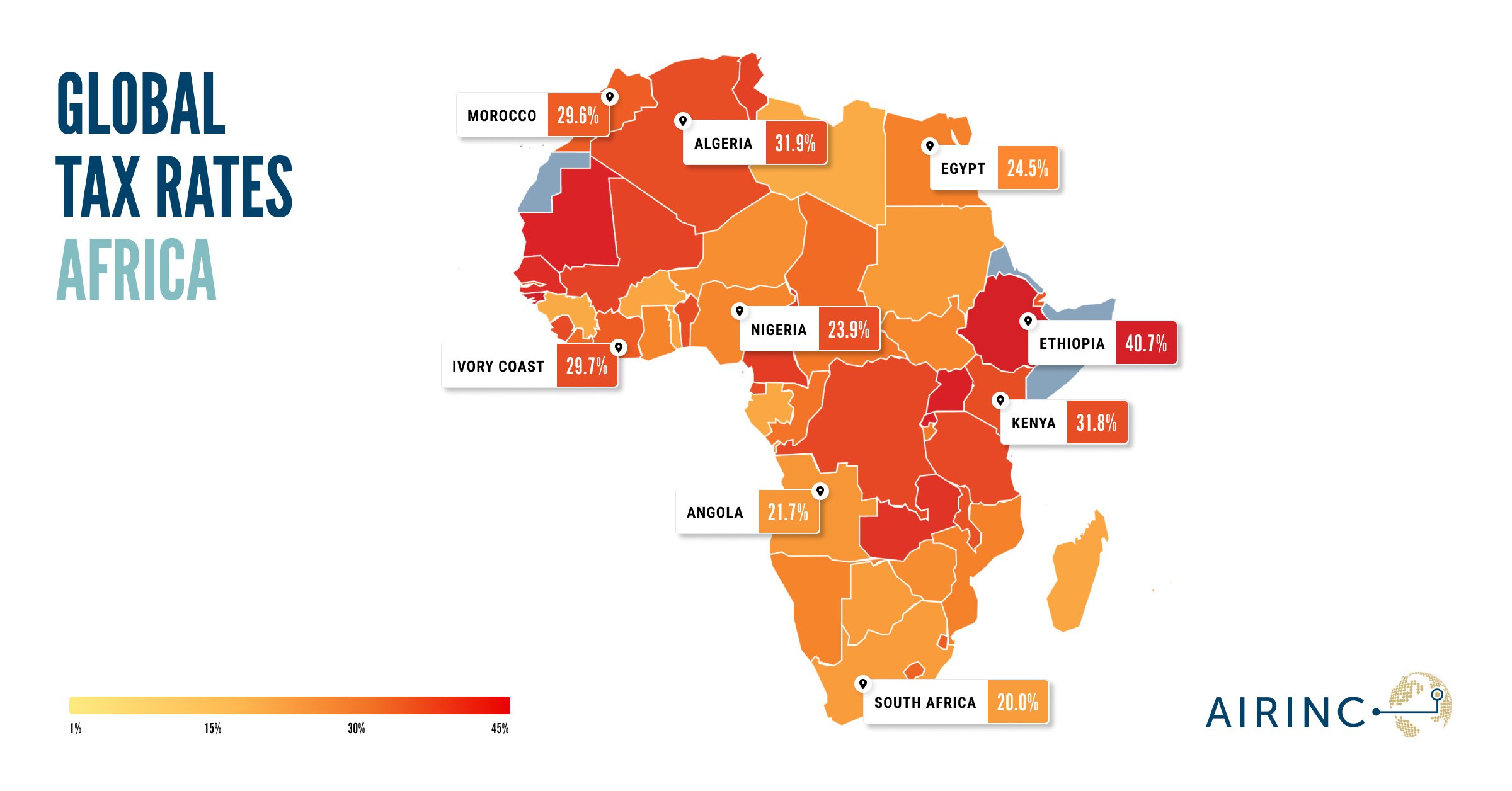

- Tax updates along with global COVID-19 individual income tax responses

- Rents dropping in London, Kiev, and Chengdu

- ...and more