Taxes, Taxes, Taxes!

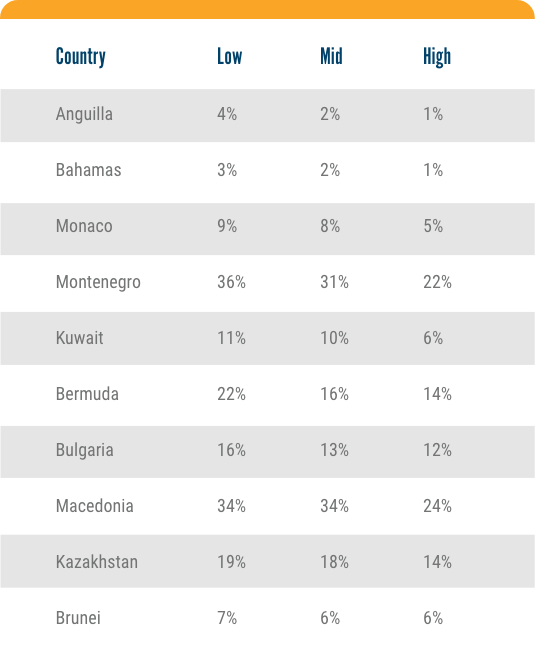

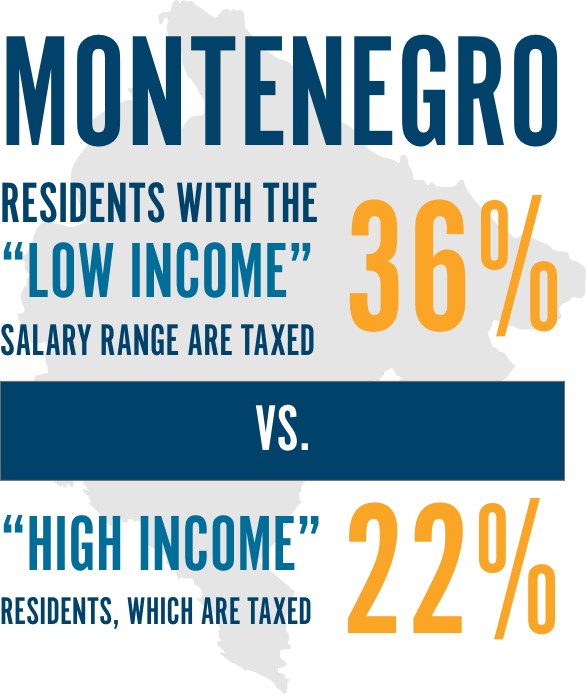

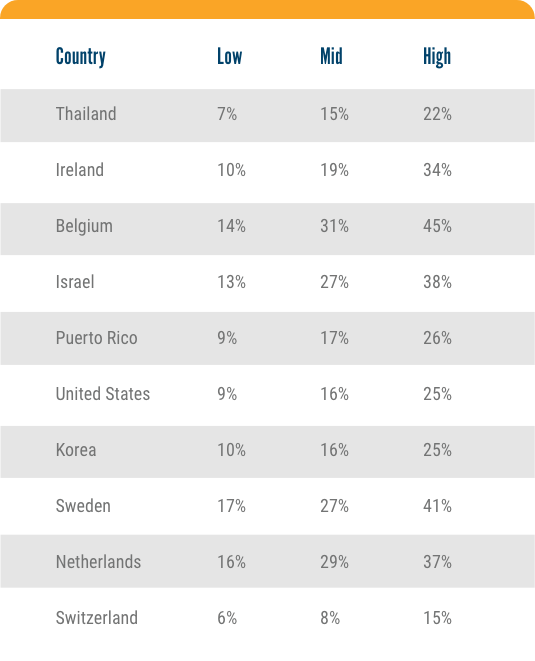

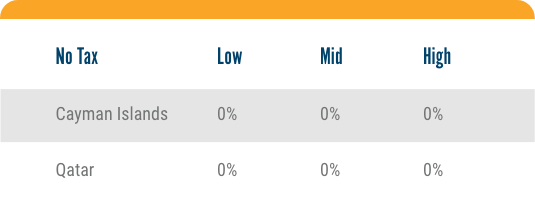

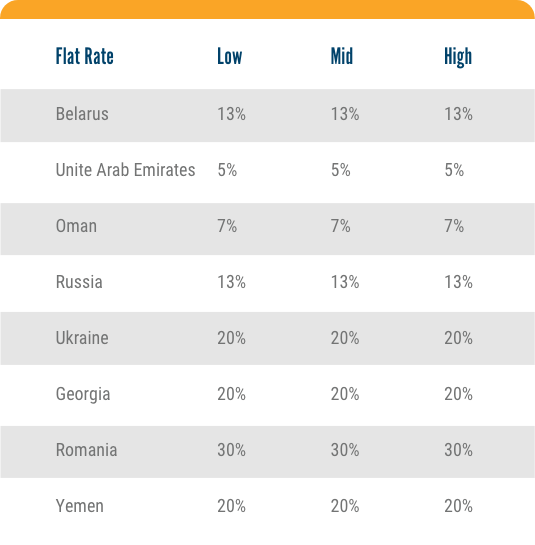

Using our international tax tools, we mined global tax rates to calculate and identify which countries have the most progressive, regressive, and flat tax rate structures. We compiled data based on three representative salary levels: low, mid, and high. The difference in effective tax rates between these salary levels is a measure of the progressive nature of the tax and social security assessed on wages.